Steps That Can Boost Your Chances of Becoming a TSP Millionaire

March 9th, 2022 | 4 min. read

There is no secret strategy to become rich. You don’t need to put all your money in a new tech stock or cryptocurrency. You don’t even need to earn a six-figure salary. Many government workers, civil servants and military service members (or retired military) just like you are proof of this.

In the last quarter of 2021, the number of millionaires investing in the Thrift Savings Plan (TSP) spiked significantly by almost 50%. As of Dec. 31, there were 112,880 TSP millionaires, up from 75,420 a year ago, according to the Federal Retirement Thrift Investment Board.

What sets these TSP millionaires apart? Nothing. They have been consistently saving and investing for decades and taking advantage of any employer match to their retirement plan contributions. They have also kept their retirement savings put, whether they changed jobs or faced an unexpected expense.

As a government worker, the FERS basic benefit is arguably your most precious retirement asset. But your TSP account can be a major factor in when you can retire and how well you live in retirement.

So, do you want to become a TSP millionaire? Here are steps that can help you reach that goal.

Just start saving in your TSP account

Let’s put it this way: the sooner you start saving, the better your chances at becoming a TSP millionaire. That’s because you get more time to take advantage of compounding interest, which is the ongoing earnings earned on your earnings.

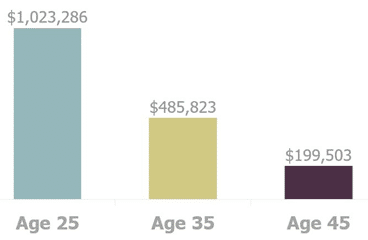

Suppose you join the federal workforce at age 25 and plan to retire at age 60. Here is an example of what the difference in ending balances could be saving 15% of a $55,000 salary when starting at ages 25, 35 and 45 (assuming a 6.5% annual return).

Take advantage of the TSP match…

How much should you save? At least to earn the full TSP match. This match maxes out at a total of 4% of your basic pay, as long as you contribute 5% or more. On top of that is a nonelective 1% contribution, for a total maximum match benefit of 5% of your pay.

Since the first 5% of your basic pay that you contribute is matched 100% by your employer, you should save a minimum of 5% of your paycheck. You’re essentially getting free money for your retirement.

Fortunately, most new employees will not need to take any action. Every employee hired after October 1, 2020 is automatically enrolled in the plan contributing 5% of their pay as pre-tax dollars. You will need to take action, however, if you wish any of the 5% to be classified as Roth or to be invested in something other than the L-fund designed for your age.

…But try to save as much as you can

The annual TSP contribution limit is $20,500 (2022). Those 50 and older get the benefit of catch-up contributions, which allows them to save an additional $6,500 per year, for a total allowable annual contribution of $27,000 (2022).

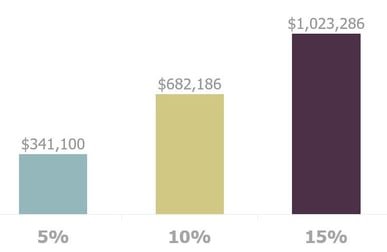

Of course, saving around $20,000 or more a year isn’t easy or always practical. A common rule of thumb is to save about 10-15% of your salary, which will allow you to replace the conventional 70-80% of your preretirement income.

Still, increasing your savings amount even a little each year makes a major difference over time. Consider how much of a difference just a 5% savings increase can have. This chart shows the ending balances from various savings rates on a $55,000 salary over 35 years, assuming a 6.5% annual return.

Choose your TSP funds wisely

The TSP has five basic investment options, ranging from very conservative to very aggressive. You don’t have to choose just one. You can invest in several funds to help spread your risk among different investment options and achieve a greater degree of diversification.

Generally, the majority of your money, if not all of it, should be allocated to stocks (the C, S & I Funds) early in your career. As you approach retirement, you should start to reduce risk and move money to more conservative investments (F or G Fund) in an effort to protect it.

How much you allocate to each fund and when you start to transition to more conservative investments is a matter of your personal situation. It is, however, important to take the right risks at the right time.

For those who doubt their ability to make investment decisions, the Lifecycle Funds (L Funds) can take the stress out of managing your TSP. Just keep in mind they have some potential drawbacks you should consider. The automatic shift in assets may not reflect current economic and market opportunities and they may become more conservative than what is appropriate for your situation.

Don’t make unnecessary TSP fund changes

A big investment mistake is to constantly change your investments around in hopes of increasing gains or avoiding losses. Building wealth takes time. You won’t become a TSP millionaire overnight, which is why it’s important to focus on the long term and avoid reacting to short-term market events.

Markets are notoriously volatile in the short term. The average intra-year drop in the S&P 500 is around 14% from 1980 to 2021, according to a report by JP Morgan. Yet, annual returns have been positive for 32 of those 42 years (more than 75%).

That’s why investors are better off being patient and sticking with their plan as the market works itself out. You don’t want to make unnecessary changes to your account that result in missing out on market gains.

Avoid TSP loans and in-service withdrawals

Under certain circumstances you may take out loans and in-service withdrawals from your TSP. But that doesn’t mean you should, unless you really really need the money.

Here’s why: Taking money out of your TSP reduces the ability for this money to stay invested and grow for the future. In other words, it reduces your chances of becoming a TSP millionaire. Each dollar withdrawn is no longer generating growth for your retirement.

Further, many people default on TSP loans because there is not the same pressure to repay them like bank loans. These defaults can lead to high tax penalties and reduced assets for retirement. Instead of using your TSP as a savings account, build a separate emergency fund that you can access at any time without penalties or fees. You’ll be better equipped to handle any unexpected expenses while staying on track toward retirement.

The Bottom Line

Certainly, becoming a TSP millionaire is easier said than done. But it’s not impossible, and the number of government workers joining the millionaire ranks is increasing. The steps above can help you get there, too. You could also benefit by working with a FERS-experienced financial adviser. Please reach out to us if you have any questions or would like advice on your investments, how much to contribute, or to get a better picture of what retirement looks like for you.

Learn more about government retirement benefits, including the FERS basic benefit, the Thrift Savings Plan and other retirement planning steps, by downloading our free, easy-to-understand guidebook, FERS Made Simple: Understanding and Maximizing Your Benefit.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.