Preparing for the Economic Recovery

May 18th, 2020 | 4 min. read

And now, for a look toward a better future.

We won’t know the full economic impact of the coronavirus outbreak for quite some time. With more than 30 million people out of work, we know the damage is severe. But we also know that eventually the economy will recover. Economic activity is generally cyclical. Every recession – no matter how deep – has been followed by an expansion.

Considering no industry has been untouched by the pandemic, some economists don’t expect the U.S. economy to recover until 2022 or later. For comparison, the 2008 Great Recession lasted 18 months, while the average economic recession going back to 1900 has been around 15 months. Each recession is unique but wholly the same in the fact that they end.

No one can accurately predict when or how fast the recovery will occur. So, making financial decisions based on predictions is usually a fool’s errand. That doesn’t mean you should sit still.

Economic recoveries have been periods of opportunity, whether in the workplace (at-home workplace, nowadays) or the stock market. Since 1950, the average expansion has lasted 67 months with GDP growth of 24.3%, 12 million jobs added and a 117% return in the stock market.

One fundamental finance principle is this: it is far better to prepare than to react. Most financial advice pertains to preparing for when things go wrong, but it is equally important to prepare for when things go right. So, it’s not too early to start thinking about the steps you’re going to take when the economy takes a turn for the better.

Rebuild your emergency fund

Arguably, the most important money move for an economic crisis is to have an emergency fund in place. The rule of thumb is to save between three to six months’ worth of expenses.

Unfortunately, most Americans lack that crucial financial life preserver. One survey found only 40% of Americans could cover an unexpected $1,000 expense. It’s worth noting this survey was taken when unemployment was low.

For many people out of work today, the $1,200 stimulus check provides only temporary relief. Meanwhile, unemployment benefits do not always replace someone’s full income, and the extra $600 benefit due to COVID-19 expires July 31. Therefore, it is likely that those individuals who do have an emergency fund have already used it or will at some point in the near future, as they should.

Once your financial situation settles, your first step should be to rebuild that emergency fund. The crisis will likely have proven just how important it is to maintain it.

With interest rates on traditional savings accounts so low, a faster way to replenish your emergency fund is to put it in an online savings account, a certificate of deposit or money market account. They are safe and liquid and provide higher interest than a regular bank account.

Catch up on debt

If you’re like most Americans right now, the economic uncertainty has pushed you to preserve cash. That means paying off debt has taken a backseat. A growing number of people have chosen to make only minimum debt payments or defer them altogether. More than 3.5 million mortgage borrowers have requested forbearance, and millions more have requested breaks on credit card payments.

When out of work or threatened with the loss of work, this is the right thing to do. Still, eliminating debt should become a priority as soon as possible. After all, paying down high-interest debt is a guaranteed high return on your money.

A recession is actually a good time to restructure debt. Interest rates typically fall during economic trouble, which means it’s possible to substitute a lower interest rate for your higher ones. For example, you could apply for a 0% interest balance transfer credit card. It’s possible to come of out of this with more manageable debt.

Recharge your investment account contributions

You will also want to restart saving for the future if you pumped the brakes on contributions to your retirement or college savings accounts.

For those who tapped their retirement accounts for immediate needs, you may consider “returning” that money. Under the CARES Act you can withdraw up to $100,000 without the early withdrawal penalty, with the option to redeposit the money over three years.

The ideal amount to set aside for retirement is 10-15% of your paycheck. And, don’t worry about what the stock market is doing. The fact that April was the best month in the stock market since 1987 shows you the difficulty of trying to time the market (get out and back in at the right time).

As mentioned above, stock market returns are typically elevated during recovery periods. Missing out can be costly. A significant portion of your returns over the long term can be attributed to just a handful of the best trading days.

Review your investments

Speaking of which, how has your portfolio held up? If fluctuations in the market have disrupted your desired asset allocation, you may need to rebalance your portfolio.

A better question though is: how have you held up? If you’ve made dramatic investment changes or found yourself terribly worried about your portfolio, then maybe your current investment strategy isn’t right for you.

In other words, the level of risk in your portfolio may not match your true tolerance. The goal is to take enough investment risk to achieve your financial goals but not so much to ever feel tempted to abandon your investment plan during market downturns.

Adjust your budget and spending habits

On top of economic anxiety, stay-at-home orders have dramatically altered consumer spending. With fewer places to go, people are spending fewer dollars. Consider that the U.S. savings rate rose to 13.1% in March, up from 8% in February. That is the highest savings rate in almost 40 years.

The past few months actually offer valuable insight for adjusting your budget and spending habits, as you have had to cut expenses, whether voluntarily or not. Some adjustments you may want to make permanent as they help you save money and build wealth. Just take a bank statement and highlight the expenses you have cut that you don’t miss.

Do the same with your quarantined spending habits. Have you enjoyed eating at home more than going out? Are you interested in purchasing fewer but higher quality goods to avoid frequent shopping trips? Or, maybe you’ve found exercising outdoors for free beats paying a monthly gym membership?

Reassess your values

As you look over your spending, think about your values (family, education, business, etc.). Money’s sole purpose is to help us sustain who we are and what we truly value. In a time of crisis, have those changed? For example, you may want to become more active in your community.

If so, identify the expenses that support those values and expenses that do not. Keep the former and reduce the latter.

Check in with a financial adviser

Making the appropriate financial decisions without constantly second-guessing yourself can be done with the help of a trusted financial adviser. For instance, a financial adviser can help establish an investment strategy tailored to your personal long-term goals (retirement, college savings, a business).

The purpose of financial planning is to make sure in advance that your financial life is aligned with your personal goals and balanced enough to benefit from periods of growth while resilient during those inevitable downturns.

The fact is that economic trouble has already happened. What are you doing about it and how can you prepare to hit the ground running when the economic cycle resets?

To quote investing legend Benjamin Graham: “As the Danish philosopher Soren Kierkegaard noted, life can only be understood backwards—but it must be lived forwards.”

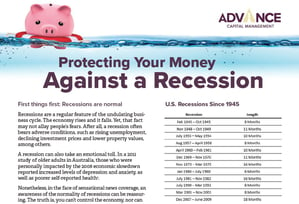

For tips and strategies to help you survive a recession, be sure to download our guide: Protecting Your Money Against a Recession.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.