AT&T Pension Payouts to Rise Slightly in 2018 – Here’s What to Know

December 21st, 2017 | 1 min. read

In November, the interest rate used to calculate AT&T pension payouts – the Composite Corporate Bond Rate – was lowered to 3.34%. That means, if you’re an AT&T employee who may retire between now and the end of the year and would like to elect a lump sum, your payout could be a little larger than last year.

In November, the interest rate used to calculate AT&T pension payouts – the Composite Corporate Bond Rate – was lowered to 3.34%. That means, if you’re an AT&T employee who may retire between now and the end of the year and would like to elect a lump sum, your payout could be a little larger than last year.

Generally, when rates are lowered, lump-sum payouts are increased, and vice versa. Even small changes in the rate will impact the size of your AT&T pension.

Therefore, rate changes may affect your decision whether to retire early or continue working, as well as to take an annuity or a lump-sum payout.

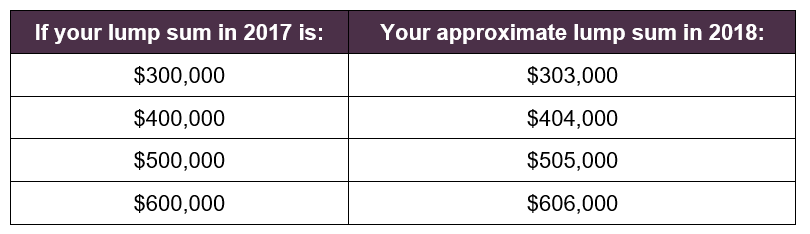

Here’s how the recent rate change may affect you:

- Your lump-sum payout will likely increase slightly.

- If you collect your pension in 2017: you will likely receive a lower lump-sum payout.

- If you collect your pension in 2018: you will likely receive a higher lump-sum payout.

The impact of this lower rate:

How does this impact your retirement plan?

Your pension is an important income source for retirement. However, it is only one part of your overall financial picture. There are many more factors to consider before you decide, such as your AT&T 401(k) savings, Social Security, other income sources, marital status and more.

We’re here to help.

Advance Capital has helped thousands of AT&T employees with all aspects of their financial lives, from managing their AT&T 401(k)plans to maximizing their AT&T pension options. Our 30-year history of working with people like you gives us a unique perspective of AT&T retirement benefits. If you have any questions about your pension or would like us to help you build a sound retirement plan, please contact us to arrange a meeting or telephone conversation.

You can also learn more by downloading our go-to guide on AT&T retirement topics: The AT&T Employee’s Guide to Retirement.