FERS Basic Benefit Plan Early Retirement Considerations

January 16th, 2020 | 3 min. read

Choosing when to retire is one of the most important – and sometimes difficult – financial decisions to make. You must align your personal needs and aspirations with the economic realities of your situation.

The average voluntary retirement age for federal employees is 63, according to a report the Congressional Research Service. This is an increase from 61.3 in 1990, indicating a trend among federal employees to retire later in their careers.

Some federal workers, however, are fortunate to have the opportunity to leave the workforce early. This has pros and cons. While retiring early may sound like a dream, the upshot is that it can affect your Federal Employees Retirement System (FERS) benefits.

How early retirement affects your FERS basic benefit

Upon retirement, FERS will pay you a monthly benefit based upon your years of service worked under FERS, your income and the age you retire. Hence, the basic benefit is often known as the monthly annuity.

To be eligible for unreduced benefits (immediate retirement) you must meet one of the following criteria:

- Must reach Minimum Retirement Age (“MRA”) (age 55-57, depending upon your year of birth) with 30 years of service

- Age 62 with 5 years of creditable service

- Age 60 with 20 years of creditable service

But federal employees can be eligible for early retirement if they have reached their MRA and have 10 years of service.

The downside is that those who elect early retirement will have their basic benefit permanently reduced by 5% for each year they retire before age 62. That could be a substantial amount of guaranteed retirement you would forgo.

Further, if you elect the monthly annuity prior to age 62, you are not eligible for a cost-of-living adjustment (COLA) until you reach age 62. Your first COLA is prorated for the number of months you receive your monthly annuity before December 1. It is annualized each year thereafter.

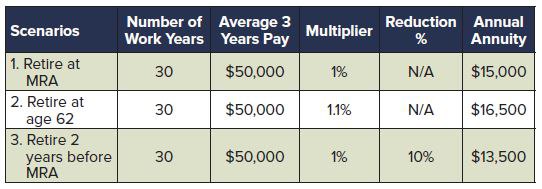

Also, your basic benefit amount is calculated by using one of two multipliers – 1% or 1.1% -- based on your retirement age. If you elect to retire prior to age 62, the pension calculation does not change to the higher multiplier of 1.1% when you turn age 62.

Essentially, your pension is permanently 10% lower than if you begin your pension at age 62.

This chart shows how a FERS annuity is impacted by your retirement age:

Simply put: if you choose to retire early, before age 62, then you should be comfortable knowing that you will receive a lower FERS basic benefit monthly payment.

Other early retirement considerations for federal government employees

Early retirement can also impact other important incomes sources.

Social Security

If you retire early, chances are that you will also file for Social Security early.

You can start to collect Social Security as early as age 62. However, your benefit will be permanently reduced. The size of your reduction depends on the number of months before your full retirement age (FRA), which is typically 66 or 67, depending on your date of birth.

If you start receiving benefits right at age 62, you are subject to the maximum discount. The maximum discount is 25% if your FRA is 66 and 30% if your FRA is 67. That discount amount decreases the closer you are to your FRA when you begin collecting benefits.

Thrift Savings Plan

As with most retirement accounts, you do not have full access to your Thrift Savings Plan until your turn age 59 ½. Should you make any withdrawals prior to that age, you are subject to a 10% early withdrawal tax penalty along with ordinary taxes. If you have a Roth account, you would owe taxes and the penalty only on your earnings.

Consider the Supplemental Annuity Benefit

One benefit available to those who retire early is the Supplemental Annuity Benefit, which actually gives you a larger retirement benefit in the period between your MRA and age 62. However, you also need to have an unreduced basic benefit to get this option (i.e., no 5% discount is applied to your monthly benefit).

Once the supplemental annuity ends, you will be eligible for Social Security. If you take advantage of the supplemental annuity, you must plan to start Social Security at age 62 or have enough assets to cover your living expenses until you decide to file.

The coordination of these different benefits is important. Remember, taking Social Security early, before your FRA, results in a permanent reduction in your benefit.

There are a lot of moving pieces when it comes to leaving the federal workforce early. To help you decide, learn more about government retirement benefits, including the FERS basic benefit, the Thrift Savings Plan and other retirement planning steps, by downloading our free, easy-to-understand guidebook, FERS Made Simple: Understanding and Maximizing Your Benefit. (click the button below)

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.