What to Know About AT&T Retirement Survivor Benefits

July 20th, 2022 | 3 min. read

As a married couple, part of creating a secure financial future involves planning around the unfortunate passing of the other. Just imagine if your spouse has to take control of the household’s finances without knowing what funds are rightly owed to him or her.

Obviously, this is not an ideal scenario. Therefore, as an AT&T employee, it’s far preferable that both of you learn what the survivor will collect in AT&T benefits.

AT&T Pension Survivor Benefits

Upon your death, your spouse is eligible for an AT&T pension survivor benefit.

The AT&T pension survivor benefit works like this: If an employee passes away before retiring, a spouse automatically receives 50% of the monthly annuity or can choose the lump-sum equivalent. This option is only available to spouses. Learn whether a lump sum or annuity payout is right for you by reading the article here.

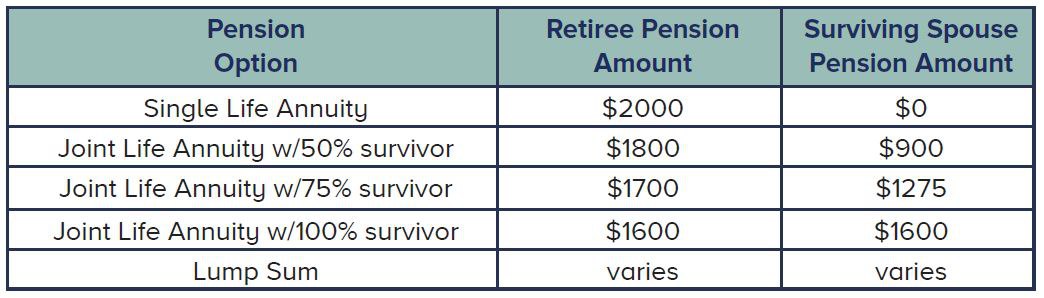

There are multiple survivor options to choose from for the monthly pension, but all are only available for a qualified spouse. Additionally, union employees also have the choice to take a full lump-sum pension payout instead of the monthly annuity. Meanwhile, management employees generally have the choice to take a partial lump-sum pension with a residual monthly pension.

The chart below shows an example of these options based on a $2,000 Single Life Annuity Pension:

AT&T 401(k) Plan Beneficiaries

All the AT&T benefits you have earned and accumulated, such as life insurance and your 401(k), can be passed on to a beneficiary in the event of your death. Chances are, if you’re married, your spouse is the listed beneficiary on your AT&T 401(k) account. While not technically a survivor benefit, it is still a potentially sizable amount of money owed to your spouse.

You can, however, name as many people as you want and add or remove names as you like. Just as long as the allocated percentages add up to 100%. For more information about managing your AT&T 401(k), check out this post.

It is important that you keep your beneficiary information current. Life changes. You may experience a divorce and get remarried. Often, people name someone as a beneficiary early in their careers and then neglect to update it. That can cause major problems for your loved ones later. Even if your wishes change, AT&T is required to honor the written designation upon your death, no matter how old the information. The designations listed on your beneficiary form are the final word – they trump your will.

If you don’t name any beneficiaries, your assets will go to probate court, which can be a time-consuming, expensive and stressful experience for your family.

Your current beneficiary designations can be viewed on the Fidelity Benefits Center website: www.netbenefits.com. Here, you will find a list of the individuals you named as beneficiaries for any accumulated balances of your pension, life insurance and 401(k) plan. Through this website, you also have the ability to change these designations at any time.

AT&T Life Insurance Benefits

Just like your AT&T 401(k), your AT&T life insurance benefits can have designated beneficiaries.

While employed, you may be eligible for basic life insurance coverage through AT&T. For most employees, basic life insurance coverage is equal to one year of your compensation. If you meet the Modified Rule of 75, you are eligible for a basic life insurance benefit after retirement. As a retiree, the amount of your basic life insurance benefit depends on your age, employment classification and compensation.

If you need additional coverage, you may purchase supplemental life insurance to meet your needs. The supplemental life insurance plan may also be available to you in retirement. Buying supplemental coverage through AT&T’s group plan is a cost-effective way to get access to additional coverage. The cost and amount of coverage you are eligible for under the supplemental plan will vary based on your employment classification, compensation and years of service, among other factors. In retirement, your age will also affect your cost and eligibility.

Again, it is important that you keep your beneficiary information current.

Social Security Survivor Benefits

Although Social Security is entirely separate from your AT&T benefits, it will be a major part of your retirement plan. Therefore, it’s a good idea to understand how this federal program works. Creating the right Social Security claiming strategy is part of our retirement planning services -- learn more here.

If your spouse passes away after at least nine months of marriage, you may be able to collect survivor benefits. You are eligible for survivor benefits as early as age 60. However, a reduction applies if you take benefits prior to your full retirement age (66 or 67, depending on your date of birth).

Upon full retirement age, your survivor benefit will equal your spouse’s actual benefits. Therefore, if your spouse delayed his or her benefit, your survivor benefit will have also increased. If your spouse passed before collecting benefits, you will receive 100% of your spouse’s benefit at your full retirement age.

You will receive either your individual benefit or your survivor benefit, whichever is greater. For example, let’s say you received $1,400 from your own benefit while your spouse received $1,600 before passing away. You will then only receive $1,600.

If you remarry before turning age 60, your entitlement to these benefits stop. Remarriage after age 60 does not affect your benefits.

Ultimately, money is a family affair. Each spouse should feel encouraged to participate, from creating a budget and setting up retirement savings accounts to meeting with a financial adviser and choosing an appropriate investment strategy. That way, both spouses are prepared for anything.

An adviser can help estimate your pension amount, provide an AT&T 401(k) review and create a personalized retirement plan. Schedule a free financial consultation today!

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.