AT&T Pension Payouts Expected to DECREASE in 2022

December 16th, 2021 | 2 min. read

If you’re on the fence of about retiring from AT&T sooner rather than later, the latest interest rate change may impact your decision.

That’s because lump-sum pension payouts for AT&T employees will likely decrease in 2022.

As a trusted financial adviser to many AT&T employees and retirees, we make it a point to post an annual article on recent interest rate changes that will affect the AT&T pension payout. This year, unfortunately, we have to deliver less than ideal news.

AT&T Pension Payout Change

In November, the interest rate used to calculate AT&T’s pension payouts – the Composite Corporate Bond Rate – was raised to 2.271%. That means if you’re an AT&T employee who may retire between now and the end of the year and would like to elect a lump sum, your payout may be lower than last year.

Generally, when rates increase, lump-sum payouts decrease, and vice versa. Even small changes in the rate will impact the size of your AT&T pension. Therefore, rate changes may affect your decision whether to retire early or continue working, as well as to take an annuity or a lump-sum payout.

How recent rate changes may affect you:

- Your lump sum pension will likely decrease. Again, when interest rates rise, lump sum distributions fall.

- If you collect your pension in 2021: you will likely receive a higher lump sum payout

- If you collect your pension in 2022: you will likely receive a lower lump sum payout

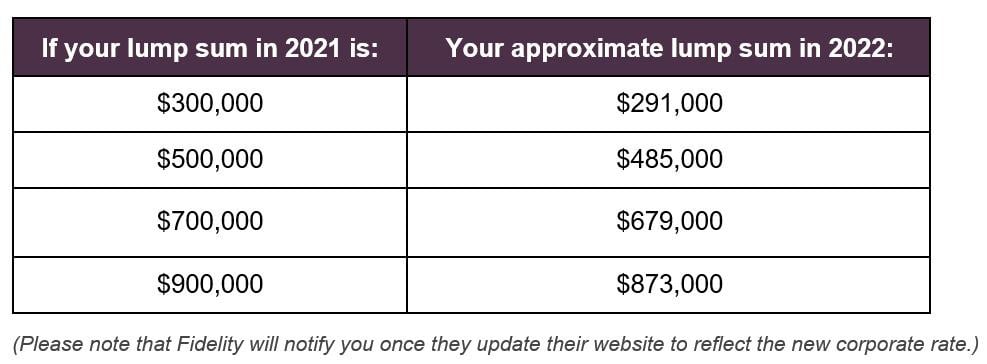

To give you a better look, here’s how the rate change could impact different AT&T lump-sum pension amounts in 2021 vs. 2022:

So, how does this AT&T pension rate change impact your retirement plan?

Your pension is an important income source for retirement. With this rate change, you may want to reconsider your decision whether to retire early, or to take an annuity versus a lump sum payout upon retirement.

However, it is only one part of your overall financial picture. There are many more factors to consider before you decide, such as your AT&T 401(k) savings, Social Security, other income sources, marital status and more.

What Should You Do with Your AT&T Pension?

Since there is more to consider than just your AT&T pension, you may benefit from working with a financial adviser to reevaluate your retirement plan.

Advance Capital has helped thousands of AT&T employees with all aspects of their financial lives, from managing their AT&T 401(k) plans to maximizing their AT&T pension options. Our 30-year history of working with people like you gives us a unique perspective of AT&T retirement benefits.

If you have any questions about your pension or would like us to help you build a sound retirement plan, please contact us to arrange a meeting or telephone conversation.

You can also learn more by downloading our go-to guide on AT&T retirement topics: The AT&T Employee’s Guide to Retirement.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.