How to Protect Against Inflation in Retirement Planning

May 23rd, 2018 | 3 min. read

Erosion is one of the most awe-inspiring forces in nature. Perhaps what’s so striking about it is that on a day to day basis, even from year to year, its effect isn’t always noticeable. But over time, the gradual wearing away of soil, dirt and rock by elements such as water or wind shapes our environment in dramatic ways.

Erosion is one of the most awe-inspiring forces in nature. Perhaps what’s so striking about it is that on a day to day basis, even from year to year, its effect isn’t always noticeable. But over time, the gradual wearing away of soil, dirt and rock by elements such as water or wind shapes our environment in dramatic ways.

A prime example is the Grand Canyon. It was worn away over the course of tens of millions of years by the Colorado River with the help of winds whipping through the formed canyon. Some researchers have even theorized that wind and the melting and freezing of glaciers has contributed to the near-complete erosion of the Rocky Mountains, not once but twice, throughout the planet's history (the reformation of the mountain range is believed to have taken place due to shifting tectonic plates).

In the world of money, erosion’s financial equivalent is inflation. It may seem like a small threat in the short term, but in the long term, it can severely wear down the value of your money. Assuming the historical rate of inflation of 3%, your money today could lose half its value in a little less than 25 years.

Inflation has been relatively tame since the 2008 financial crisis. So, it’s understandable why it isn’t top of mind for many investors and soon-to-be retirees. But, as the economy continues to grow, inflation is expected to rise with it.

Therefore, it’s a mistake to overlook inflation in retirement planning. Especially, when you also consider that you will be drawing down your assets and that several retirement-related costs, such as healthcare and housing, tend to rise above the rate of inflation.

The Effect of Inflation in Retirement Planning

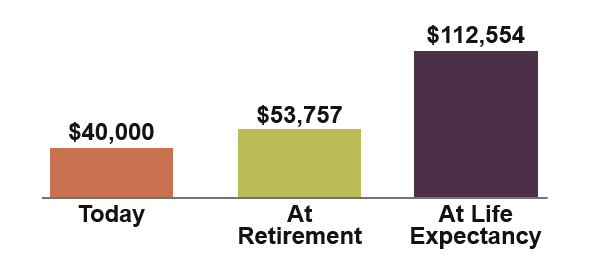

To get a better sense of why you need to account for inflation in your retirement plan, imagine you’re age 55 and plan to retire at age 65. Your current annual income is $100,000 and you need to live off 80% of that amount in retirement. Half will be covered by your Social Security benefit, which leaves 40%, or $40,000, to be funded with your retirement savings.

Due to inflation, however, your income needs will grow by the time you retire. At your retirement date of age 65, your income need will be $53,757, assuming 3% inflation. Now, let’s say your life expectancy is 90 years old. By then, your income need will balloon to $112,554.

Retirement income needs

The Role of Stocks as Inflation Protection

Conventional wisdom says you should invest more conservatively as you near retirement. That is, lower the amount of stocks in your portfolio to take some risk off the table. However, it’s possible to make the mistake of becoming too cautious.

Sure, you may not need the same level of growth in your portfolio. Yet, stocks, because of their higher growth potential, provide another important benefit to retirement investors: inflation protection.

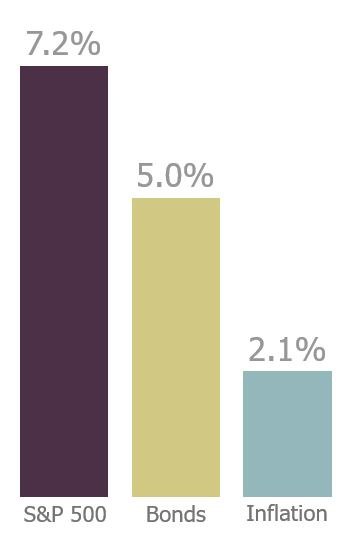

Over time, stocks tend to outperform bonds, making them a better bulwark to the corrosive effects of inflation. This is shown in the chart below comparing 20-year annualized returns between stocks and bonds and inflation.

20-year annualized returns (1998-2017)

Source: JP Morgan.

Instead of hitting the brakes and going from say a 70/30 stock-to-bond portfolio to a 20/80 portfolio, you may want to just ease off the gas. Consider investing in a 50/50 or 40/60 portfolio, depending on your level of wealth and retirement needs.

How Inflation Affects Other Income Sources

Of course, your retirement savings are only one piece of the puzzle. You should also understand how inflation affects your other income sources.

Pensions

If you’re fortunate to receive a pension, it’s important to know that it may not be indexed to inflation. That means you won’t receive a cost-of-living adjustment (COLA) if you choose the monthly payout and may experience a substantial loss of buying power over time. A lump-sum payout, on the other hand, invested in an IRA gives you the ability to choose investments that may help your money grow above the rate of inflation.

Social Security

Social Security provides a COLA each year based on inflation as measured by the Consumer Price Index. Although the many retirees who rely on their benefit as their prime source of income may find it underwhelming. In 2017, the Social Security COLA was only 0.3%. In 2016, there was no COLA. It’s true the Social Security COLA will start to rise as the rate of inflation returns to more historical levels. But, it likely won’t keep pace with particular costs that affect older consumers and that rise faster than inflation, such as prescription drugs and utilities.

Annuities

An annuity is attractive as a potentially guaranteed stream of income. Inflation protection though doesn’t come standard in annuities. Instead, to receive a COLA with your annuity you must purchase it like an upgrade, which increases the total cost of the annuity and reduces your return.

The fact is inflation, like Mother Nature, is going to take its course. You can’t totally avoid it. What you can do is take the proper retirement planning steps to put your money further out of its reach.

The information in this presentation should not be construed, in any manner whatsoever, as a substitute for personalized individual advice from Advance Capital Management. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Any examples shown were hypothetical and used to demonstrate a concept.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.