Electing AT&T Survivor Benefits

February 23rd, 2022 | 2 min. read

A common question we’re asked: How can I make sure my spouse is financially provided for? In this article we take a closer look at the AT&T Survivor Benefit options.

When helping people create a comprehensive financial plan, we look at not only how to use your assets for a comfortable retirement, but also to ensure your loved ones are protected in the event you pass away.

The AT&T pension offers survivor benefits. If you’re married upon retirement, you’ll need to elect a survivor benefit. Which benefit you choose will determine how much of your AT&T pension that your spouse will receive. However, electing to cover a spouse will cause a reduction of the monthly basic benefit paid both to you and your spouse in the event of your death.

AT&T Survivor Benefit Options

If an employee passes away before retiring, a spouse automatically receives 50% of the monthly annuity or can choose the lump sum equivalent. This option is only available to spouses.

At retirement, the employee has multiple survivor options to choose from for the monthly pension, but all are only available for a qualified spouse.

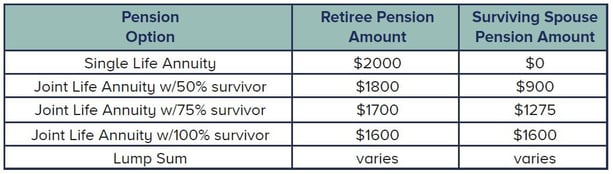

- Single Life Annuity: retiree receives a full pension amount without a benefit going to the surviving spouse

- Joint Life Annuity with 50% Survivor: retiree receives a reduced pension amount; surviving spouse receives a benefit that matches half of that amount

- Joint Life Annuity with 75% Survivor: retiree receives a reduced pension amount; surviving spouse receives a benefit that matches 75% of that amount

- Joint Life Annuity with 100% Survivor: retiree receives a reduced pension amount; surviving spouse receives a benefit that matches 100% of that amount

Additionally, union employees also have the choice to take a full lump-sum pension payout instead of the monthly annuity. Meanwhile, management employees generally have the choice to take a partial lump-sum pension with a residual monthly pension.

The chart below shows an example of these options based on a $2000 Single Life Annuity Pension:

Don’t Forget Your AT&T 401(K)

All the AT&T benefits you have earned and accumulated, such as life insurance and your 401(k), can be passed on to a beneficiary in the event of your death. Chances are, if you’re married, your spouse is the listed beneficiary on your AT&T 401(k) account. While not technically a survivor benefit, it is still a potentially sizable amount of money owed to your spouse.

You can, however, name as many people as you want and add or remove names as you like. Just as long as the allocated percentages add up to 100%.

It is important that you keep your beneficiary information current. Even if your wishes change, AT&T is required to honor the written designation upon your death, no matter how old the information. The designations listed on your beneficiary form are the final word – they trump your will.

If you don’t name any beneficiaries, your assets will go to probate court, which can be a time-consuming, expensive and stressful experience for your family.

What AT&T Survivor Benefit Is Right for You?

There are a variety of things to consider for each option. Electing to choose a reduced benefit now for a benefit later can make sense for some but not for others. That means the right option for you depends on the personal circumstances of you and your spouse.

Think through the survivor options with the goal being to maximize income for your family, not just your pension. In many cases, a married couple will choose one of the survivor benefit options instead of the single life annuity.

If, however, you have an adequate amount of other financial assets or your spouse also has a pension plan, it may make sense to consider the single life annuity option, or the lower partial benefit.

You want to consider your options carefully; preferably, with the help of an AT&T-experienced financial adviser. Retirement can last longer than you think, so you don’t want to take the risk of your surviving spouse having inadequate income.

Want to learn more about your AT&T retirement benefits? Download our go-to guide on AT&T retirement topics: The AT&T Employee’s Guide to Retirement.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.