How Much Should You Set Aside to Retire from AT&T?

August 22nd, 2019 | 3 min. read

If all goes according to plan. Those are the rose-colored words people commonly say when they think they’ve got retirement fully covered. If all goes according to plan, I’m all set for retirement. They are often spoken by people who expect to retire with a sizeable pension or some kind of financial windfall, such as from selling a business.

But, as AT&T workers who’ve received severances or buyout offers know, not everything goes according to plan. Suddenly, retirement isn’t such a sure thing. Moral of the story: Don’t take anything for granted. Ultimately, reaching retirement is your responsibility.

Of course, you can’t control corporate restructuring or downsizing. What you can control, however, is how much you save.

When it comes to retirement planning, your AT&T pension is only one piece of the puzzle. It’s your AT&T 401(k) account that can make the difference in achieving a comfortable retirement. A well-funded 401(k) can give you the financial flexibility to stay on track when things change.

So, how much should AT&T workers save for retirement?

The 401(k) rule of thumb

It goes without saying the more you save, the greater the likelihood you’ll meet your retirement goals.

The annual 401(k) contribution limit is $19,000 (2019). Those 50 and older get the benefit of catch-up contributions, which allows them to save an additional $6,000 per year, for a total allowable annual contribution of $25,000 (2019). (Keep in mind, most non-management AT&T employees are limited to a total contribution of no more than 30% of pay.)

Of course, saving around $20,000 every year is unrealistic for many workers. You’ve got a life to fully live today, too. Instead, a common rule of thumb to follow is to save about 10-15% of your salary, which will allow you to replace about 70-80% of your preretirement income when you retire.

At the very least, you should make the full Basic contribution to maximize AT&T’s employer match. After one year with the company, AT&T matches 80% of your Basic contribution.

For managers, your Basic contribution is the first 6% of your salary. For most non-managers, it’s a dollar amount based on your banded pay. Essentially, the full Basic contribution along with the full employer match could get you to that ideal 10% savings target.

How much you should have saved by retirement

Now you know how much to set aside from your paychecks while working. But, how much in total should you save by the time you retire? As mentioned above, having enough retirement income to replace 70-80% of your pre-retirement income will generally allow you to maintain the same standard of living you enjoy now.

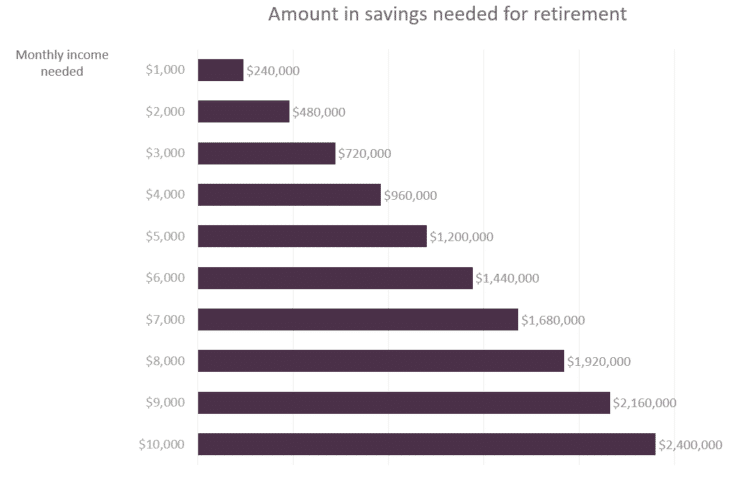

Calculated using the “rule of 20”, which is a general rule of thumb that states you should save $20 for every $1 you expect to spend in retirement. You can reasonably live off this amount for around 25 years or more at a 4-5% withdrawal rate.

So, if you have a $75,000 salary, then you would need your portfolio and other income sources to provide $52,500 to $67,500 in income each year, plus annual increases to adjust for inflation.

We, however, typically recommend replacing 100% of your preretirement income. Although some of your living costs will fall in retirement (gas, shopping, etc.), others will rise (health care). Not to mention people have retirement dreams (buying a cabin, taking extended trips, etc.). At worst, this savings target gives you a little financial cushion in retirement (who can complain about saving too much?).

Now, what does that equate to in actual figures?

Many financial news stories these days recommend just about everyone should save $1 million. The truth is there is no one-size-fits-all retirement savings target. How much YOU need will depend on the size of YOUR pension, Social Security benefit and other assets.

For a simple calculation, you can take your estimated monthly retirement expenses and subtract your guaranteed income (monthly pension and Social Security), then you’ll know how much you need from your portfolio every month. Of course, if you elect a lump-sum pension payout and put it into an IRA, you can expect the need to withdraw more.

Once you know how much you need from your savings each month, you can estimate the amount in savings you need for retirement, as shown in the chart below.

Again, you can never assume anything is guaranteed. Taking it upon yourself to save enough to cover your estimated retirement expenses is the surest way to achieve the retirement you want.

That’s where a financial plan comes in. With a financial plan you can cover all your bases and prepare yourself for when life throws you a curve ball.

If you’re an AT&T employee or retiree who wants tailored financial help, contact us. Or, start putting together a plan right now and one our advisers will reach out with a full review of your situation.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.