Why You Need to Know These Key AT&T Pension Dates

August 4th, 2023 | 3 min. read

If you want to maximize your AT&T pension, your first thought may be to reach for a calculator. But what you may need is a calendar. That’s because, when retiring from AT&T, you need to be mindful of certain key dates.

Advance Capital Management has been serving AT&T employees and retirees since 1986, when three former telephone company executives founded it. We understand what important factors impact your pension – and how difficult it can be to navigate them all on your own.

Three of those critical factors are your (1) service date, (2) retirement date and (3) commencement date.

Below, I’ll explain what you need to know about these AT&T pension dates.

This article covers the following:

- AT&T pension service date

- AT&T pension retirement date

- AT&T pension commencement date

- AT&T pension process

AT&T pension service date

Your service date is when you started working at AT&T.

You need to know this because your “years of service” is one of the factors that help determine the size of your pension benefit.

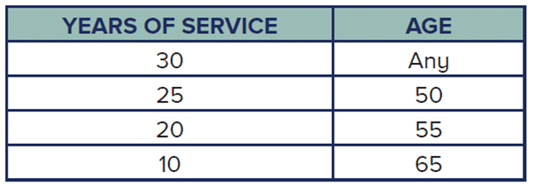

You’re eligible for a vested pension benefit after five years of service. Still, your benefit will be negatively affected if you do not reach the age and service breakpoints for your employment position. This is commonly known as the modified 75-point rule since the combinations add up to 75 in most cases (pictured below).

However, you must meet BOTH minimum requirements. It can be misleading since not every combination of 75 points applies.

For example, assume you have 24 years of service and are age 51. Although the combination adds up to 75 (24+51=75), you do not qualify because you fail to meet both minimum requirements at each breakpoint.

AT&T pension retirement date

This is what it sounds like: the date when you retire from AT&T. Along with your service date (when you start), your retirement date (when you leave) determines whether you meet the rule of 75 requirements. It ultimately dictates how many years you work at AT&T and at what age you retire.

Therefore, meeting those age and service breakpoints should be a critical factor in planning your retirement date to ensure you receive your full pension.

AT&T pension commencement date

Your AT&T pension commencement date is when your pension begins. Many AT&T employees think that your pension begins immediately or automatically once you retire. That’s not the case!

You can retire and not commence your pension for several years.

In fact, it may make sense to wait a year to commence your pension based on prevailing interest rates. Remember, when interest rates decrease, your lump sum pension increases – and vice versa. So, if rates were set to drop, you might want to delay your commencement to receive a larger lump sum pension later.

This is where working with an Advance Capital Management adviser can help you assess your best option.

AT&T pension and collection process

Now that you understand these key dates, you may be wondering what the actual pension and collection process looks like. So, here is a brief outline of how we would help you as your adviser:

- Select a retirement date. First, we will work with you to decide on an appropriate retirement date. This would be based on the rule of 75, as discussed above, and your other assets and overall readiness to retire.

- Run an estimate. Next, we would help you run a pension estimate using the date you decide on.

- Choose a lump sum or monthly annuity pension and whether to defer. This is when we’ll help you decide between a lump sum or monthly annuity and whether or not it makes sense to delay commencing your pension as well. The great thing about running a pension estimate is that it will show both payout options. And then, as your adviser, we can run multiple scenarios for comparison.

- Complete your pension paperwork with spousal consent. Finally, once you have made an official election, we will help you complete the pension paperwork, which will require both a notary and spousal consent.

The bottom line

Every Advance Capital adviser specializes in helping you process your AT&T pension and plan for retirement. Schedule a free consultation today. We can help you complete everything correctly and on time. Remember that you can start this process up to 180 days before your retirement date, which we highly encourage.

Ian Smith is a financial adviser committed to helping individuals and families feel confident about their financial well-being. Taking a holistic approach, he educates and guides clients on all of life’s financial decisions involving investments, retirement, taxes, insurance, estate planning and more.