Navigating the AT&T 401(k) Plan

January 6th, 2017 | 5 min. read

Although AT&T employees are provided a pension, the ability to retire on your terms depends greatly on the health of your 401(k). The AT&T 401(k) plan allows you to grow your savings for retirement. Unlike the pension, however, you do all the legwork.

Which is why people often find their 401(k) plans confusing. Without financial help, they don’t know how to invest their money or how much to save. In a recent survey of 401(k) participants by Charles Schwab, fewer than half were confident making investment decisions on their own.

Need help managing your AT&T 401(k)? Speak with a qualified financial adviser who can help you manage your AT&T retirement benefits.

Have no fear, AT&T employees. We’ll walk you through your 401(k) plan to help you understand how it works and, most importantly, how it can support your dreams for retirement.

Contributions

Let’s start with saving money. While you’re working, AT&T allows you to save a portion of each paycheck into your 401(k) account, where it can grow tax-deferred for future use. Here are the different types of ways you can contribute to your account:

Basic contributions – After one year with the company, AT&T matches 80% of your Basic contribution. For managers, your Basic contribution is the first 6% of your salary. For most non-managers, it’s a dollar amount based on your banded pay. You should make the full Basic contribution to maximize the employer match.

Supplementary contributions – If you make the full Basic contribution, you can save even more in the form of Supplementary contributions. Your Basic plus Supplementary contributions, however, cannot exceed the annual IRS limit ($19,500 in 2020). For most non-managers, you are also limited to a total contribution of no more than 30% of your pay.

Catch-up contributions – Managers and some non-managers who are age 50 or older may also make Catch-up contributions (up to $6,500 in 2020) beyond the annual IRS limit. Neither the Supplementary nor Catch-up contribution is eligible for the company match.

Ultimately, consider saving as much money as possible in your 401(k). The more you save, the greater the likelihood you can meet your retirement goals. If you find it difficult to save, set a reasonable savings goal and make small increases over time; especially, if you receive a pay increase.

Investment Fund Options

Now, what should you buy with your savings? The process of selecting the right mix of investments in your 401(k) is critical to your financial success. It is also the part people often find the most challenging.

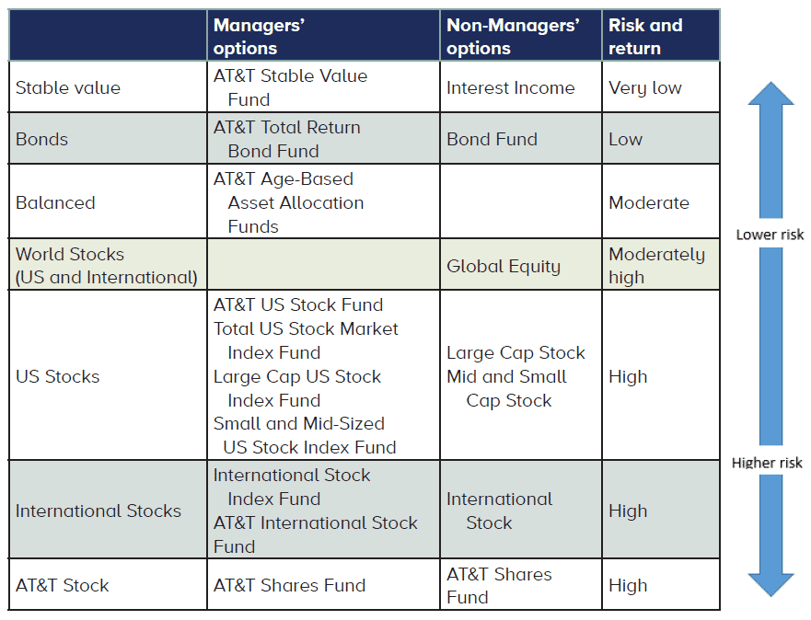

While managers and non-managers have different 401(k) investment options, there are choices in each program that can help your money grow at a level of risk you are comfortable with. Your decision is easier when you know at least a little bit about each of the investment options available. Here is a summary of the funds in the AT&T 401(k) plan:

Managers also have access to Fidelity BrokerageLink, where you may select from a wider array of investments that you manage on your own.

Tips for Choosing Funds

Start aggressive then reduce risk closer to retirement. Younger employees generally should have more money allocated to stocks for their high return potential. Over time, you should gradually reduce risk and move more of your accumulated savings to lower-risk investments.

Avoid investing too conservatively. After the financial crisis in 2008, many employees moved their savings into low-risk funds. Unfortunately, many of these people then missed out on the gains of the stock market rebound. It is important to diversify and maintain some level of risk for growth potential.

Avoid investing too aggressively. Some people make the mistake of investing in funds that have the highest historical returns while ignoring the high risk associated with these funds. This strategy may work well for younger employees, who have time to recover from losses, or those who have a high tolerance for risk, but it can be dangerous for those nearing retirement.

While some employees try to invest on their own or rely on recommendations from coworkers, everyone’s situation is unique. Working closely with an experienced adviser can help you choose the funds most appropriate for you and your specific financial goals.

Managing Your Account

The first time shouldn’t be the only time you review the fund options available to you. Check your account periodically to make sure you’re still on track. These factors can affect your journey toward retirement:

Markets can be volatile. Your investment amounts will move up and down with the markets. If they move too much, you may need to rebalance – sell what’s up, buy what’s down – to maintain your investment choices.

Economic forces often shift the need for different investments. For instance, lower interest rates may mean a change in how much you hold in bonds versus stocks.

As you progress through your career, adjust your allocation between growth assets (stocks) and income funds (bonds) to better manage your risk. Again, you’ll likely need to be aggressive early in your career then move to a more conservative portfolio as you get closer to retirement.

401(k) Loans

Most employees have the option to take a loan from their 401(k) account. There are costs: a quarterly maintenance fee and interest on the loan amount.

The minimum loan amount is $500 for non-management and $1,000 for management employees. The maximum is the lesser of (1) 50% of your 401(k) balance OR (2) $50,000 less the highest outstanding loan balance in the prior 12 months. Repayment is typically deducted from each paycheck over a specified timeframe, dictated by the plan.

Ultimately, try to avoid borrowing from your 401(k). A loan reduces the amount you have invested and growing for your future. Any time you take from your retirement savings to pay for current expenses, you put your retirement at risk.

Instead, build a separate emergency fund that you can access at any time without penalties or fees. You’ll be better equipped to handle any unexpected expenses while staying on track toward retirement.

Distributions

Finally, when and how you withdraw money from your 401(k) account comes with its own important considerations.

Hardship withdrawals

Generally, there are limited circumstances where you can make a withdrawal from your 401(k) while still employed, such as a financial hardship. A hardship withdrawal requires documentation and approval for a specific circumstance, including:

- Medical care for you or your dependents.

- Costs directly related to the purchase of your principal residence, excluding mortgage payments.

- Tuition and related education fees for the next six months of post-secondary education for you, your dependents or designated beneficiary.

- Costs for burial expenses for your parents, dependents or designated beneficiary.

- To prevent your eviction from your principal residence or its foreclosure.

This is just a brief summary. If you need a hardship withdrawal, contact your 401(k) provider as soon as possible to make certain your need qualifies.

Partial distributions

Upon leaving AT&T, it is common to rollover your 401(k) to an Individual Retirement Account (IRA). But you may leave some or all your savings in your AT&T 401(k) account.

If you retire from AT&T in the year in which you turn age 55 or older, you have full flexibility regarding withdrawals from your 401(k), meaning no early withdrawal penalties. For non-managers, the most common withdrawal is to take a Partial Distribution. Four times per year you can contact the administrator and request a withdrawal from your account.

Managers may elect scheduled monthly withdrawals and/or up to eight Partial Distributions. The election of monthly withdrawals counts as one of your eight Partial Distributions.

Taxes

One area of your 401(k) that provides no flexibility is tax withholdings. Every withdrawal is subject to a mandatory 20% federal tax plus applicable state taxes.

401(k) rollovers

A 401(k) rollover is the transfer of funds from your 401(k) account to an IRA. There are many reasons why you may want to roll over your savings to an IRA, including:

- Greater investment choices

- Withdrawal flexibility

- More withholding options

- Professional management by an adviser of your choosing

Note: For IRAs, age 59½ is when you gain full flexibility and can make withdrawals without penalties.

When done properly, no tax applies to the rollover. To conduct a rollover, work with a financial adviser to ensure that it’s done properly and to avoid a possible taxable event.

This concludes our journey through the AT&T 401(k) plan. We hope you learned a lot and feel more confident in your financial future.

Please note that this blog was adapted from our interactive e-book, The AT&T Employee’s Guide to Retirement. If you want to learn more about your AT&T retirement benefits and other retirement planning steps, download your copy today!