Understanding the Basics of the FERS Basic Benefit

August 2nd, 2018 | 3 min. read

By Kurt Mears, Advance Capital Management Financial Adviser

From postal workers to VA doctors, we’ve had the pleasure to work with many federal government employees.

It’s not a stretch to say the federal government employs some of the brightest people on the planet. Many federal jobs are highly specialized in fields ranging from communications and energy to medicine and surveillance. In a nutshell, if you’re a federal government employee, you’re probably pretty smart.

However, all that brain power isn't a guarantee you fully understand your retirement benefits package. A good place to start is with the Federal Employees Retirement System (FERS) Basic Benefit, or “monthly annuity.”

In what’s a rarity for most workers these days, the FERS Basic Benefit provides a guaranteed pension-like stream of income. It will be one of your most important sources of income in retirement. Knowing how it works can help you determine when you’re ready to retire.

What is the FERS Basic Benefit

Upon retirement, FERS will pay you a monthly benefit based upon your years of service worked under FERS, your income and the age you retire. Hence, the basic benefit is often known as the monthly annuity.

For this benefit, you pay 0.8% of your basic pay each pay period. Basic pay does not include bonuses, overtime, holiday pay, night differential, or payment based on accrued or accumulated leave.

When you are eligible to receive the FERS Basic Benefit

There are two eligibility options that affect the size of your basic benefit:

- Unreduced Benefits: Eligibility for unreduced benefits (immediate retirement) requires you to meet one of the following criteria:

- Reach Minimum Retirement Age (“MRA”) (age 55-57, depending upon your year of birth) with 30 years of service; or

- reach age 62 with 5 years of creditable service; or

- reach age 60 with 20 years of creditable service.

- Early Retirement: Employees may be eligible for early retirement if they have reached their MRA and have 10 years of service. However, those who elect early retirement will have their basic benefit permanently reduced by 5% for each year they retire before age 62.

How your FERS basic benefit is calculated

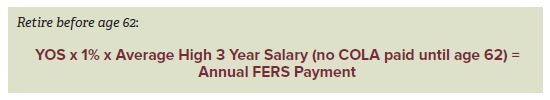

FERS pays benefits using the following two formulas based upon your retirement age:

These formulas can look confusing at first glance. To help you make sense of them, here are explanations for each variable:

Years of service (YOS): This is the number of years worked while in FERS. Unused sick leave is converted into days/months for the purpose of crediting additional partial years when determining your YOS.

Average High 3 Year Salary: This number is any three consecutive years of basic pay. It does not have to be a calendar year.

Cost-of-living adjustment (COLA): A COLA is applied yearly for only those receiving an annuity at age 62 or older. If you elect the annuity prior to age 62, you are not eligible for a COLA until you reach age 62. Your first COLA is prorated for the number of months you receive your monthly annuity before December 1. It is annualized each year thereafter.

Multiplier of 1% versus 1.1%: The formula is slightly different if you elect to take the annuity at age 62 versus early, or prior to turning 62. If you elect to retire early, the pension calculation does not change to the higher multiplier of 1.1% when you turn age 62.

The FERS Basic Benefit Survivor Annuity

The FERS Basic Benefit also has a survivor annuity that covers a spouse if you pass away. Electing to cover a spouse will cause a reduction of the monthly basic benefit paid both to you and your spouse in the event of your death.

The reductions are as follows:

- Monthly annuity benefit is reduced by 10% for a survivor benefit of 50% of the monthly annuity benefit (before it is reduced by the 10% to pay for the survivor benefit)

- Monthly annuity benefit is reduced by 5% for a survivor benefit of 25% of the monthly annuity benefit (before it is reduced by the 10% to pay for the survivor benefit)

If married, think through the survivor options to maximize income for your family. In most cases, a married couple chooses a survivor option instead of the single life annuity (this is the option with no survivor benefit, and it pays the highest monthly pension amount).

However, this is a personal decision that depends on the circumstances of you and your spouse. If you have enough assets or your spouse also has a pension plan, it may make sense to consider the single life option, or the lower 25% benefit instead of the 50% benefit. This is not a decision that should be taken lightly due to the risk of the surviving spouse having inadequate income in retirement.

Learn more about government retirement benefits, including the FERS basic benefit, the Thrift Savings Plan and other retirement planning steps, by downloading our free, easy-to-understand guidebook, FERS Made Simple: Understanding and Maximizing Your Benefit. (click the button below)

Kurt Mears is a Chartered Retirement Planning Counselor who provides federal workers with comprehensive wealth management solutions, such as retirement planning and investment advice, to help them achieve their financial goals. He is also one of Dave Ramsey's designated SmartVestor investing professionals. Contact him for a free, no obligation financial consultation.

As a financial adviser, Kurt takes a comprehensive approach to help clients work toward their financial goals by providing wealth management tools including retirement planning, investment portfolio advice and tax strategies. He specializes in federal government benefits and is a Chartered Retirement Planning Counselor.