How the Modified Rule of 75 Affects Your AT&T Retirement Benefits

April 29th, 2025 | 2 min. read

Anyone nearing retirement should know his or her number. That is, how much you need saved to retire. But as an AT&T employee nearing retirement, there’s another important number to know.

You could say it’s just as important as the target amount you plan to save in your AT&T 401(k) plan to help supplement your AT&T pension.

The number is 75 -- and it can greatly impact your AT&T retirement benefits.

That’s because AT&T relies on the “modified rule of 75” to determine an employee’s retirement eligibility, pension and retiree medical benefits.

AT&T Modified Rule of 75 Breakdown

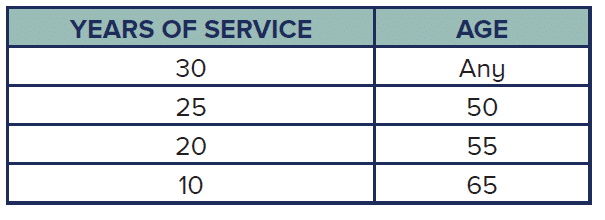

You are eligible for a vested pension benefit after five years of service, but your benefit will be negatively affected if you do not reach the age AND service breakpoints for your employment position, as shown in the chart below.

This is commonly known as the modified rule of 75 since the combinations add up to 75 in most cases.

However, you must meet BOTH minimum requirements.

Other Important Things to Know

The AT&T modified rule of 75 can be misleading since not every combination of 75 points applies.

For example, let’s assume you have 24 years of service and are age 51. Although the combination adds up to 75 (24+51=75), you do not qualify because you fail to meet both minimum requirements at each breakpoint.

Additionally, you may receive a reduced pension benefit if you take your benefit prior to age 55, even if your combination meets the 75-point rule. If you’re are a union employee with 30 or more years of service, however, the pre-55 reduction does not apply.

For AT&T management employees who meet the 75-point rule but don’t have 30 years of service, their pension benefit will be reduced if taken before age 55.

If you do not meet the 75-point rule yet are pension eligible (5 years of service), you will receive your earned AT&T pension at age 65. Taking it prior to age 65 will result in a significant reduction. Read this blog post to learn more about your AT&T pension.

Further, employees who satisfy the modified rule of 75 may be eligible for subsidized retiree medical, dental, vision and life insurance benefits.

When it comes to planning for retirement, it’s difficult to find financial planning help for your specific situation. After all, how many planners know the ins and outs of AT&T's pension benefit, 401(k) plan, etc. And in your case, as an AT&T employee, the Composite Corporate Bond Rate.

Don't worry -- we can help. Learn more about all the financial planning services we offer AT&T workers here.

Advance Capital Management prides itself on having worked with AT&T employees and retirees for over 30 years.

Schedule a free consultation with an AT&T retirement and benefits expert here for help with your retirement planning needs.

We even wrote the book on it! So, we encourage you to download the guide below to help you better understand how to get the most out of your AT&T retirement benefits.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.