Are You Sabotaging Your 401(k)?

September 28th, 2017 | 5 min. read

Often, the one thing preventing you from reaching your goals is yourself. People tend to unwittingly sabotage their own success by reacting to situations in ways that hinder their progress.

Often, the one thing preventing you from reaching your goals is yourself. People tend to unwittingly sabotage their own success by reacting to situations in ways that hinder their progress.

It can be the result of negative emotions, such as a fear of failure and self-doubt, or negative behaviors like procrastinating and acting impulsively.

You’ve likely experienced some form of self-sabotage before. Maybe you didn’t think you were qualified for a job you really wanted, so you didn’t properly prepare for the interview or didn’t even apply. Maybe you have a novel saved on your computer that can wait for another day.

In most cases, it’s a natural reaction. Our brains use self-sabotage as a safety mechanism to protect ourselves from uncomfortable feelings. One thing that generates a lot of mixed feelings is money.

That’s why many people are victims of self-sabotage when it comes to their finances. One common example is an unwarranted belief you aren’t smart enough to manage your money. Another is avoiding even talking about money out of embarrassment or fear that you’ll never be financially stable.

Therefore, some people put in as little effort as necessary when dealing with their finances. A prime example is saving in a 401(k) plan. The typical working household nearing retirement with a 401(k) and an IRA has a median $111,000 combined. That would yield less than $400 a month in retirement, according to a recent report by the Boston College's Center for Retirement Research.

That’s alarming considering that most workers no longer have plush pensions to rely on for income in retirement. However, it’s not surprising when you consider many people don’t have a strong understanding of investing. According to a Prudential survey, 42% of investors don’t know how their assets are allocated in their portfolios. Nearly three-quarters (74%) of pre-retirees said they should be doing more for their accounts, while 40% of participants said they just don’t know how to prepare for retirement.

If you think your 401(k) isn’t doing as well as you think it should be, have no fear. You can still make the most of it. Here are ways you might be sabotaging your 401(k) – and your chances at a comfortable retirement – and what to do to stop.

Never increasing your contribution

The way you may be causing most harm to your 401(k) is by simply not saving enough. People typically start saving in a 401(k) at a young age when their salary is at its lowest point and retirement seems like an eternity away. Therefore, people will understandably start with a small contribution rate.

Unfortunately, many people fail to increase their contribution rate as they get older and their salary rises. For example, workers who are auto-enrolled into 401(k) plans tend to be enrolled at a low 3% contribution rate, and they stay at that level for the long term. If you never increase your contribution rate, you are virtually guaranteeing you won’t meet your retirement goals.

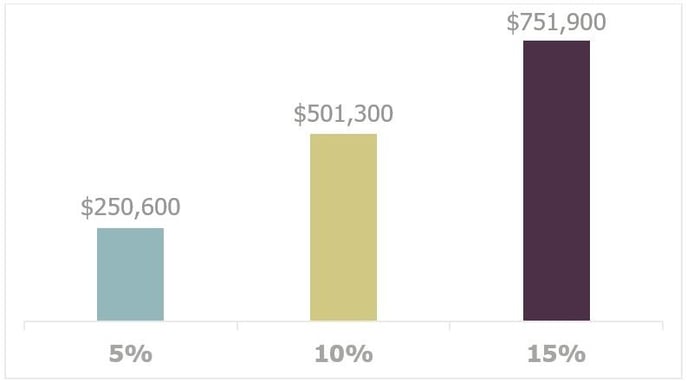

A widely accepted retirement savings rate is between 10-15% of gross income. Consider how much of a difference just a 5% savings increase can have, as illustrated in the example below.

Difference in ending balances from various savings rates on a $50,000 salary over 35 years (assuming a 5.5% annual return)

Paying high fees

Fees in your 401(k) are taken directly from your account, so there’s a good chance you’ve never paid attention to them. Plus, they can be hard to locate and understand. You can, however, find at least the total cost of being a participant on your statement. And, the most important thing to understand is this: the more you pay in fees, the less you get to keep of your earnings.

Therefore, it’s crucial to keep your costs as low as possible. Although you can’t control plan fees, such as administrator and record keeping costs, you can control investment fees. Therefore, make cost a deciding factor in the investments you choose. A high expense ratio doesn’t equate to a high return. It is usually the opposite, as an expensive fund must perform that much better than a comparable cheaper fund to justify its cost.

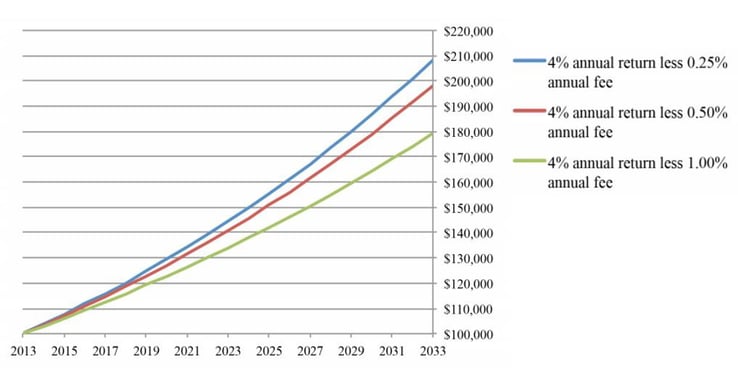

To see just how important fees are in saving for retirement, consider the effect of fees on a portfolio over time.

Difference in portfolio balances from various annual fees on a $100,000 investment over 20 years (assuming a 4% annual return)

Over 20 years, just a 0.75% difference in annual fees can mean an extra $30,000 in your portfolio. If your 401(k) plan includes only funds that charge around 1% or more, then you likely have a bad investment menu. Request that your plan sponsor work toward providing cheaper investment options.

Choosing the wrong asset allocation

Asset allocation refers to how your account is divided among different investments – stocks, bonds, etc. It should reflect several personal factors such as your retirement savings target, age and attitude toward risk.

Choosing the wrong asset allocation can have negative effects on your future account balance, both if it’s too aggressive or too conservative. Generally, your asset allocation should be aggressive (a higher portion of stocks) early in your career when growth is your primary investment goal. Then you can gradually scale back risk by allocating your account to lower-risk investments like bonds so that you can better preserve what you’ve earned over a long career.

One way people try to solve this problem is to invest in a target date fund. These funds act like an autopilot option. Each target date fund has a different year attached to it, with objective being that you choose the year closest to your ideal retirement date. They are designed to start aggressive and then become more conservative over time as the target year gets closer.

While target date funds are convenient and better than choosing funds randomly, they do have drawbacks worth considering. Since they become conservative automatically, there is potential to miss out on growth opportunities. Eventually, a target date fund can even become too conservative for your needs. A better option may be to meet with your plan’s financial adviser, if available, and identify what asset allocation is most appropriate for you, then review your portfolio annually.

Taking a hardship withdrawal or loan

The biggest downside of a 401(k) hardship withdrawal or loan is the reduction of the account balance, which has a long-term negative effect on the compound interest and future account balance.

It’s tempting to use the money for a variety of eligible reasons, such as a down payment on a house or medical care. But, the penalty for doing so can be steep. If you withdraw money from a retirement account before the age of 59 ½, you may be subject to a 10% early withdrawal penalty on top of the income tax you will have to pay on the distribution.

Even though 401(k) loans are repaid, any time you take from your retirement savings to pay for current expenses you put your retirement at risk. Further, if you leave your company or are fired before the loan is paid off, the remaining loan balance is due immediately. Most people taking 401(k) loans don’t have that amount of extra cash available, otherwise they wouldn’t take the loan. If you fail to repay the loan on time, it’ll count as a normal distribution, which means it’ll be subject to ordinary income taxes and possibly the early withdrawal penalty.

Instead, build a separate emergency fund that you can access at any time without penalties or fees. You’ll be better equipped to handle any unexpected expenses while staying on track toward retirement.

Buying too much company stock

If company stock is available in your 401(k), you may feel obligated to invest in it. When investing in a retirement account though, your obligation should be to yourself and your retirement. Individual stocks and bonds have greater risk than more diversified investments like mutual funds. Further, investing in the same company that provides your paycheck means most of your financial life depends on the performance and sustainability of one company.

Sometimes you may have no choice. Some companies fund their matching contributions in company stock. You should consider selling these shares as soon as the plan document allows and reinvesting in diversified investments that are in line with your desired asset allocation.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.