The Benefits of Long-Term Investing

May 25th, 2022 | 3 min. read

During periods of extreme market declines, a natural emotional reaction can be to “take control” by selling out of the market and seeking safety in cash. This is due to “loss aversion” – or the fact that losses hurt more than gains feel good. The results of this action can be devastating because positive returns are more likely to occur by investing over the long term.

Of course, staying invested for the long term is easier said than done. That’s why whenever the market has you thinking about the exit, it’s a good time to remind yourself of these long-term investing benefits.

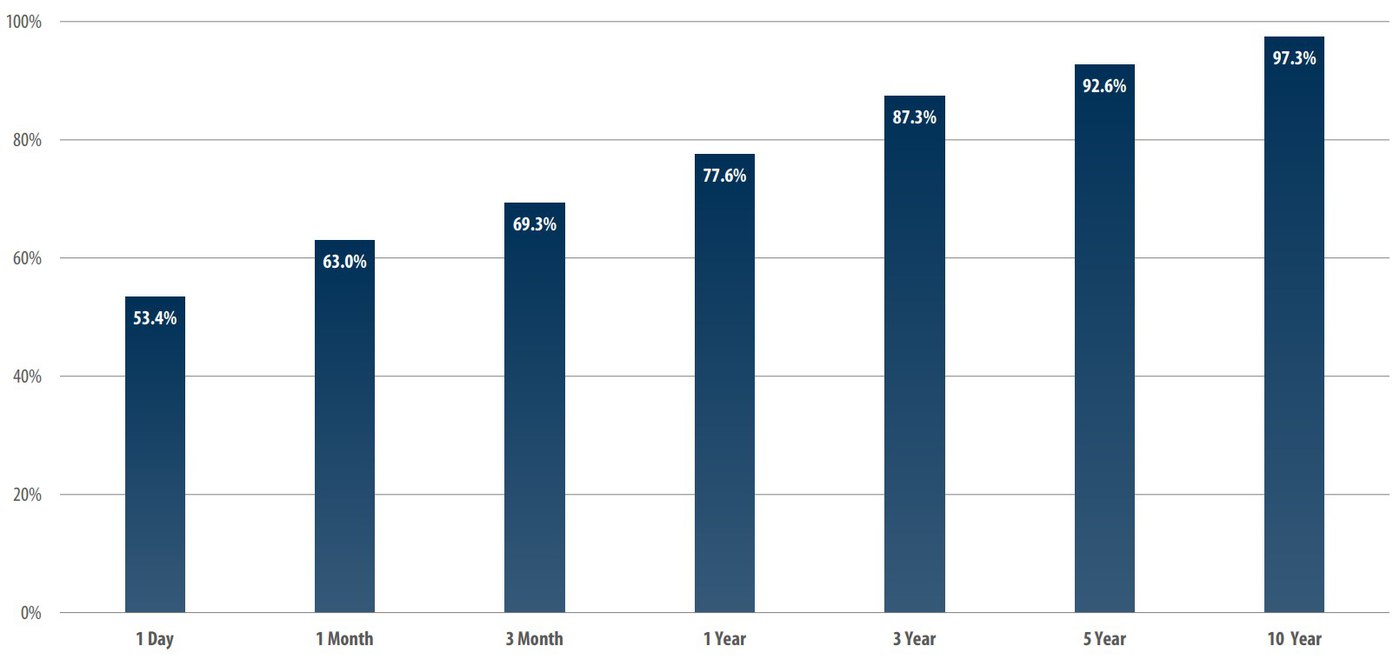

The odds of a positive gain are significantly higher

Some people like to cynically say the stock market is like a casino. People place bets, and whether you win or lose is just up to chance. That is wholly wrong for a variety of reasons. A major reason though is that the odds in the stock market are not stacked against you.

When you play games in a casino, the odds are essentially always the same. They generally favor the casino and don’t change based on what happened before or how long you’ve played. For example, the odds of a roulette wheel landing on red or black is always 50-50.

In the stock market, on the other hand, history has shown that the longer you play, the higher your chances of a positive return. Since 1937, the probability of a positive return over a single day has been 53.4%. But over a 10-year period, the odds of a positive return spikes to 97.3%.

Probability of Positive Returns (S&P 500 Index – Since 1937)

Source: First Trust

This is why it’s better to avoid checking your portfolio too often.

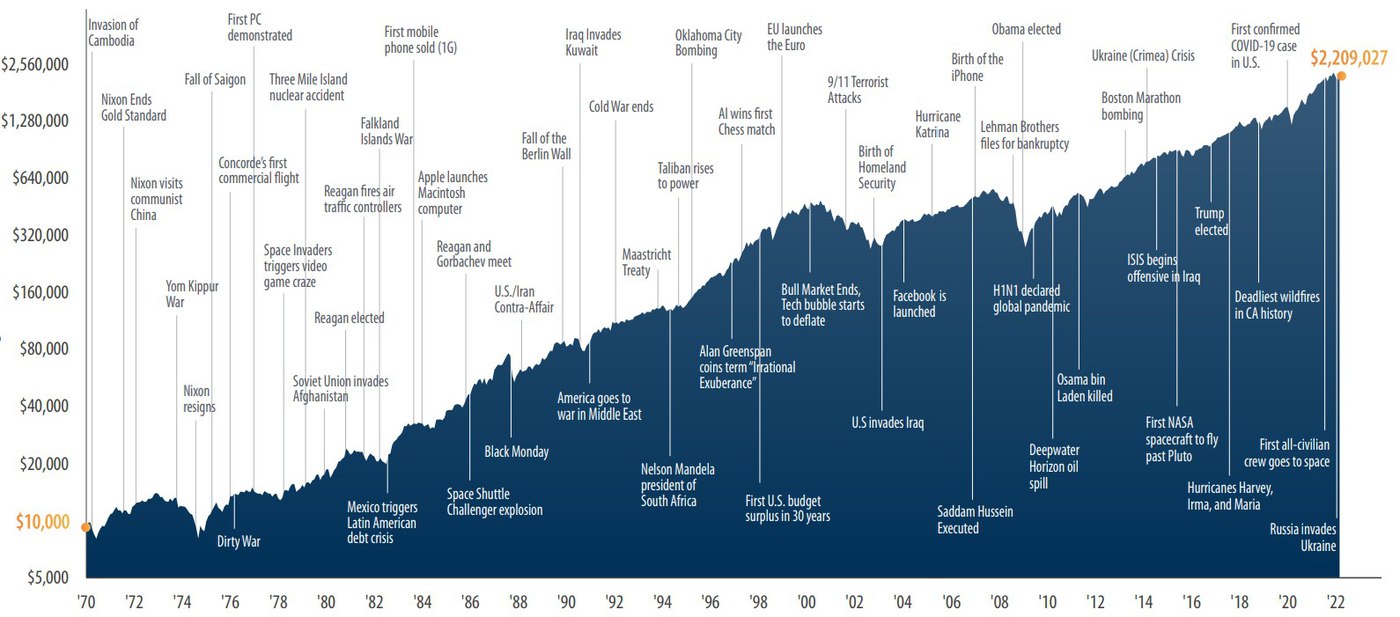

The reason the odds of a positive return increase dramatically over time is due to the stock market’s historical resiliency. Despite a lot of uncertainty and many down periods, investors who stay the course are generally rewarded in the long term. Since 1970, a $10,000 investment in the S&P 500 would now be worth more than $2 million, regardless of all the bumps along the way.

Source: Frist Trust

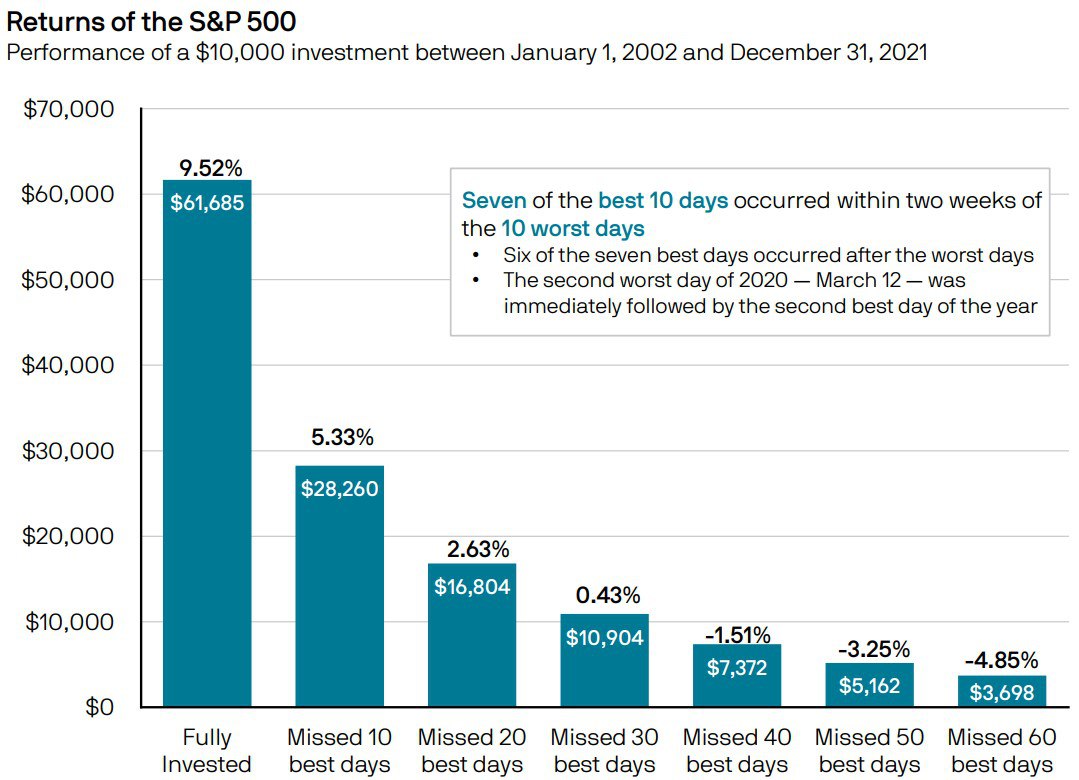

You get to experience the best trading days

A common finance adage is, “there is no such thing as a free lunch.” By investing over the long term, however, you all but guarantee you get the best meals.

Consider that a large portion of your earnings as an investor will come from only a handful of positive days in the market.

Just look at returns of the S&P 500 over a 20-year period, 2002 – 2021. Hypothetically, if you were to leave a $10,000 investment fully invested during those two decades, it would have earned a 9.52% return and grown to $61,685. But miss just the 10 best trading days over those 20 years, your return would have been only 5.33% and your balance cut by more than half at $28,260.

Source: JP Morgan

Your return would have progressively worsened the more “best days” you missed. By the time you missed out on the 40 best days, you would have started to lose money. Further, the best and the worst days tend to occur right next to each other. Seven of the best 10 days in the stock market occurred within two weeks of the 10 worst days.

The fact is, no one knows when these best trading days will occur. The only way to ensure you participate in them is to invest for the long term.

You can take full advantage of compounding

So, what does this all mean for your portfolio? The longer you participate in the growth of the stock market, the more you can take advantage of the power of compounding -- the earnings earned on your earnings.

Over time, those earnings multiply exponentially. Just consider how much saving 15% of a $55,000 salary ($8,250) over 35 years comes from compounding when left untouched. The ending balance is $1,035,000, of which around 70% is the earnings from compounding.

If investing were easy, there would be no risk involved and, therefore, no return. As the benefits above show, one of the best ways to use that risk to your advantage is to invest for the long term. What investments you should stick with over that time depends on your personal situation and can be decided with the help of a financial adviser.

If you're worried about the market, learn why sticking with a diversified investment strategy over the long term is often the best approach. Download our free guide on "How to Survive a Market Downturn."

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.