Should Federal Workers Choose a TSP Roth or Traditional Account?

August 18th, 2021 | 2 min. read

Similar to a private company 401(k) plan, the Thrift Savings Plan allows each federal worker to save a portion of his or her paycheck in a tax-deferred investment account that can grow for future use as income in retirement. However, you are given access to two different account options: a TSP Roth and traditional account.

So, which should you choose? Roth or traditional? Or, both?

The choice between a Roth and traditional account is a common retirement planning dilemma that requires a review of your current financial situation – and a little time travel.

No, this isn’t the premise of a bad science fiction movie, but rather an essential part of the retirement planning process. Often, smart financial decisions involve a look toward the future. You have to travel in time (metaphorically speaking) to determine where you want to be and estimate what the financial details may look like: your lifestyle, adjusted gross income, discretionary expenses, etc.

Saving and investing for retirement is a long-term enterprise. Where you want to be in the future influences your decisions in the present. This includes choosing the right account. The differences between TSP Roth and traditional accounts can be either advantages or disadvantages depending on where you are today and where you’ll be tomorrow.

To help you decide which account makes the most sense for you, let’s compare the major differences between a TSP Roth and traditional account.

TSP Roth and traditional accounts explained

It essentially all comes down to taxes.

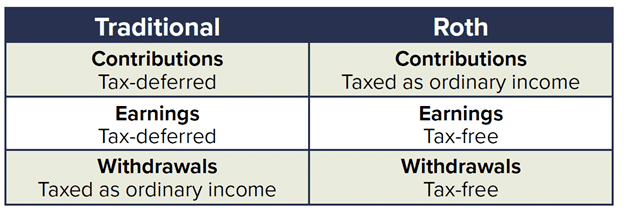

There are two TSP account options for your contributions – Roth or traditional – which affect when your savings and any growth is taxed. By putting traditional contributions into the TSP, you postpone (defer) paying income taxes on this and any growth until you take the money out during retirement (pay later). On the other hand, you pay the taxes now on Roth contributions (pay now), but this money and any growth will come out tax-free.

Tax differences between TSP Roth and Traditional accounts

Choosing between a TSP Roth and traditional account

Choosing between a TSP Roth and traditional account

Here’s the thing: you do not have to limit yourself to just one choice. You can contribute to both a TSP Roth and traditional account in any proportion you wish.

When deciding how much to put into either account, you should consider two questions:

1. Will I pay higher taxes now or when I need this money in retirement?

This is your primary deciding factor. Let us assume you will be in a 20% effective tax bracket in retirement. If you are in the middle of your peak earning years right now and paying 30%+ back to the government, put your contributions into a traditional account. If your income is low, as you are just starting off, for example, pay your 10-12% taxes now via Roth instead of waiting to pay 20% when you take the money out.

2. How much of my retirement assets are pre-tax vs after-tax?

To a lesser extent, or if the first question is close to equal, having a mixture of pre-tax (traditional) vs after-tax (Roth) assets in retirement can provide financial flexibility. However, each person’s financial needs are unique, and you may have considerations that go beyond your current and future tax rate. You want to create a comprehensive financial plan that considers your entire financial picture – FERS basic benefit, Social Security, financial goals, other assets, etc. – to decide what makes sense for you.

If you can’t determine what side of the pre-tax vs. Roth debate you fall on, contact us and we can help figure out what's best for your financial situation. One of our advisers will answer your questions and put together a comprehensive financial plan for you for no cost and no obligation.

Learn more about federal retirement benefits by downloading our free, easy-to-understand guidebook, FERS Made Simple: Understanding and Maximizing Your Benefit.

As a financial adviser, Kurt takes a comprehensive approach to help clients work toward their financial goals by providing wealth management tools including retirement planning, investment portfolio advice and tax strategies. He specializes in federal government benefits and is a Chartered Retirement Planning Counselor.