Switching Jobs? Don’t Leave Your Old 401(k) Behind

June 16th, 2021 | 3 min. read

Generally, one of the biggest retirement mistakes you can make is to leave an old 401(k) behind at a previous employer. Yet, people often make this mistake when switching jobs or retiring.

The average worker changes jobs 12 times throughout their career. That translates into a lot of money left sitting in old retirement accounts unmanaged.

By the end of this year, Americans will have nearly $1.35 trillion left behind in retirement accounts that are connected to previous employers, according to a new study. Almost a fifth of all the money American workers have in retirement accounts is tied up in old plans. The estimated average size of those old accounts is $55,000.

But who wants to deal with juggling several different retirement accounts? The good news is that you don’t have to when you consolidate retirement accounts. This can help you avoid leaving your hard-earned money behind, and instead put it to work for your financial goals.

Why leaving behind a 401(k) is a mistake

Leaving an old 401(k) behind can be a mistake for several reasons. You may be paying administrative and investment fees for each account. Plus, it makes it difficult to implement a cohesive investment strategy for your long-term goals.

Worst of all, an account you leave behind may be inappropriately invested, leading to lower investment returns. Think of it like a garden you eventually leave unattended. It becomes overgrown with weeds that keep your flowers from blooming. With a 401(k), because of fluctuations in the stock market, it can become overgrown with risk or poor-performing assets that hinder your growth.

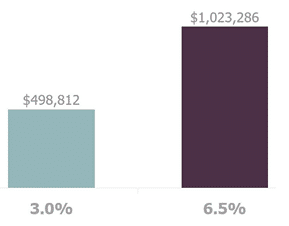

A difference of just a few percent in returns can make a huge difference over time. For example, let’s say you save 15% of a $55,000 salary over 35 years. Look at the difference in ending balances if we were to assume a rate of return of only 3% compared to 6.5%. It’s reduced by more than half.

Ultimately, an old 401(k) could be a substantial sum of money that could provide more growth to your overall retirement savings.

What to do with your old 401(k)s?

There are four things you can do with a former employer’s retirement account:

- Keep it

- Transfer it to your new employer's plan (if allowed)

- Withdraw the entire balance in cash

- Roll it over into an IRA

For many people, the best option is the IRA rollover, which is the transfer of funds from your retirement account into a Traditional IRA or Roth IRA. It provides a variety of advantages.

For one, an IRA allows you to select from a much larger number of investments than an employer-sponsored retirement account. More investment options give you a greater degree of flexibility to create an investment portfolio that is better aligned with your financial situation, goals and risk tolerance. Also, you may be able to lower your fees and expenses with lower-cost investments.

Perhaps, best of all, an IRA rollover can greatly help simplify your retirement savings and investments. You can put all your old 401(k)s in one place by consolidating them into an IRA. This makes it easier to manage your assets under a cohesive investment strategy as well as monitor your progress.

Further, you can work with a financial adviser to directly manage your IRA for you, which is not always an option with a 401(k) or other employer-sponsored account.

And don’t worry about losing any tax benefits. An IRA provides similar tax advantages that are typically offered in 401(k) plans or other retirement accounts.

How to find old 401(k)s

If you’ve left behind a retirement account, such as a 401(k) or 403(b), contact your former employer. Someone is likely happy to talk and willing to confess some important intel. At the very least, obtain contact information for the plan administrator. You can also find this information on an old account statement.

Of course, companies go bankrupt, get bought, change locations, etc. So, you may have to search the news online or contact a former co-worker to determine who has inherited the plan.

Additionally, scour the National Registry of Unclaimed Retirement Benefits, which allows you to perform a free search for any retirement plan balances in your name.

When to leave an old 401(k) behind

Everyone’s financial situation is different. There are always exceptions. So, let’s go over why you may want to leave an old 401(k) behind.

If you separate from your employer or retire in the year in which you turn age 55 or older, but are under age 59 ½, you might choose to roll over only a portion of your 401(k) to an IRA. In this situation, you can take withdrawals from your 401(k) without incurring the 10% early withdrawal penalty, even though you're under age 59 ½. This exception is commonly referred to as the “Age 55 Rule.”

Some individuals opt to move most of their 401(k) to an IRA but leave behind a small amount of savings to use as a retirement emergency fund. This could give you greater flexibility of income. You will have to balance this option against the benefits of an IRA.

A job change can be a very exciting event. It is a way to take everything you learned in your previous role and grow your career. Just don’t forget about your 401(k) – it can go and grow with you, too!

Learn more about saving and investing in an IRA by downloading our Guide: IRAs: What You Should Know. Whether you’re a stay-at-home parent, small business owner, freelancer or someone who just doesn’t like their 401(k), our guide explains how you can save for retirement. (Click button below.)

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.