Recent rate changes may affect AT&T pension payouts

December 15th, 2016 | 1 min. read

3.43% corporate rate will INCREASE lump-sum pension payouts for AT&T employees in 2017

3.43% corporate rate will INCREASE lump-sum pension payouts for AT&T employees in 2017

As a trusted financial adviser to many AT&T employees and retirees, we wanted to inform you about recent interest rate changes that will affect your pension payout. If you are planning to retire soon, please review this important information.

In November, the interest rate used to calculate AT&T’s pension payouts – the Composite Corporate Bond Rate – was lowered to 3.43%. Small changes in the interest rate will impact the size of your lump-sum pension.

How recent rate changes may affect you

- Your lump sum pension will likely increase. When interest rates fall, lump sum distributions rise.

- If you retire in 2016: you will likely receive a lower lump sum payout

- If you retire in 2017: you will likely receive a higher lump sum payout

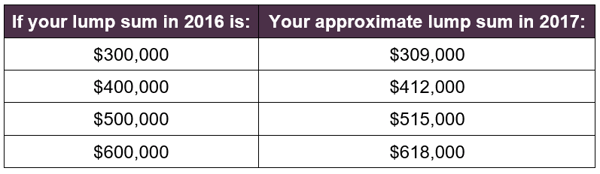

The impact of this lower rate:

How does this impact your retirement plan?

Your pension is an important income source for retirement. These changes may affect your decision whether to retire early, or to take an annuity or a lump sum payout at retirement. However, it is only one part of your overall financial picture. There are many more factors to consider before you decide – and we’re here to help.

Advance Capital has helped thousands of telephone company employees make smart financial decisions. If you have any questions about your pension or would like us to help you build a sound retirement plan, please contact us to arrange a meeting or telephone conversation.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.