Your Retirement Portfolio Should Be Stuffed like a Turducken

November 23rd, 2016 | 3 min. read

Like many financial concepts, a retirement portfolio can be hard to visualize. What should your retirement portfolio look like? This time of year, as we all try to visualize our holiday menus, look to the turducken for insight.

Like many financial concepts, a retirement portfolio can be hard to visualize. What should your retirement portfolio look like? This time of year, as we all try to visualize our holiday menus, look to the turducken for insight.

If you’re unfamiliar, a turducken is a dish consisting of a deboned chicken stuffed into a deboned duck, which is then stuffed into a deboned turkey. That’s three delicious and distinct meats all in one bite. (If you’re vegetarian, we present to you the “veggieducken.”) The turducken embodies an important investment strategy known as diversification.

Do you know if your portfolio is properly diversified? Get a FREE portfolio review from an Advance Capital adviser who will provide recommendations for your financial goals.

Diversification is a financial term you’ve likely heard. It’s used frequently in the media, and it’s something your financial adviser, if you have one, has probably talked to you about. However, you may not fully understand it or its importance in regards to your retirement portfolio.

Essentially, diversification means stuffing, like a turducken, your portfolio with a variety of investments. You buy many securities in different asset classes – domestic stocks, internationals stocks, bonds, alternative investments, etc. – whose prices tend to move in different directions. When some securities go up, others go down. It is the financial equivalent of the old adage: “Don’t put all your eggs in one basket.”

Over time, diversification can provide a smoother journey toward your financial goals.

The importance of diversification in a retirement portfolio

Some may frown on the turducken as a culinary Frankenstein, just another wild product of modern cooking. A dinner table sideshow that’s meant to be looked at, not eaten.

But, the cooking technique of engastration, stuffing and cooking one animal inside another, dates to the Middle Ages. There are dishes like the turducken made by different cultures around the world. Such dishes are prized for their tenderness and flavor, as the juice of each animal is absorbed by the other.

Similarly, some may at first think of diversification as an odd investment strategy. After all, why buy investments that move in opposite directions? Isn’t the point to only buy those that go up?

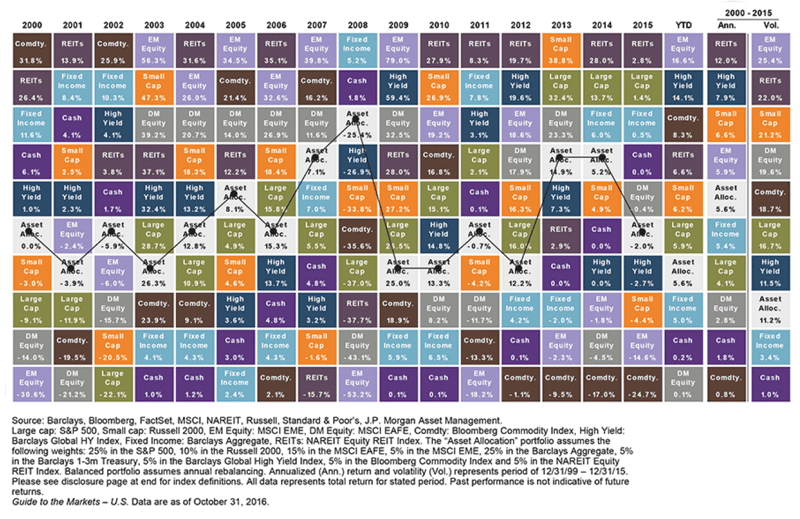

The reality is that in any given year, any investment can win or lose. Last year’s winners becomes this year’s losers, and vice versa. This is shown in the chart below.

Asset class returns 2000-2015

That means picking securities and sectors or timing the market is extremely difficult. Diversification, on the other hand, eliminates the guesswork and helps you avoid making costly mistakes.

Benefits of a diversified retirement portfolio

As a young worker, you can be aggressive with your investments. You could even invest 100% of your savings into stocks. After all, your objective is to grow your money. Plus, you have a long time before you need it, so you are better able to recover from any market downturns.

As you get older, managing risk becomes more important. You want to start preserving all that money you’ve saved and earned over the course of your career.

The primary benefit of diversification is that it can lower your overall risk. Your money isn’t tied to the performance of single asset. And, as the positive performance neutralizes the negative performance, you should experience steadier returns over time. This can help you stay the course toward your financial goals. You won’t hit home runs, but you won’t strike out either.

Additionally, diversification provides more opportunities for growth. You may think lowering your risk means reducing your return based on the common risk-return relationship. But, a broadly diversified retirement portfolio, comprised of a mixture of stocks and bonds, can perform better than one filled with conservative investments such as bonds. By casting a wide net, you’re better positioned to capture any growth when the market rises or falls.

In retirement, you still need a steady level of growth. Your retirement could span 20 or 30 years or longer so it is necessary to outrun inflation. Consider that the historical inflation rate is 3%, which means your money would lose half its value in a little over 20 years.

And, in an investment environment like today when rates remain low and opportunities for growth are harder to come by, diversification is more important than ever.

How to diversify your retirement portfolio

The true meaning of diversification isn’t to just own more than one investment. As a simple example, you can’t buy stock in Google, Facebook and Twitter and claim you’re diversified. That would be like stuffing a turkey with another turkey and then another turkey, yet still calling it a turducken.

Retirement investors are better off in broadly diversified portfolio containing many asset classes, such as domestic and international stocks, big and small company stocks, government and corporate bonds, and alternative investments.

That’s why we recommend our clients invest in many low-cost mutual funds and ETFs. We think this gives them a better opportunity to generate enough returns for their specific financial goals while controlling risk and costs.

And, it’s how we think everyone should build their retirement portfolio. When all is said and done, you can cook up a good retirement.

LEARN MORERead these related articles:

Speak with an Advance Capital adviser who can help create a comprehensive retirement plan for all your financial goals – no cost, no obligation. Fill out the contact form or call 800-345-4783. |

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.