A Comprehensive Look at the FERS Pension

June 29th, 2022 | 6 min. read

As a government employee, the Federal Employees Retirement System (FERS) Basic Benefit is a benefit available to you to help replace your current income and live a comfortable retirement. It is commonly referred to as the FERS pension. The size of your benefit can vary greatly as it depends on personal decisions you make during your working years.

To help you gain a better understanding of your FERS pension, we provide the most important factors in your decisions below. Ultimately, we recommend that you meet with a FERS-experienced financial adviser to best determine what choice is right for your financial goals.

What is the FERS pension?

Upon retirement, FERS will pay you a monthly benefit based upon your years of service worked under FERS, your income and the age you retire. Hence, the basic benefit is often known as the monthly annuity or FERS pension.

For this benefit, you pay 0.8% of your basic pay each pay period. (Basic pay does not include bonuses, overtime, holiday pay, night differential, or payment based on accrued or accumulated leave.)

When you are eligible for the FERS pension

There are two eligibility options that affect the size of your basic benefit:

- Unreduced Benefits: To be eligible for unreduced benefits (immediate retirement) you must meet one of the following criteria:

- Must reach Minimum Retirement Age (“MRA”) (age 55-57, depending upon your year of birth) with 30 years of service

- Age 62 with 5 years of creditable service

- Age 60 with 20 years of creditable service

It is possible to retire earlier than your MRA, but that requires circumstances outside of your control such as involuntary separation without cause, reorganization, retirement offers, or disability.

- Early Retirement: Employees can be eligible for early retirement if they have reached their MRA and have 10 years of service. Those that elect early retirement will have their basic benefit permanently reduced by 5% for each year they retire before age 62.

How your FERS pension is calculated

An understanding of the FERS pension calculation can help you decide when it is the right time to retire.

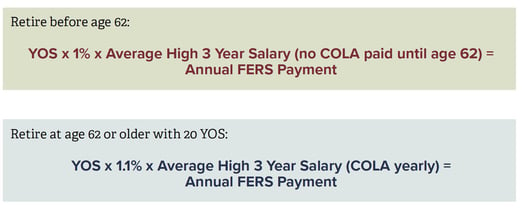

FERS pays benefits using two formulas based upon your retirement age. Here is a breakdown of each variable used in these formulas:

Years of service (YOS)

This is the number of years worked while in FERS. Unused sick leave is converted into days/months for the purpose of crediting additional partial years when determining your YOS.

Average high 3-year salary

This number is any three consecutive years of basic pay. It does not have to be a calendar year.

Cost-of-living adjustment (COLA)

A COLA is applied yearly for only those receiving an annuity at age 62 or older. If you elect the annuity prior to age 62, you are not eligible for a COLA until you reach age 62. Your first COLA is prorated for the number of months you receive your monthly annuity before December 1. It is annualized each year thereafter.

Multiplier of 1% versus 1.1%

The formula is slightly different if you elect to take the annuity at age 62 versus prior to turning 62. If you elect to retire prior to age 62, the pension calculation does not change to the higher multiplier of 1.1% when you turn age 62.

What about locality pay?

Again, the FERS pension is based on years of service, salary (highest three consecutive years), a cost-of-living adjustment and a specific multiplier. But there are millions of federal employees across the world working and living in vastly different economic locations. That means some employees will receive different levels of compensation based on where they are located. This is known as locality pay.

Locality pay is an adjustment to your base pay that compensates you for higher living expenses in the area where you work. The locality pay adjustment is included as part of your base pay when calculating your FERS pension. There is no adjustment made to where you live after you are retired.

Although locality pay is part of the FERS pension calculation, it’s not as big of a factor as other variables that go into the benefit formula.

Ways to increase your FERS pension

Essentially, the higher each variable of the FERS formula is, the higher your annual payment. That tells you what options you have to increase your benefit.

- Work longer

Since years of service is a major determinant, delaying retirement, even if for a few years, can lead to significantly more retirement income. It also gives you more time to grow your TSP account.

- Move up the ladder

A higher-paying position or a raise will boost your average high 3-year salary. This will help you in the near term, as you earn more, and in retirement with a higher benefit payout.

- Wait until age 62 or older to retire

As shown above, the multiplier is greater after age 62, so it pays not to retire too early. Waiting gives you the higher multiplier and the additional years of service.

Figuring out your own FERS pension

If you wanted to, you could plug in your numbers and come up with a rough calculation of your benefit amount. But what that may not give you is a good indication of how ready you are to retire. You’ll need some additional retirement planning.

It helps to have a few different projections of what your financial future may look like. This will let you choose an appropriate retirement date and determine how much you need from other retirement income sources (TSP account, Social Security, etc.).

Essentially, there are two ways to do this:

- On your own

The U.S. Office of Personnel Management has a useful FERS retirement calculator called the Federal Ballpark Estimator. It gives you a general idea of what to expect from your FERS pension. But the drawbacks of retirement calculators are that they may not provide accurate numbers, can be limited as to what financial assets you can include and, therefore, may provide limited results.

So, if you want more comprehensive retirement planning, consider working with a financial professional.

- With professional help

A financial professional is able to present you with an entirely personalized and comprehensive retirement plan that includes a variety of estimations based on your FERS pension, TSP plan and all other assets. Further, a professional can suggest different strategies to take that you may not realize are available to you. Plus, unlike a calculator, you can actually ask a person questions.

FERS pension supplemental annuity benefit

An important feature of FERS for those choosing to retire before age 62 is the supplemental annuity benefit. This supplement mimics your Social Security retirement benefit and is payable to those who are able to retire on an immediate annuity that is not reduced for age.

You are eligible for the supplemental annuity benefit if you:

- retire voluntarily on an immediate annuity that is not reduced for age;

- or reach your MRA and retired involuntarily or voluntarily because of reorganization or reduction in force.

The supplemental annuity benefit is payable until age 62, which is when you become eligible for Social Security retirement benefits. It ends at age 62 regardless of whether or not you decide to take Social Security retirement benefits or defer them until a later time.

Think of this benefit as if you were age 62 and fully insured for Social Security retirement benefits. Specifically, the benefit is calculated by estimating the Social Security retirement benefit over a 40-year career and then reducing this benefit proportionately by the number of years of FERS service.

For example, if you had 32 years of FERS service, this amount would be divided by 40 as follows: 32/40=.8 or 80%. Therefore, you would receive 80% of your projected Social Security retirement benefit at age 62.

The supplemental annuity benefit is subject to an earnings test. Earning income in the form of wages after retirement will reduce the supplement by one dollar for every two dollars over the limit (which changes yearly). Income from the FERS Basic Annuity is NOT included in the test. Also, there is no COLA.

FERS pension survivor annuity

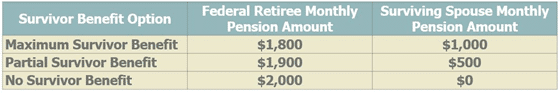

There are a couple of options available for married retirees that can extend a portion of FERS pension payments to their surviving spouse.

Here are the options:

- Self-Only Annuity: This “single life” annuity will pay the full annuity amount only until the retiree passes – nothing is left for the surviving spouse.

- One-Half Maximum Survivor Benefits: While the retiree lives and receives benefits, the pension amount will be reduced by 5% per month. In exchange, the surviving spouse will receive 25% of the retiree’s full annuity amount after the retiree passes.

- Maximum Survivor Benefits: While the retiree lives and receives benefits, the pension amount will be reduced by 10% per month. In exchange, the surviving spouse will receive 50% of the retiree’s full annuity amount after the retiree passes. If the spouse unfortunately passes away prior to the retiree, any reduction is restored to the full annuity amount from that point on until the retiree passes.

This chart gives you an example of these options based on a $2,000 FERS single life annuity:

As an example: If Diane, a federal employee, is married to Jack and she could receive a full FERS pension annuity of $1,000 per month, she can either 1) receive $1,000 until she passes with nothing for Jack, 2) receive $950 per month until she passes and Jack receives $250 per month for the rest of his life, or 3) receive $900 per month until she passes and Jack receives $500 per month for the rest of his life. If Jack passes before Diane, Diane would receive the full $1,000 per month from that time forward in any scenario.

Federal Employee Health Benefits

Retirees from FERS are allowed to maintain their Federal Employee Health Benefits (FEHB) coverage by paying through their FERS pension, as long as they have been covered for at least the previous five years leading up to retirement. This is especially important to bridge the gap between retirement and Medicare eligibility at age 65.

FEHB coverage can then be reduced or eliminated based on which Medicare or Medicare Advantage plan is chosen. If married, it is important to consider a survivor annuity as described above so that FEHB coverage would continue for the surviving spouse. If the Self-Annuity option is chosen, the spouse will lose coverage when the retiree passes.

If you have any questions concerning your FERS pension in particular, or if your job might have another arrangement or formula, contact an Advance Capital Management financial adviser for help!

Learn more about government retirement benefits, including the FERS pension, Thrift Savings Plan and other retirement planning steps, by downloading our free, easy-to-understand guidebook, FERS Made Simple: Understanding and Maximizing Your Benefit.

As a financial adviser, Kurt takes a comprehensive approach to help clients work toward their financial goals by providing wealth management tools including retirement planning, investment portfolio advice and tax strategies. He specializes in federal government benefits and is a Chartered Retirement Planning Counselor.