4 Things to Remember During a Volatile Market

April 11th, 2018 | 3 min. read

As an investor, it’s hard not to feel uneasy when markets turn volatile. After all, those ups and downs can impact something very important to you – your money. This is especially the case for those nearing or in retirement. Those invested dollars are now one of your primary sources of income.

As an investor, it’s hard not to feel uneasy when markets turn volatile. After all, those ups and downs can impact something very important to you – your money. This is especially the case for those nearing or in retirement. Those invested dollars are now one of your primary sources of income.

Often, the best course of action when the market fluctuates is to do nothing at all. But, that may not help you feel any less anxious.

So, while it’s not possible to control the market, it’s possible to endure the emotional roller coaster often associated with a volatile market when you keep these four things in mind.

1. Market volatility is normal

If Isaac Newton had been a market analyst, his third law of motion would go something like this: “What goes up must come down, and up again, and down again, and up again, and down again, and on and on.”

In other words, markets constantly rise and fall. They always have and always will. The only things that change are the reasons behind the sudden bumps and dips.

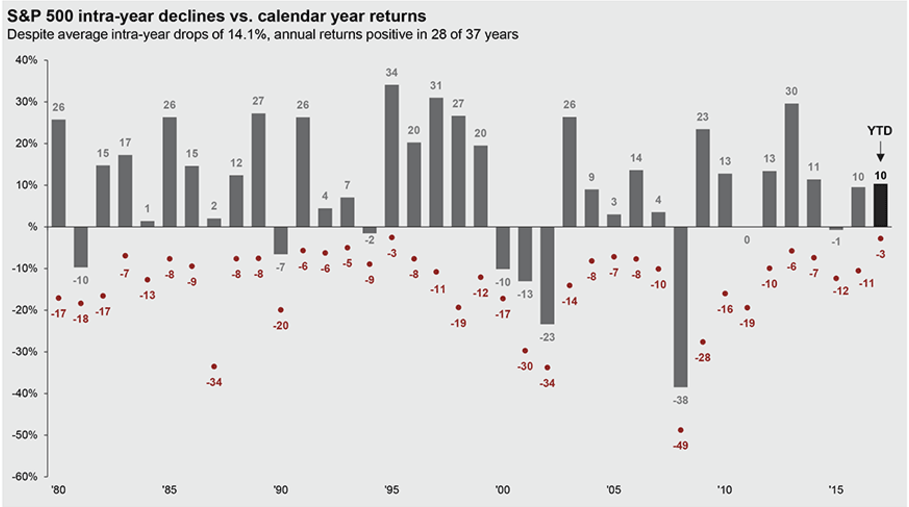

Consider that the average decline in the S&P 500, a commonly used representation of the stock market, each year since 1980 is 14.1%, as shown in the chart below.

Volatility happens

Source: FactSet, Standard & Poor, J.P. Morgan Asset Management. The red dots represent the market decline (from high point to low point) in a given year. The grey bars represent the total return for the entire year.

So, it’s not uncommon in any given year to see the market take a dive.

One way to avoid that uneasy feeling is to simply avoid looking at market numbers at all costs. A better and more pragmatic solution is to remember volatility is inevitable, and that over the long term, day-to-day market swings are inconsequential. Because, despite the average double-digit decline, the S&P 500 had positive annual returns in 28 of the past 37 years dating back to 1980, with the average annual return of 8.5%.

2. That’s not your portfolio

The fact is, the market numbers you see in the news are not yours. They may not even be close. That’s because the typical retirement investor owns more than the Dow.

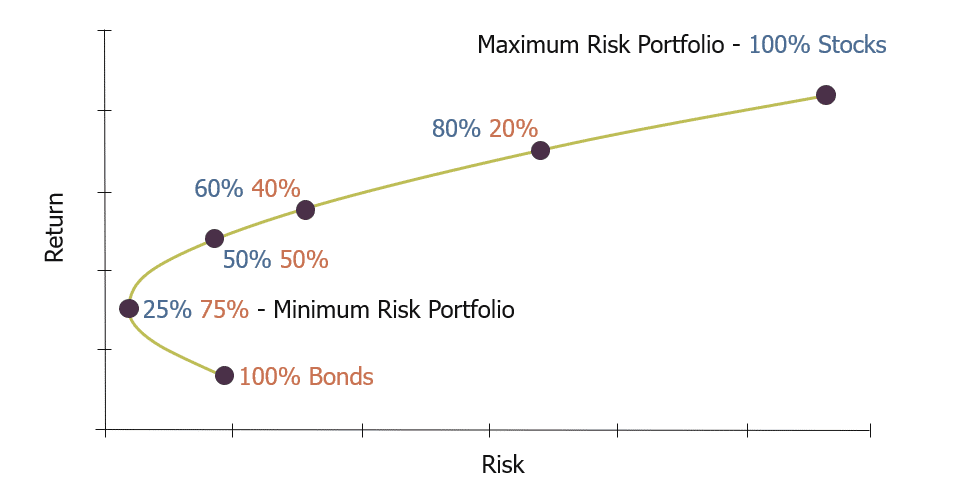

Instead, you are invested in a broadly diversified portfolio, generally comprised of stocks and bonds. So, your portfolio won’t move in lockstep with the stock market. Essentially, stocks are meant to provide growth; bonds are meant to provide protection. Think of your portfolio as a big ocean liner, where stocks are the engine and bonds are the ballast.

A diversified investment strategy can help you take the least amount of risk to still achieve the desired amount of return for your financial goals. Diversification spreads risk, creating a much smoother investment journey.

The amount of stocks and bonds you should own – your asset allocation -- depends on personal factors like your age, tolerance for risk and financial goals. If you don’t have a diversified portfolio or don’t know, contact an adviser to analyze your current investments and recommend an appropriate asset allocation.

You are likely somewhere here

3. The benefits of rebalancing

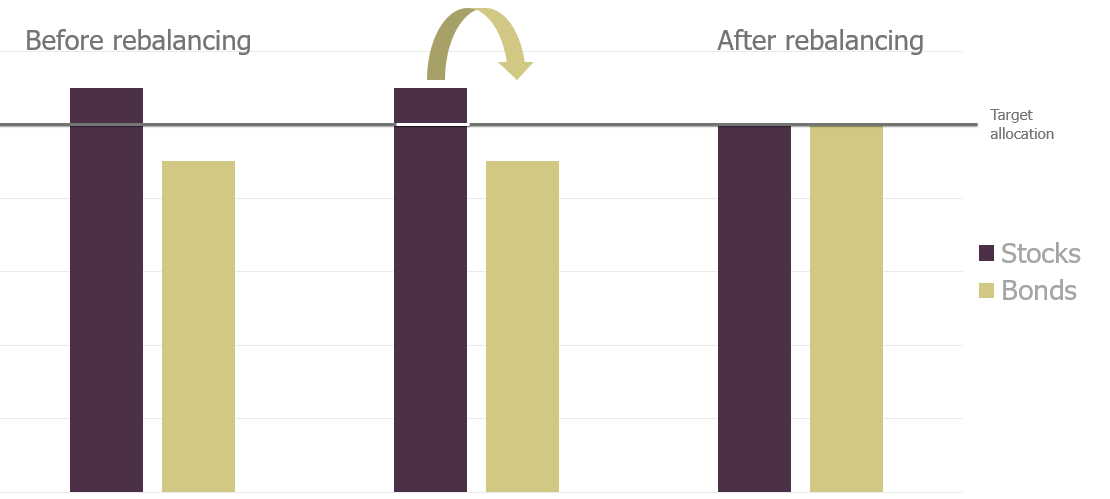

Prolonged market upswings can make your portfolio more stock-heavy. Rebalancing – generally, selling what’s up to buy what’s down – helps you do two things. One, it allows you to reap your earnings. Two, and most importantly, it helps you reduce risk and return your portfolio back to your desired asset allocation.

Rebalancing is something we do automatically as a convenience for clients. Those who invest themselves should make it a point to rebalance periodically.

Selling high, buying low

4. Stick with your financial plan

The secret to long-term investing is just as much about what you do as what the market does. A comprehensive financial plan is designed to guide you over the long haul, with the expectation of market bumps along the way.

Again, the best course of action is often doing nothing at all. Or rather, just sticking with the plan. A financial plan can provide that peace of mind when market volatility starts to make you feel anxious enough to do something.

Letting emotions trump your financial plan can produce disastrous results.

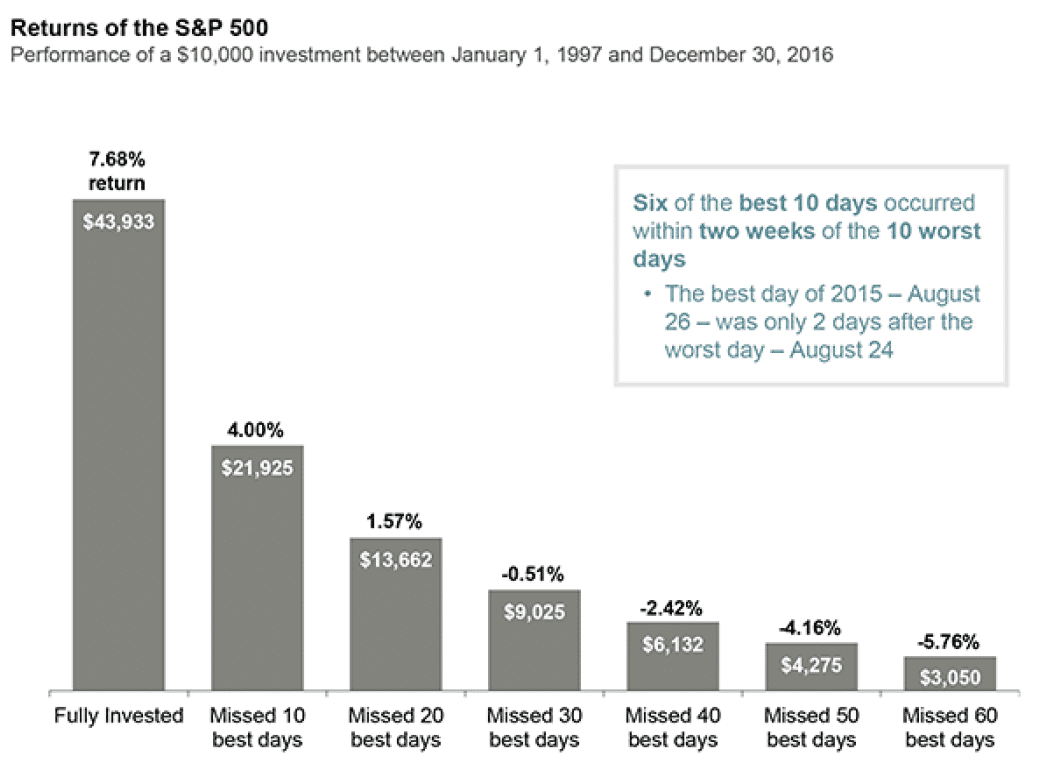

If you try to adjust your portfolio in hopes of avoiding a loss or earning a big gain, you’re likely to fail. Over a 20-year period, six of the best 10 days in the stock market occurred within two weeks of the 10 worst days. So, it’s nearly impossible to predict the good and bad days. Instead, it’s better to take the good with the bad by staying fully invested, as shown in the example below.

The good, the bad and the ugly

Source: J.P. Morgan Asset Management.

Someone who missed just the 10 best days would have earned a return that was more than 3.5% less than someone who was fully invested.

With a little understanding of how markets work and how your portfolio is invested, it can be easier to remain calm during a volatile market. Which helps you avoid mistakes and lets your money survive unscathed. Ultimately, when markets fluctuate wildly, remember this: like any storm, this too will pass.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.