How to Calculate Your FERS Retirement Benefit

August 12th, 2020 | 3 min. read

What every federal government employee knows is that one of your primary retirement income sources will be the FERS basic benefit. Along with Social Security, this pension-like system is a coveted form of guaranteed income. What you may not know is how exactly your FERS retirement benefit is calculated.

The FERS system uses a specific formula based upon your years of service worked under FERS, your income and retirement age.

Why should it matter to you? An understanding of the FERS benefit calculation can help you decide when it is the right time to retire.

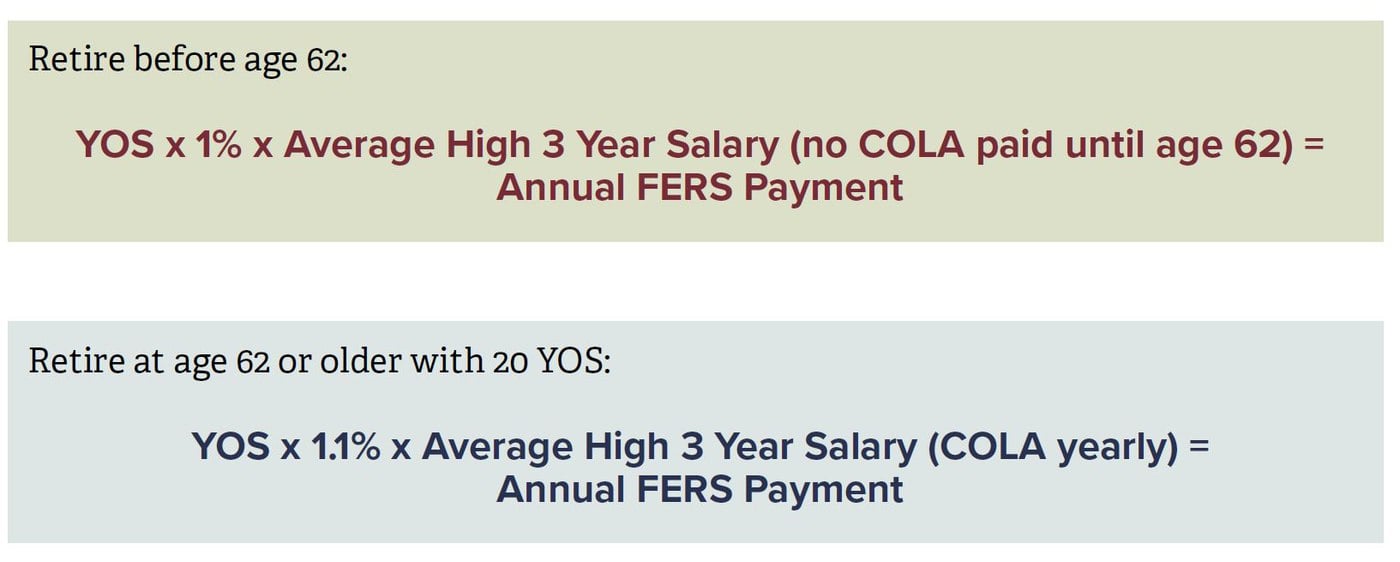

The FERS benefit formulas

FERS pays benefits using two formulas based upon your retirement age. Here is a breakdown of each variable used in these formulas:

Years of service (YOS)

This is the number of years worked while in FERS. Unused sick leave is converted into days/months for the purpose of crediting additional partial years when determining your YOS.

Average high 3-year salary

This number is any three consecutive years of basic pay. It does not have to be a calendar year.

Cost-of-living adjustment (COLA)

A COLA is applied yearly for only those receiving an annuity at age 62 or older. If you elect the annuity prior to age 62, you are not eligible for a COLA until you reach age 62. Your first COLA is prorated for the number of months you receive your monthly annuity before December 1. It is annualized each year thereafter.

Multiplier of 1% versus 1.1%

The formula is slightly different if you elect to take the annuity at age 62 versus prior to turning 62. If you elect to retire prior to age 62, the pension calculation does not change to the higher multiplier of 1.1% when you turn age 62.

Ways to increase your FERS retirement benefit

What may be most important isn’t how the math works, but rather how you can increase your FERS benefit. Essentially, the higher each variable of the FERS formula is, the higher your annual payment. That tells you what options you have to increase your benefit.

1. Work longer

Since years of service is a major determinant, delaying retirement, even if for a for years, can lead to significantly more retirement income. It also gives you more time to grow your TSP account.

2. Move up the ladder

A higher-paying position or a raise will boost your average high 3-year salary. This will help you in the near term, as you earn more, and in retirement with a higher benefit payout.

3. Wait until age 62 or older to retire

As shown above, the multiplier is greater after age 62, so it pays not to retire too early. Waiting gives you the higher multiplier and the additional years of service.

Remember, there are three ways to become eligible for unreduced FERS benefits (immediate retirement): (1) you must reach Minimum Retirement Age (“MRA”) (age 55-57, depending upon your year of birth) with 30 years of service; (2) reach age 62 with 5 years of creditable service; or (3) reach age 60 with 20 years of creditable service.

Federal employees are eligible for early retirement if they have reached their MRA and have 10 years of service. Those that elect early retirement, however, will have their basic benefit permanently reduced by 5% for each year they retire before age 62.

How to calculate your FERS retirement benefit

If you wanted to, you could plug in your numbers and come up with a rough calculation of your benefit amount. But what that may not give you is a good indication of how ready you are to retire. You’ll need some additional retirement planning.

It helps to have a few different projections of what your financial future may look like. This will let you choose an appropriate retirement date and determine how much you need from other retirement income sources (TSP account, Social Security, etc.).

Essentially, there are two ways to do this:

1. On your own

The U.S. Office of Personnel Management has a useful FERS retirement calculator called the Federal Ballpark Estimator. It gives you a general idea of what to expect from your FERS benefit. But the drawbacks of retirement calculators are that they may not provide accurate numbers, can be limited as to what financial assets you can include and, therefore, may provide limited results.

So, if you want more comprehensive retirement planning, consider working with a financial professional.

2. With professional help

A financial professional is able to present you with an entirely personalized and comprehensive retirement plan that includes a variety of estimations based on your FERS benefit, TSP plan and all other assets. Further, a professional can suggest different strategies to take that you may not realize are available to you. Plus, unlike a calculator, you can actually ask a person questions.

The date you retire from FERS

the date you retire from FERS can carry significant importance based on your cash flow needs.

Here’s why:

Once you retire as a FERS employee, your retirement date becomes the first of the following month. Your first FERS annuity check then will be sent to you on the first day of the following month after retirement.

For example, let’s say you retired on February 14. Your annuity retirement date would be March 1 and your first FERS annuity check would arrive on April 1.

Learn more about The Best Dates to Retire from FERS.

Learn more about government retirement benefits, including the FERS basic benefit, the Thrift Savings Plan and other retirement planning steps, by downloading our free, easy-to-understand guidebook, FERS Made Simple: Understanding and Maximizing Your Benefit.

As a financial adviser, Kurt takes a comprehensive approach to help clients work toward their financial goals by providing wealth management tools including retirement planning, investment portfolio advice and tax strategies. He specializes in federal government benefits and is a Chartered Retirement Planning Counselor.