7 Biggest Investment Mistakes

February 24th, 2021 | 5 min. read

On a Mount Rushmore of famous investors, two prominent faces you would find are Warren Buffet and Charlie Munger. The long-term investment decisions of this dynamic duo turned Berkshire Hathaway into a multinational conglomerate worth more than half a trillion dollars -- and made themselves among the richest people in the world.

But that’s not the full story. Their success is as much a result of what they did not do as what they did do. They didn’t try to be right, but rather avoid being wrong.

As Charlie Munger tells it: “It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.”

Put another way, “don’t be stupid” is a winning investment strategy. Think of investing as a game where the less mistakes you make, the longer you get to play and more investment growth you can earn. When you try to outsmart the market, you often end up losing.

As part of a don’t-be-stupid investment strategy, here are the 7 biggest investment mistakes that will get in the way of building wealth and achieving your financial goals.

1. Investing without goals

The reason for investing is to save money and grow it into a larger pool of money. But, how big should the pool be? What is the most efficient way to fill it?

With specific goals in mind, you can determine the amount of money you need at a certain time. For example, I need $1 million to retire at age 65. That then tells you how much you need to save and how much of a return you need from your investments. All of which in turn helps you choose what type of investments are most appropriate.

Without goals to help guide your planning, you could make the mistake of choosing investments based on unreliable data, such as historical performance.

Generally, your financial goals fall under three separate categories: short-, medium- and long-term. At one end are goals you plan to achieve within months or 1-2 years, so you would save in a traditional savings account, online savings account, money market account or certificate of deposit. On the other end, are goals you don’t plan to achieve for 10 years or longer, like retirement. So, you can take on risk by investing in stocks and bonds in an investment account, such as a 401(k) or an IRA.

2. Waiting to invest

One successful investing ingredient people can easily overlook is time. It may sound obvious to say the sooner you start to invest, the more likely you will be successful.

But that is the mistake most investors come to regret.

A survey of investment account owners found that more than three-quarters of Americans say they regret not investing earlier.

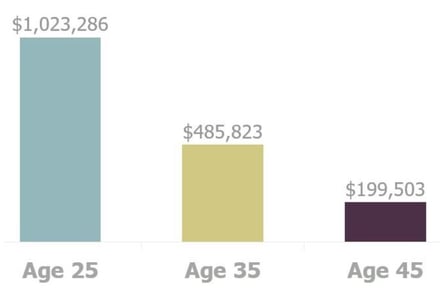

For good reason. When you start investing can make a big difference over time. Suppose you start working at age 25 and plan to retire at age 60. Here is an example of what the difference in ending balances could be saving 15% of a $55,000 salary when starting at ages 25, 35 and 45.

Starting early: difference in ending balances saving 15% of a $55,000 salary starting at various ages until age 60 (assuming 6.5% annual return)

In this example, 20 years is a difference of more than $800,000!

3. Paying high investment fees

Fees and other related costs are just part of investing. You pay for the funds you invest in, and you pay for the help to manage them. But that doesn’t mean you should pay more than you have to.

Do you know how much you pay? If not, you’re not alone. A Cerulli Associates report found that 22% of investors are “not sure” what investment fees they pay, while 23% think their investments and services are free (!).

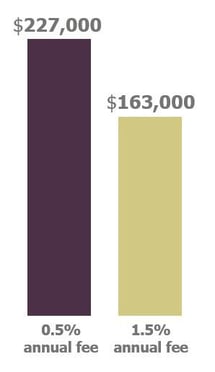

The math is simple: The more you pay in fees, the less of your return you get to keep. That’s less money you have in your portfolio compounding and building wealth.

Consider an investor with a $25,000 portfolio balance earning an average 7% return with 0.5% in fees can expect it to grow to $227,000 in 35 years. If that same investor paid 1.5% in fees, the balance would grow to only $163,000. Just a 1% difference in fees reduces the ending portfolio by $64,000.

That’s why it is important to make sure you fully understand the costs involved when investing. Avoid investments that charge commissions, 12b-1 fees, and other fees that may not directly benefit you. And look for low-cost investments in your 401(k) or other employer-sponsored retirement account. In other words, if you are choosing between two similar funds, choose the cheaper one.

Just as important, work with an adviser who can help find the appropriate investments for your goals at the lowest cost. Be sure to find an adviser who will also openly explain the costs to you. Preferably, hire an adviser who is a fiduciary, which means the person providing financial services is legally obligated to act in your best interest.

4. Trying to time the market

Basically, market timing is the process of selling your investments before the market hits bottom and then buying back into the market to reap the recovery.

Timing the market is a very difficult strategy to pull off. Not only do you have to time the exit right (sell before the market drops) but also the moment to get back in (buy before the market rebounds).

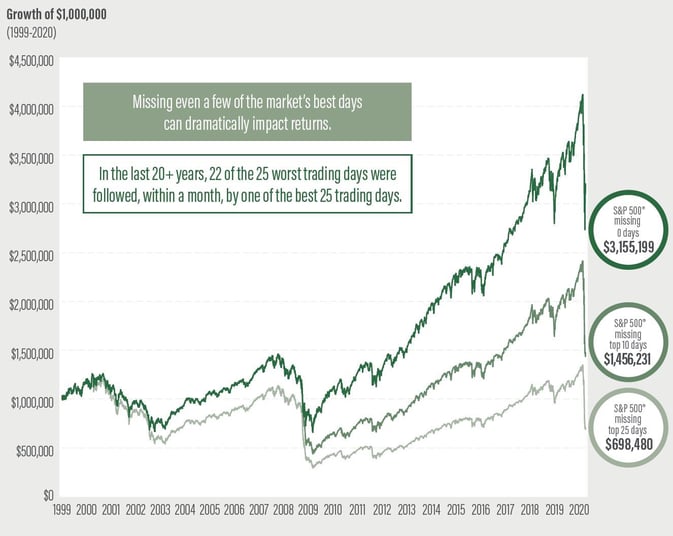

But here’s the thing: much of the stock market’s biggest gains tend to occur on a small number of days. In the last 20 years, 22 of the 25 worst trading days were followed, within a month, by one of the best 25 trading days.

These are days that are almost impossible to reliably predict; and missing out on them can greatly harm your chances of reaching your financial goals.

A hypothetical $1,000,000 invested in the S&P 500 (shown in the chart below) would be worth more than 50% LESS in value by missing just the 10 best trading days.

Source: AMG Funds

This is proof that investors are better off focusing on time in the market instead of timing the market.

5. Not diversifying

It doesn’t take psychic powers to become a successful investor. In fact, the better way to invest is by acknowledging the fact you can’t predict the future. The trick is diversification, which is the investment strategy of owning a mix of investments in your portfolio.

Generally, the more variety of investments you own, the more protected you are from significant losses, and the greater your chances for owning market winners.

There is always the risk of losing money in the market. That risk is highest if you invest all your money in one investment. The strategy of investing in multiple asset classes and among many securities can help lower your overall investment risk – and help keep you from missing out on the investments producing positive investment returns.

That doesn’t mean never seeing a loss. But it does mean lower volatility. With a diversified portfolio, the highs and lows are evened out.

6. Not rebalancing

Long-term investing doesn’t mean that you set your portfolio and forget it.

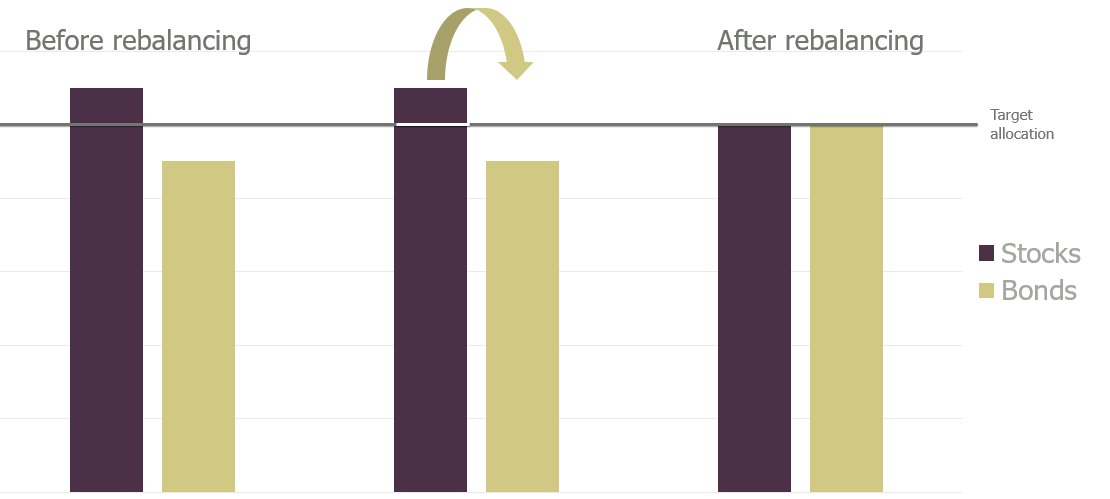

Prolonged market upswings can make your portfolio more stock heavy. Rebalancing – generally, selling what’s up to buy what’s down – helps you do two things. One, it allows you to reap your earnings. Two, and most importantly, it helps you reduce risk while returning your portfolio back to your desired asset allocation.

Rebalancing your portfolio should be done periodically, such as once a year.

Rebalancing: Selling high, buying low

7. Using investment accounts as an ATM

Your financial life can be full of unexpected challenges and moving targets. There are leaking roofs, broken-down cars, medical emergencies. Then there are weddings, new homes, babies. In all, there are times when a substantial sum of cash comes in handy.

That need for cash can tempt people into tapping their investment accounts, often a company retirement plan. This is a major mistake for a couple reasons.

Firstly, any time you take money from your retirement savings to pay for current expenses, you guarantee having less money in retirement. Not only does it reduce your balance, but you also miss out on all those potential earnings from compounding (the earnings earned on your earnings over time).

Just consider how much saving 15% of a $55,000 salary over 35 years comes from compounding when left untouched:

Secondly, there are potential tax consequences. Withdrawals are taxed at your ordinary income tax rate. And, if you are under the age of 59 ½, you may also be subject to a 10% early withdrawal penalty.

Instead of using your 401(k) as an ATM, build a separate emergency fund that you can access at any time without penalties or fees. You’ll be better equipped to handle any unexpected expenses while staying on track toward retirement.

The good news is that all of these mistakes are easily avoidable when you have professional help. A financial adviser can not only recommend the right investment choices for your situation, but also act as a stopgap between you and a big mistake.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.