How AT&T Retirement Plan Survivor Benefits Work

March 26th, 2018 | 2 min. read

To appropriately plan for the future, you and your spouse should know what to do upon the unfortunate passing of the other. Just imagine if your spouse must suddenly take control of the household’s finances without knowing what funds are rightly owed to him or her.

Obviously, this is not an ideal scenario. Therefore, as an AT&T employee, it’s far preferable that both of you learn, while both of you are living, what the survivor will collect in AT&T benefits.

Upon your death, your spouse is eligible for an AT&T pension survivor benefit. Further, you can name your spouse as the beneficiary of your other AT&T retirement benefits, including your 401(k).

AT&T Pension Plan

The AT&T pension survivor benefit works like this: If an employee passes away before retiring, a spouse automatically receives 50% of the monthly annuity or can choose the lump-sum equivalent. This option is only available to spouses.

There are multiple survivor options to choose from for the monthly pension, but all are only available for a qualified spouse. Management employees also have the choice to take a partial lump-sum pension with a residual monthly pension.

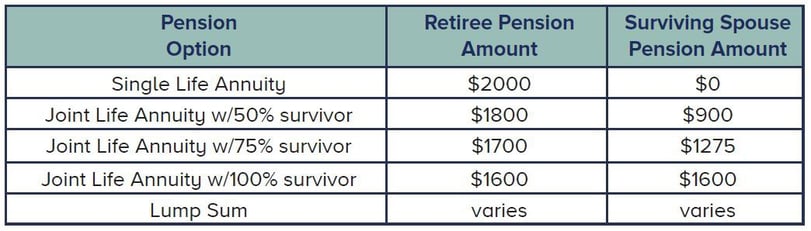

The chart below shows an example of these options based on a $2,000 Single Life Annuity Pension:

AT&T 401(k) Plan

All the AT&T benefits you have earned and accumulated, such as life insurance and your 401(k), can be passed on to a beneficiary in the event of your death. Chances are, if you’re married, your spouse is the listed beneficiary on your AT&T 401(k) account. While not technically a survivor benefit, it is still a potentially sizable amount of money owed to your spouse.

You can, however, name as many people as you want and add or remove names as you like. Just as long as the allocated percentages add up to 100%.

It is important that you keep your beneficiary information current. Life changes. You may experience a divorce and get remarried. Often, people name someone as a beneficiary early in their careers and then neglect to update it. That can cause major problems for your loved ones later. Even if your wishes change, AT&T is required to honor the written designation upon your death, no matter how old the information. The designations listed on your beneficiary form are the final word – they trump your will.

If you don’t name any beneficiaries, your assets will go to probate court, which can be a time-consuming, expensive and stressful experience for your family. Therefore, double check your beneficiaries periodically and especially after major life events.

Ultimately, money is a family affair. Each spouse should feel encouraged to participate, from creating a budget and setting up retirement savings accounts to meeting with a financial adviser and choosing an appropriate investment strategy. That way, both spouses are prepared for anything.

You can learn more by downloading our “go-to guide” on AT&T retirement topics: The AT&T Employee’s Guide to Retirement. CLICK THE BUTTON BELOW. This interactive guide covers all AT&T benefits, with the goal of helping you make more informed retirement planning decisions.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.