Navigating High Inflation

March 16th, 2022 | 5 min. read

.jpeg)

It doesn’t take a government report to know that prices are higher now than a year ago.

If you’ve filled up the gas tank, ordered a cheeseburger or tried to buy a new couch in the past year, then you’ve probably felt a little sticker shock due to rising inflation.

KEY TAKEAWAYS

- Inflation rose 7.9% in February, as food and energy costs push prices to the highest in more than 40 years

- There is no perfect investment inflation hedge

- The impact of inflation and how to manage it depends on personal factors

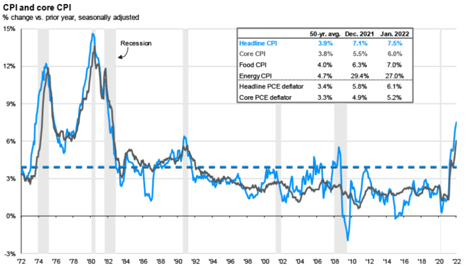

The consumer price index, which measures a wide-ranging basket of goods and services, increased 7.9% over the past 12 months, according to the Labor Department’s Bureau of Labor Statistics. That is the fastest pace since 1982. Excluding volatile food and energy prices, so-called core inflation rose 6.4%.

Inflation can be a tricky subject because it’s not always clear why prices are increasing or what prices are increasing at an abnormally rate.

Furthermore, the impact of inflation and how to manage it can vary from person to person depending on personal factors, such as where you live, what things you like to buy and your age.

So, let’s look at some general steps that can help you navigate high inflation.

Don’t panic

We know, it hurts just about every time you swipe that debit card these days. But that doesn’t mean you should take drastic steps under the assumption that elevated inflation is here to stay.

Historically, inflation rises and falls. Unlike, say, the stock market, inflation does not follow an upward trend. As, the following chart shows, there are often long periods of tame inflation. For example, from the 1980s to 2020, inflation stuck pretty close to its 50-year average of 3.9%.

Source: JP Morgan Asset Management

Therefore, we can say confidently that inflation will eventually come back down.

When?

That’s very difficult to say, especially when you consider that inflation of this magnitude is not due to one single variable. Today, we are experiencing high energy costs due to a war and high demand, a tight labor market, the continued spending of trillions of government stimulus and on-going supply chain problems. Talk about a perfect storm. Yet, despite the severity of these economic stresses, they can be resolved over time.

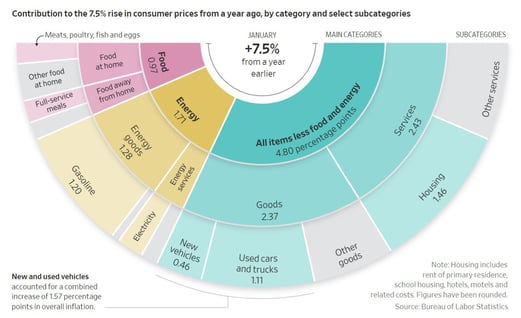

Another important thing to keep in mind is that prices for goods and services don’t all experience the same rate hikes. This graph from the Wall Street Journal breaks down what categories contributed most to February’s inflation jump of 7.5%. Energy and food are things we all need and will see higher prices. But those us who are not in the market for a car or new furniture, for example, are unaffected by some of these increases.

Furthermore, where you live will also plays a role in the type of price increases you see, as we know cost-of-living varies from location to location.

Avoid drastic changes to your portfolio

Inflation is an investment risk. Your real return is simply the return you receive after the rate of inflation is taken into account. So, if a stock returns 10% in a given year and the current rate of inflation is 5%, the real return is 5%.

While giving up a big chunk of your investment returns to inflation is a reasonable concern, the answer is not to try to earn an even higher return. Risk and return are related. So, to try to increase your return means taking on more risk. That could cause even greater investment losses than inflation in the event of a market downturn.

Keep in mind, a financial adviser who works with you to create a suitable portfolio for your financial goals will have already considered the impact of inflation. That’s why the best solution is often to stay the course, as inflation does not last forever. While the returns will fluctuate, the long-term objective is to have a return that exceeds inflation.

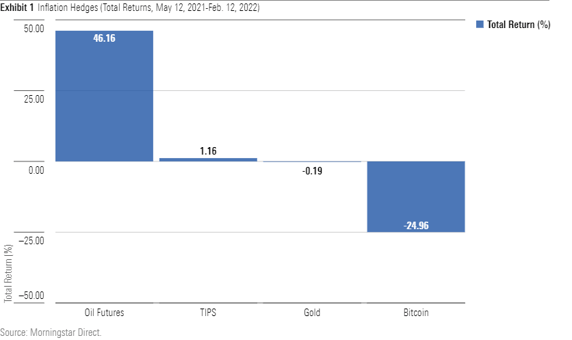

Remember, there is no perfect inflation hedge

Okay, so if you don’t try to take on more risk, how about shifting to other assets in hope of hedging against inflation?

The problem is that investments don’t always work the same way every time. While some tweaks can be made to your portfolio, such as adding more bonds that are less sensitive to inflation hikes, you cannot expect to fully hedge inflation.

What investments hold up best during this latest rise of inflation will only be known in hindsight. For example, the following chart shows some of the assets thought as inflation hedges, such as gold and Treasury Inflation-Protected Securities (TIPS), have been anything but recently.

Consider delaying Social Security

If you’re nearing retirement, you may want to consider waiting to file for your Social Security benefit.

Social Security provides a cost-of-living adjustment (COLA) each year based on inflation as measured by the Consumer Price Index. But many retirees who rely on their benefit as their prime source of income may find it underwhelming because many costs that affect older consumers tend to rise faster than inflation, such as prescription drugs and utilities.

For example, Social Security’s 2022 cost-of-living adjustment (COLA) — a generous 5.9% — won’t help retirees much. Higher prices will likely take a big bite out of that boost in benefits every month, and this year’s 14.5% increase in Medicare Part B premiums will likely finish the rest.

You have the option to take Social Security at age 62 or wait until your full retirement age, which is usually either 66 or 67, depending on when you were born. But you can wait until age 70 to start. Putting off the date you start to collect will help your benefits grow by as much as 8% a year from your full retirement age up until age 70.

Keep in mind, your portfolio may need to bridge the gap until you start receiving your delayed benefits. Essentially, the fewer other income sources you have and the longer your life expectancy, the more it makes sense to wait to take your benefit.

Pension? Consider taking a lump sum payout

If you’re fortunate to receive a pension, you can typically take it as a monthly annuity or in one lump-sum payout. There are pros and cons to both.

While the pension annuity guarantees you a monthly paycheck, it’s important to know that it may not rise with inflation. So, you could experience a substantial loss of buying power in those paychecks over time.

By taking a lump-sum pension payout, you can invest it in an IRA. This gives you the ability to choose investments that may help your money grow above the rate of inflation. The downside, however, is that it exposes your pension money to market risk. Ultimately, what works for you depends on your personal financial situation and attitude toward risk.

Be careful with other financial products

Annuity payments from lifetime income annuities, for instance, are generally fixed, which makes them vulnerable to inflation. To receive an inflation adjustment with your annuity you must purchase it like an upgrade, which increases the total cost of the annuity and reduces your return.

Temporarily reduce spending, if possible

Where possible, defer purchases that are affected by temporary price hikes. If you’re paying more on things you absolutely need – food and energy – you don’t want to compound the pain by paying elevated prices for discretionary goods. Also, review your budget and look for expenses that you can perhaps reduce or cut for a while – dining out, unused memberships, etc.

Increase your income

Are there steps you can take to increase your income, even if it’s only a temporary bump, to get you through this current wave of inflation?

If you’re working, you may want to approach your employer about a suitable pay raise. Additionally, consider some doing some freelance work or starting a side hustle.

If you’re already retired, speak to a financial adviser to determine if a temporary bump in withdrawals from your retirement accounts would be appropriate. Another option is taking a part-time job.

The bottom line

Inflation is one of several financial factors that are beyond our control. But there are things we can do to help manage it as best we can, both today and over time. What those steps are highly depend on your personal financial situation and needs.

Learn about saving and investing in an IRA by downloading our Guide: IRAs: What You Should Know. Whether you’re a stay-at-home parent, small business owner, freelancer or someone who just doesn’t like their 401(k), our guide explains how you can save for retirement. (Click button below.)

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.