Drawbacks of TSP Lifecycle Funds

May 27th, 2020 | 3 min. read

When it comes to your health, you typically get the professional advice of a qualified doctor. You don’t just choose from a menu of treatments. But when it comes to your long-term financial health, it’s often all up to you.

Federal government employees have a great employer-sponsored retirement plan in the form of the Thrift Savings Plan (TSP). Yet, unlike the FERS Basic Benefit, your TSP is fully under your control. You decide how much money to save and what to invest it in.

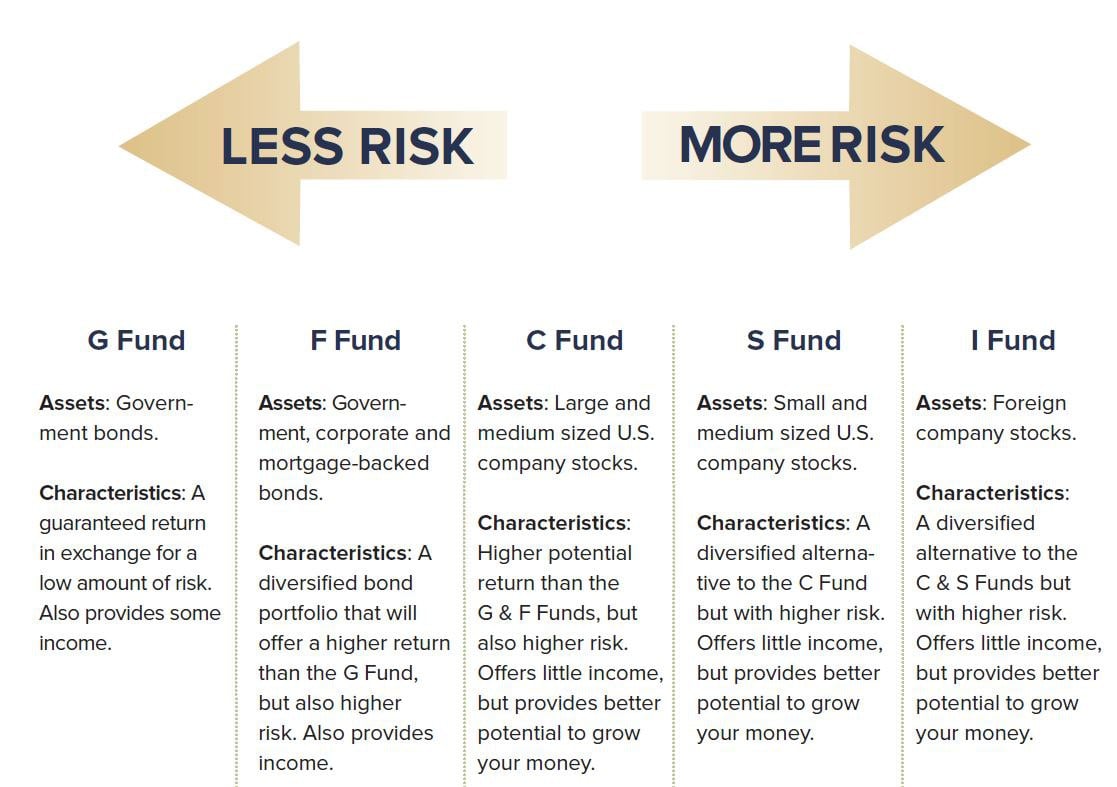

The TSP has five basic investment options, ranging from very conservative to very aggressive. You don’t have to choose just one. You can invest in several funds to help spread your risk among different investment options and achieve a greater degree of diversification.

Choosing the right investments to help you reach retirement can be a challenge.

Generally, the majority of your money, if not all of it, should be allocated to stocks (the C, S & I Funds) early in your career. As you approach retirement, you should start to reduce risk and move money to more conservative investments (F or G Fund) in an effort to protect it. How much you allocate to each fund and when you start to transition to more conservative investments is a matter of your personal situation.

However, it is important to take the right risks at the right time. For those who doubt their ability to make investment decisions, TSP Lifecycle Funds (L Funds) can help eliminate the guesswork. They are the default options for participants who don’t make any investment selections.

How TSP Lifecycle Funds Work

L Funds work just like common target date funds in that they are managed with a particular target retirement date in mind. They follow a glide path, starting more aggressive when the employee starts and then gradually becoming more conservative as the employee approaches retirement. These funds offer a combination of the five investment options listed above.

There are various L Funds available, each with a different year attached to them, of which you can choose the year closest to your ideal retirement date. Once the L Fund reaches its target date, it rolls into the L Income Fund. The L Income Fund is a very conservative fund meant to pay income during retirement.

Potential TSP Lifecycle Fund Drawbacks

L Funds can be convenient as they provide employees automatic management of their TSP portfolio. However, they have some serious drawbacks you should consider.

L Funds do not take the right risks at the right time.

For example, as of 2016 the L 2040 fund had less than 75% of its total assets invested in stocks. Since the fund is not anticipating a withdrawal until 2035 at the earliest, this fund is very conservative for money that will not be withdrawn for almost 20 years.

Over a 20-year period of time, a substantial amount of growth can be missed by not owning enough stocks.

L Funds reallocate money without regard to underlying economic fundamentals.

The L Fund holdings are adjusted once per quarter according to a preset formula. If stocks pose a potentially good buying opportunity, the fund will not adjust to purchase more stocks. Conversely, if stocks do not look as attractive as other asset classes, there will be no reduction in stock holdings.

L Funds become too conservative upon their maturity date.

The L 2040 fund, for example, matures in 2040 and turns into the L Income Fund, with 20% in stock funds and 80% in bond F and G Funds. A conservative but more prudent retirement portfolio may hold 50-60% in the F and G Funds with the remaining 40-50% in the TSP stock funds to provide more exposure to growth and risk-controlled income.

Investing is better than not investing. Despite these drawbacks, the L Fund is a suitable choice if you’re uncomfortable choosing among the other TSP investment options, or you don’t get around to making a selection. Still, the investment you choose in your portfolio can be the difference in achieving the retirement you’ve always wanted.

If you want a professional advice for your long-term financial goals, you can also seek the qualified guidance of a financial adviser.

Learn more about government retirement benefits, including the FERS basic benefit, the Thrift Savings Plan and other retirement planning steps, by downloading our free, easy-to-understand guidebook, FERS Made Simple: Understanding and Maximizing Your Benefit.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.