Why You Invest in Bonds

March 4th, 2020 | 2 min. read

The two costliest mental pitfalls investors face are fear and greed. Though an argument could be made for a third, equally harmful danger: amnesia.

During one of the longest bull markets in history, it can be easy to forget why anyone would own anything other than stocks. From 2009 to the end of 2019, the S&P 500 gained more than 400%. In a positive stretch like that, what’s the point of owning conservative investments like bonds?

The simple fact that you can never know when such a streak will come to its inevitable end.

Investors were given a rude reminder when fears of the coronavirus sent the stock market into correction territory (a decline of 10% or more) in the last week of February. The S&P 500 fell around 13% from its all-time high.

.png?width=1238&name=%5EGSPC_YahooFinanceChart%20(1).png)

While most of the attention was focused on the turbulence in the stock market, there was a lot more going on in the financial markets. Principally, bond prices jumped, with Treasury yields hitting historic lows (prices move inversely to yields). Meanwhile, the iShares Core U.S. Aggregate Bond ETF, which tracks the Bloomberg Barclays U.S. Aggregate Bond Index, resembled an upside-down view of the stock market.

This juxtaposition is a helpful reminder of an important cornerstone of long-term investing. A reminder of a crucial role bonds play in your portfolio.

Invest in bonds for stability

As a more conservative investment, bonds don’t offer as high of a return as stocks. Yet, they have lower volatility and don’t experience as deep of losses as stocks.

Bond prices generally move independently from stock prices, which helps prevent your overall portfolio from falling in lockstep with the stock market.

Bonds, therefore, serve as a valuable portfolio diversifier. They help lower overall risk in your portfolio without dramatically sacrificing returns.

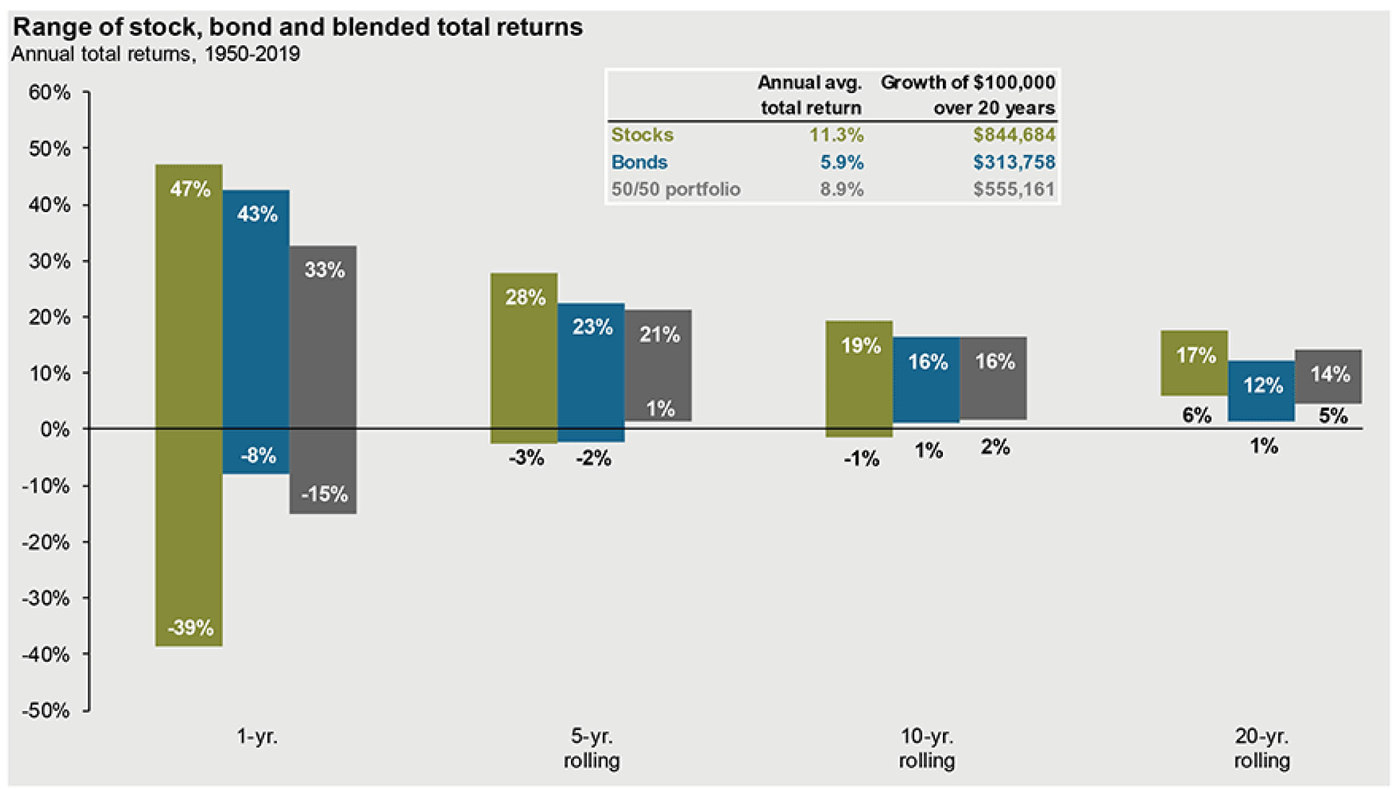

Consider the performance of a 50/50 stock/bond portfolio over the past 80 years, according to J.P. Morgan’s Guide to the Markets. (Stocks represent the S&P 500 Shiller Composite and bonds represent data from Strategas/Ibbotson for periods from 1950-2010 and Bloomberg Barclays Aggregate thereafter.) Such a portfolio would have produced an 8.9% annualized return. That’s just 2.4% lower than the 11.3% annualized return of an all-stock portfolio. And, without the potential for steep downturns in any given year, as evidenced by the one-year returns.

With the exception of being many years away from retirement or having the intestinal fortitude to stick with stocks no matter what, why take so much additional risk for little additional return?

Ultimately, how much you invest in bonds should depend on your financial goals and temperament.

The most important thing to remember is that with a balanced portfolio you can benefit from periods of growth while being resilient during those inevitable stock market downturns. Which increases the chances you stick with it and actually realize those benefits.

In that sense, bonds can provide not only financial stability but mental stability, too. Because switching investment plans from fears driven by short-term market performance is about the worst thing you could do.

If you feel uncomfortable about falling stock prices, find solace in an often underappreciated part of investors’ portfolios—bonds. It’s a great reminder that you have already prepared for moments like this.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.