A Comprehensive Look at AT&T’s Pension Plan

October 6th, 2021 | 4 min. read

Picture this scenario: You’re an AT&T employee who is about to retire. Before you can walk out the door one last time, however, you must choose which AT&T pension benefit is right for you. Either a monthly pension, lump-sum pension, or a combination of the two depending upon your classification (management or union).

Every AT&T employee faces this decision upon retirement. It’s an important one. Your AT&T pension will be one of your major sources of income in retirement. Pension plans, however, can be complex and difficult to understand.

Want to make sure you choose the right pension benefit? Click here to schedule a free financial consultation with an AT&T retirement and benefits expert today.

The right choice for you depends on your personal circumstances. There is not a single, right answer for everyone, so it is a decision you want to consider carefully.

To help you gain a better understanding of your AT&T pension, we provide the most important factors in your decision below. We recommend that you meet with your financial adviser to best determine what choice is right for your financial goals.

How Your Pension Is Calculated

There are three factors that help determine the size of your pension benefit:

- years of service,

- pension band (for union employees only) and

- income level

The higher each of these factors, the greater your pension benefit.

You are eligible for a vested pension benefit after five years of service, but your benefit will be negatively affected if you do not reach the age and service breakpoints for your employment position. Additionally, you may receive a reduced pension benefit if you take your benefit prior to age 55, unless you are a union employee with 30 or more years of service.

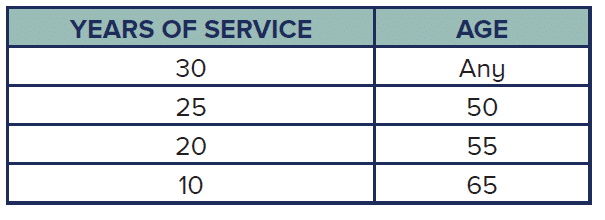

AT&T Pension Plan Modified Rule of 75

There is also a medical benefit for retirees offered from AT&T. Medical benefits are subsidized as long as you reach any of the minimum years of service and age breakpoints in the chart below. This is commonly known as the modified 75 point rule since the combinations add up to 75 in most cases.

However, you must meet BOTH minimum requirements. It can be misleading since not every combination of 75 points applies.

For example, let’s assume you have 24 years of service and are age 51. Although the combination adds up to 75 (24+51=75), you do not qualify because you fail to meet both minimum requirements at each breakpoint.

AT&T Vested Pension vs. Service Pension

You become vested in the AT&T pension plan when you: (a) have five* years of service (bargained) or (b) turn 65 years of age while employed with the company, whichever is later. Once you reach either target, you will be eligible for a vested pension.

The service pension, meanwhile, is earned by long-term employees. You are eligible for a service pension if you: (a) have 30 years of service or (b) meet the “modified rule of 75,” which generally states you must reach certain years of service and age breakpoints that usually add up to 75. (For more information about the rule of 75, read “How the Number 75 Affects Your AT&T Retirement Benefits.”)

*Three years of service for management employees

AT&T Vested Pension Options

The reality is many workers don’t stay with AT&T long enough to earn a service pension. Therefore, they receive a vested pension. With a vested pension, you have a choice to make. You can either:

(1) defer it until age 65, or

(2) take it prior to age 65 – but at a substantial discount. For example, if you take your pension at age 58, your pension amount will be reduced by approximately 50%.

Again, your pension is likely a primary source of income in retirement. That’s why it’s better to maximize it by deferring your vested pension. To do that, you essentially do nothing except arrange to start receiving your payout upon your 65th birthday. There is no added benefit to delay beyond age 65.

AT&T Pension Plan Survivor Benefits

The AT&T pension offers survivor benefits. If an employee passes away before retiring, a spouse automatically receives 50% of the monthly annuity or can choose the lump sum equivalent. This option is only available to spouses. Learn more about AT&T's benefit options for survivors here.

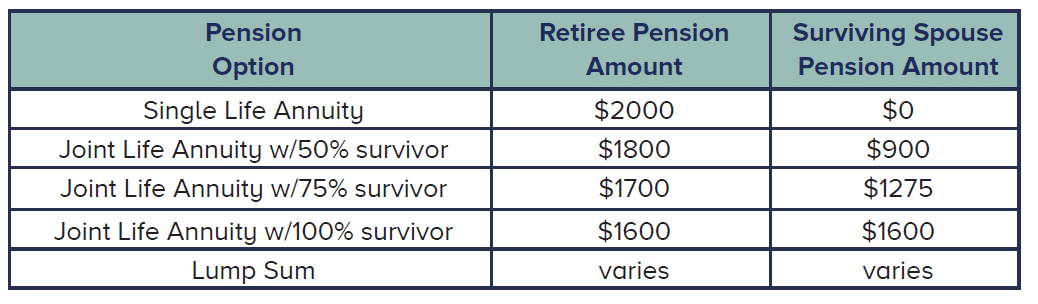

At retirement, the employee has multiple survivor options to choose from for the monthly pension, but all are only available for a qualified spouse. Additionally, union employees also have the choice to take a full lump-sum pension payout instead of the monthly annuity.

Meanwhile, management employees generally have the choice to take a partial lump-sum pension with a residual monthly pension.

The chart below shows an example of these options based on a $2000 Single Life Annuity Pension:

AT&T Pension Plan: Monthly Pension vs. Lump Sum

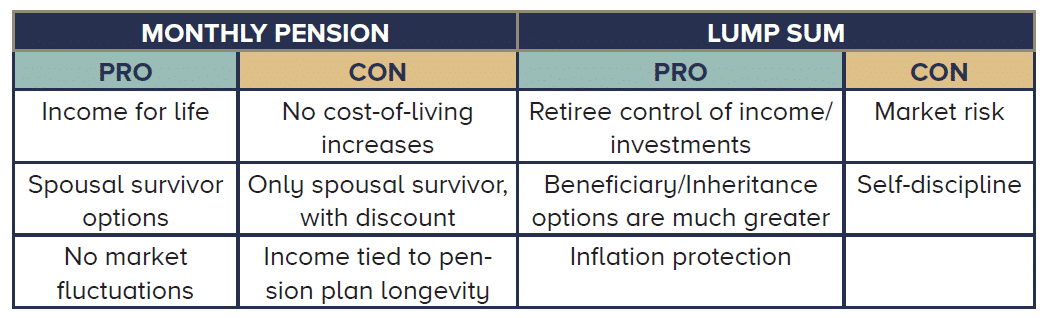

Upon retirement, you have choices. Employees can elect to receive a monthly payout like a traditional pension. Or, both union and management employees can convert all (union) or a portion (management) of their pension into a one-time lump-sum benefit, which can be subsequently rolled over into an Individual Retirement Account (IRA) and then controlled by the retiree. Interest rates and life expectancy factors are used to calculate the lump-sum amount.

There are pros and cons to each payout option. Deciding which option is most appropriate for you requires many considerations. It is best done with the help of a professional, who can incorporate all aspects of your financial life – Social Security, 401(k), real estate, inheritance, etc. – into your decision.

Helping you choose the right pension upon retirement is part of our retirement planning services. Learn more here.

When comparing a monthly pension to a lump sum, here are some essential considerations:

How Interest Rates Impact AT&T Pension Lump Sums

Your AT&T lump sum pension is calculated using the Composite Corporate Bond Rate, an interest rate published each month by the IRS. Each year, the company uses the rate published the previous November.

When interest rates rise, AT&T pension lump sum payouts fall. When interest rates fall, AT&T pension payouts rise.

Where to Find AT&T Pension Information

With nearly 40 years helping AT&T employees, we consider ourselves experts on all things related to AT&T retirement benefits. Sometimes, however, we’re unable to fully assist those looking for specific personal information that we can’t access. For example, former employees who worked briefly at AT&T many years ago and want to know if they’re eligible for a pension. Or, a deceased employee’s child or spouse searching for their loved one’s benefit information.

What we can do is send people in the right direction. If you need personal AT&T pension or benefit information, here are the places to find it.

Fidelity administers the AT&T pension and 401(k). They can provide employees with pension estimates, 401(k) balances and more. Employees can also change their beneficiaries on either plan through Fidelity.

Contact information:

Fidelity Pension & 401(k) Service Center

800-416-2363

netbenefits.fidelity.com

However, most AT&T employees searching for pension information are looking for comprehensive financial planning beyond their AT&T retirement benefits, including filing for Social Security, IRA rollovers and tax planning strategies.

For that, we recommend speaking to a financial advisor – and we’re here to help. For a free financial planning consultation, you can request a free consultation with an AT&T experienced financial adviser here.

You can learn more about navigating your AT&T retirement benefits by downloading our free ebook: The AT&T Employee’s Guide to Retirement.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.