How Rising Interest Rates May Affect You

April 6th, 2022 | 2 min. read

One important factor you can’t control in your financial life is government policy. And, recently, the Federal Reserve raised its policy interest rate by a quarter of a percentage point.

KEY TAKEAWAYS

- The Federal Reserve is expected to raise rates multiple times in 2022

- Higher rates don't necessarily mean negative returns for stocks and bonds

- Some consumer loan rates will likely rise, leading to higher monthly payments

By raising its federal funds rate — the rate banks charge one another for overnight loans — the Fed directly or indirectly impacts other types of interest rates – on mortgages, car loans and credit cards. It can also have a ripple effect in stock and bond markets.

The reason for raising rates is that higher borrowing costs can slow down inflation by tempering demand. Six more similarly sized rate increases are expected this year.

To help you plan ahead, here are some ways rising interest rates may affect you.

Stocks and Bonds

Higher interest rates tend to create more volatility in the stock market, mainly because it costs businesses more to operate when money is expensive to borrow. But that doesn’t mean stocks are destined to fall. In fact, the S&P 500 was higher a year after the first increase every time during the Fed’s previous eight hiking cycles.

What about bonds?

Generally, bond prices and rates have an inverse relationship. When rates go up, bond prices go down. But bonds can be just as resilient as stocks during a hiking cycle.

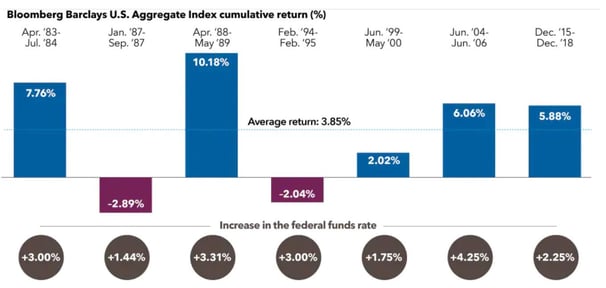

Despite rising rates, bond yields and other factors that increase bond values can actually help provide a positive total return. During hiking cycles over the past several decades, bonds, as represented by the Bloomberg Barclays U.S. Aggregate Index, had negative total returns only twice. The average return for these periods was nearly 4%.

Source: Capital Group

Therefore, rising rates is not a compelling enough reason for most investors to make dramatic changes to their portfolios. We believe investors should stick with a diversified portfolio that is aligned with their financial goals.

Consumer Loans

A number of borrowing costs for consumers are expected to go up.

Credit cards

Most credit cards have a variable rate, which is tied to the federal funds rate. Cardholders, therefore, can expect to pay more in interest. Those carrying an outstanding balance may want to look for zero-interest balance transfer offers. Of course, the best way to prevent rising rates from affecting your credit is to just pay off your balance every month.

Auto loans

Auto loan rates will likely rise since they typically track the five-year Treasury, which is impacted by the federal funds rate.

Student loans

Federal student loans carry a fixed rate, which means most student borrowers who rely on those loans don’t have to worry about the Fed’s actions. But private student loans are not. So, private student loan borrowers should expect to pay more.

Mortgages

Mortgage rates aren’t as influenced by Fed rate changes as you may think. Your typical 30-year fixed rate mortgage is priced off the 10-year Treasury bond. Home equity lines of credit and adjustable-rate mortgages, on the other hand, are more directly tied to the Fed’s moves. These rise in conjunction with the funds rate. Borrowers that are impacted may want to consider asking their lenders about refinancing to a lower, fixed rate.

Savings

For savers, higher interest rates are a good thing. As the Fed raises rates, banks typically pay more interest on savings accounts.

However, today’s rates on savings and money market accounts remain stubbornly low. So, you can’t plan to move money into a certificate of deposit (C.D.) and even expect it to surpass the rate of inflation. But, you may be able to find some CDs and online banks that are starting to raise their rates.

Ultimately, even modest rate hikes can impact your finances. Whether it is good or bad generally depends on if you’re saving or borrowing.

If you concerned about interest rates negatively impacting the stock market and your portfolio, download our free guide: HOW TO SURVIVE A MARKET DOWNTURN.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.