Should You Elect a FERS Survivor Benefit?

July 10th, 2019 | 2 min. read

From postal workers to VA doctors, we’ve had the pleasure to work with many federal government employees. A common question we’re asked: How can I make sure my spouse is financially provided for? In this article we take a closer look at the FERS Survivor Benefit options.

When helping people create a comprehensive financial plan, we look at not only how to use your assets for a comfortable retirement, but also to ensure your loved ones are protected in the event you pass away. In addition to things like life insurance, a key component of that are survivor benefits.

The FERS Basic Benefit has a survivor annuity option that covers a spouse in the event of your death. If you’re married upon retirement, you’ll need to elect a survivor benefit. Which benefit you choose will determine how much of your FERS pension that your spouse will receive. However, electing to cover a spouse will cause a reduction of the monthly basic benefit paid both to you and your spouse in the event of your death.

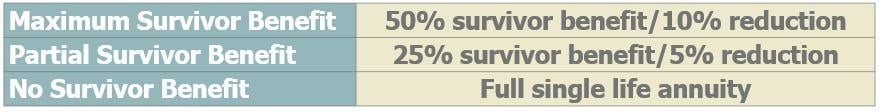

FERS Survivor Benefit Options

Maximum Survivor Benefit

If you choose the maximum survivor benefit, your spouse receives 50% of your full monthly FERS pension annuity benefit while your monthly benefit is then reduced by 10%.

Partial Survivor Benefit

With the partial survivor benefit, your spouse receives 25% of your full monthly FERS pension annuity benefit while your monthly benefit is then reduced by 5%.

No Survivor Benefit

If you choose not to elect a survivor benefit, your surviving spouse will not receive a benefit upon your death. Your monthly benefit isn’t reduced, but your pension payments will stop once you pass away and your spouse may no longer be eligible for federal health insurance.

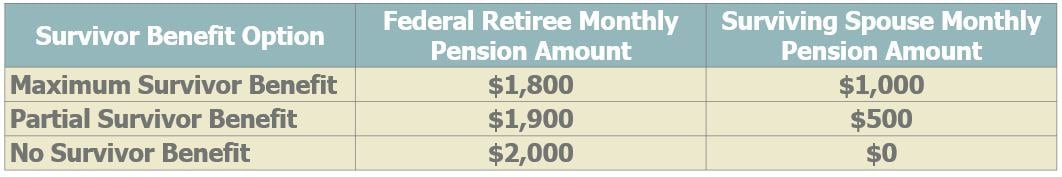

This chart gives you an example of these options based on a $2,000 FERS single life annuity:

The Choice Is Personal

As you can see, there are potential pros and cons for each option. That means the right option for you depends on the personal circumstances of you and your spouse.

Think through the survivor options with the goal being to maximize income for your family, not just your pension. In most cases, a married couple will choose one of the survivor benefit options instead of the single life annuity.

If, however, you have an adequate amount of other financial assets or your spouse also has a pension plan, it may make sense to consider the single life annuity option, or the lower 25% partial benefit.

Remember, this is an important – and permanent – decision. You want to consider your options carefully; preferably, with the help of a FERS-experienced financial adviser. Retirement can last longer than you think, so you don’t want to take the risk of your surviving spouse having inadequate income.

Learn more about government retirement benefits, including the FERS basic benefit, the Thrift Savings Plan and other retirement planning steps, by downloading our free, easy-to-understand guidebook, FERS Made Simple: Understanding and Maximizing Your Benefit. (click the button below)

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.