What to Know About Contributing to the Thrift Savings Plan

August 15th, 2018 | 3 min. read

From postal workers to VA doctors, we’ve had the pleasure to work with many federal government employees. The one area we advise them to focus most of their attention is here: the Thrift Savings Plan (TSP).

Here’s why.

The “three-legged stool” is an old metaphor once commonly used in the finance industry when talking about sources of income in retirement. The three legs represent Social Security, employer pensions and personal savings. But, the analogy is flawed. For one, a stool conjures thoughts of sitting, while saving and investing in retirement is an active process. Plus, there are more than just three potential retirement income sources.

Perhaps, a better metaphor would be sailing a boat across the open ocean. You have a variety of forces that can help propel you forward, such as the current and the wind. But, the thing most under your control is the boat – much like your TSP account.

Almost all factors of the TSP are dynamic. This gives the TSP greater potential than any other part of FERS to boost your chances at a comfortable retirement. However, it also creates more room for costly mistakes.

Is a Traditional or Roth account better?

Similar to a private company 401(k) plan, the TSP allows each employee to save a portion of his or her paycheck in a tax-deferred investment account that, hopefully, grows for future use as retirement income.

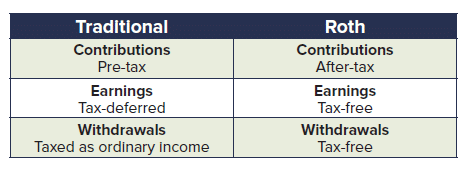

There are two account options in the TSP: a Traditional account and a Roth account. The Traditional option allows you to defer money from your paycheck pre-tax. You then pay taxes as ordinary income when you withdraw money from your TSP account in retirement. In a Roth account, you defer money from your paycheck after-tax, which allows you to withdraw money from your TSP tax-free.

Essentially, the difference between the Traditional and the Roth option is when you pay taxes. Which option is right for you depends on your unique tax situation and income needs, both while working and in retirement.

- Choose a Traditional account: if you anticipate being in a lower tax bracket in retirement. The further along in your career, the better off you are contributing to the Traditional option due to the likely scenario of having equal or lower taxable income in retirement.

- Choose a Roth account: if you anticipate being in a higher tax bracket in retirement. Generally, the Roth option benefits those early in their career, who do not have the burden of being in a high tax bracket.

How much should you save in your TSP account?

Since the first 5% of your basic pay that you contribute is matched 100% by your employer (see below), you should save a minimum of 5% of your paycheck. You’re essentially getting free money for your retirement. Furthermore, both your contribution and the company contribution grow tax-deferred, which means every dollar that you contribute lowers your taxable income by a corresponding amount.

The maximum you can contribute is limited by IRS rules. In 2024, employees under the age of 50 can contribute up to $23,000. Employees age 50 or older can contribute an extra $7,500 (known as a catch-up contribution) for a total annual contribution of $30,500.

Ultimately, consider saving as much money as possible in your TSP. You certainly don’t want to lead an unfulfilling lifestyle by saving too much money, but the more you save, the greater the likelihood you can meet your retirement goals.

New Catch-Up Contribution Limits for Ages 60-63 Starting in 2025

Starting January 1, 2025, the new catch-up contribution limit is either $10,000 (which will adjust with inflation) or 150% of the regular catch-up limit, whichever is higher. This change applies to you if you’re 60, 61, 62 or 63 years old and eligible for catch-up contributions.

Changes to Catch-Up Contributions for Higher Incomes Starting in 2026

If your income from TSP-eligible jobs is above a certain level, your catch-up contributions will automatically be Roth contributions. This means they’ll be made after taxes are taken out. The exact income level that triggers this change will be adjusted for inflation each year and announced by the IRS. To give you an idea, the initial threshold was set at $145,000 for 2023. This means, if your income in 2025 is above the set threshold and you’re eligible for catch-up contributions, any contributions you make in 2026 will be added to your Roth balance.

Taking advantage of the TSP employer match

As mentioned, the TSP offers a matching program that you should take full advantage of.

First of all, those who started working prior to August 1, 2010, receive an automatic contribution of 1% from their employer whether or not they chose to contribute to the TSP. Meanwhile, those who started working after July 31, 2010, are automatically contributing 3% of their pay to the TSP (unless they opted out) and receive an employer match of 4% for a total contribution of 7%.

In general, TSP accounts receive employer matching using the following schedule:

- Each employee receives a 1% of basic pay employer contribution, whether or not the employee contributes anything.

- Employer matches the first 3% of basic pay deferred to the TSP.

- Employer matches 50% of the next 2% of basic pay contributed.

- Employer matches max out at 5% of basic pay for the first 5% an employee contributes.

Ultimately, contributing to the TSP – early and often – can be your ticket to a successful journey toward retirement.

Learn more about government retirement benefits, including the FERS basic benefit, the Thrift Savings Plan and other retirement planning steps, by downloading our free, easy-to-understand guidebook, FERS Made Simple: Understanding and Maximizing Your Benefit. (click the button below)

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.