Navigating Medicare Basics to Find the Right Plan

December 13th, 2017 | 5 min. read

Navigating the ins and outs of Medicare, the national health insurance for people age 65 and older and people with disabilities, is anything but easy. Healthcare though will likely be your biggest retirement expense, so Medicare isn’t something you can easily ignore either. Choosing the wrong plan can be expensive.

By familiarizing yourself with the basics and knowing where to turn for help if you need it, you can identify a plan that will work for you – and avoid unnecessary costs.

You’re eligible for Medicare at age 65

When you turn 65, Medicare becomes your primary health care provider and any private insurance you have becomes your secondary payer.

When you can enroll in Medicare

There are several different enrollment periods for Medicare:

Initial enrollment period: You can first enroll in Medicare Part A and Part B during a seven-month period starting three months before the month you turn 65.

General enrollment period: As of 2024, coverage no longer begins on July 1 when someone enrolls during this period. It now begins on the 1st of the month following the enrollment. For example, if someone enrolls January 8, coverage begins February 1, and so on.

General Enrollment Period is also known as "Open Enrollment Period". This is the period between January 1 and March 31, where those who are enrolled in a Medicare Advantage Plan can switch to a different Medicare Advantage Plan or Original Medicare (and join a separate Medicare drug plan). People can only switch their MA plan once during this time.

Special enrollment period: A special enrollment period can be triggered with various life events anytime throughout the year. These include:

- Losing health coverage (Retirement, Layoff, etc.)

- Moving

- Getting married

- Having a baby, or adopting a child

- Household income is below a certain amount

Annual Enrollment Period (AEP): The period between October 15th and December 7th every year is called the Medicare "Annual" Enrollment Period (AEP), not "Open" Enrollment as indicated. That is important because Jan 1-March 31 is OPEN Enrollment.

You must enroll on time

You are required to enroll in Medicare on time or you may be subject to late-enrollment penalties and a gap in health insurance coverage. Only if you are collecting Social Security when you turn 65 will you be automatically enrolled in Medicare. If not, then you will have to sign up for Medicare, beginning three months prior to your 65th birthday, as mentioned above.

How to enroll in Medicare

You can enroll for Medicare through the Social Security website at www.socialsecurity.gov, or by calling 1-800-772-1213.

The different parts of Medicare

Part A covers hospital services, including inpatient care, skilled nursing facility care, hospice care and home health care. The monthly premiums are free if either you or your spouse paid Medicare payroll taxes for at least 10 years, which makes you fully insured. You still must pay a deductible for any hospitalization. If hospitalization lasts longer than 60 days, you may be responsible for part or all of the daily rate. If you don’t qualify for premium-free Part A, you’ll pay either $278 or $505 each month (2024) depending on how long you or your spouse worked and paid Medicare taxes.

Part A covers hospital services, including inpatient care, skilled nursing facility care, hospice care and home health care. The monthly premiums are free if either you or your spouse paid Medicare payroll taxes for at least 10 years, which makes you fully insured. You still must pay a deductible for any hospitalization. If hospitalization lasts longer than 60 days, you may be responsible for part or all of the daily rate. If you don’t qualify for premium-free Part A, you’ll pay either $278 or $505 each month (2024) depending on how long you or your spouse worked and paid Medicare taxes.

Part B provides medical coverage such as doctor visits, outpatient services, home health care, durable medical equipment and some preventive services. There is a monthly fee for Part B, which is $174.10 each month (2024) (or higher depending on your income). This is deducted from your monthly Social Security check, if you are collecting benefits. Some individuals who enroll for the first time and individuals with higher incomes may be charged an additional premium. Meanwhile, lower income individuals who qualify for assistance may be exempt.

Part C, known as Medicare Advantage, is offered by private insurers and acts as an alternative to purchasing Medigap and Part D. If you opt for one of these plans, you’re essentially getting an all-in-one insurance policy. It will cover a specific amount of your deductibles and copays, and will usually include medications. Most plans also include dental, vision and/or hearing, but for an extra cost.

Part D is the prescription drug coverage portion of Medicare, and is provided by private insurers. You are not required to sign up for Part D if you have creditable coverage that is expected to pay, on average, at least as much as Medicare’s standard prescription drug coverage. If your coverage is not creditable, you may have to pay a penalty for as long as you have Medicare coverage.

After meeting the deductible, you pay a copayment or coinsurance, and the plan pays its share until the total drug costs (including what you have paid) reach $5,030. The coverage gap "donut hole" amounts are from $5,030 - $8,000. One IMPORTANT change for 2024 is that when someone gets out of the donut hole and reaches catastrophic coverage, they no longer pay 5%...it is now $0.

Medicare doesn’t cover everything

There are many services and supplies Medicare doesn’t cover. You can avoid the surprise out-of-pocket costs from these gaps with a supplemental insurance policy, but there are many plans to consider. Begin this process well before your effective Medicare start date to ensure that your supplemental insurance kicks in at the same time.

Medigap is designed to cover the gaps Medicare does not, such as deductibles, co-payments and coinsurance amounts. As if Medicare wasn’t confusing enough already, there are dozens of companies offering over 100 Medigap plans. The difference is in costs. Therefore, you want to shop by first selecting the plan type you need, and then pick the insurer and premium that works for you.

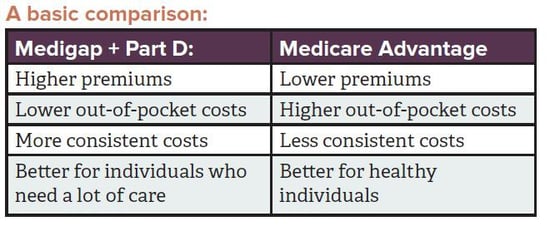

Most people find they need to choose between a Medigap plan and Part D or a Medicare Advantage plan (Part C). There are pros and cons to both. The supplemental coverage option that’s right for you depends on your personal factors, such as your financial situation and your health.

Medicare should be integrated into your financial plan

Considering how much Medicare plan costs and coverage vary, choosing the right one means doing some homework. Contact the Medicare office for more information by visiting the Medicare website at www.medicare.gov or calling 1-800-MEDICARE (1-800-633-4227).

You should also contact your financial adviser to discuss what Medicare plans may best fit into your financial plan. Paying for more coverage than you need or a premium that you can’t afford can derail your retirement goals.

Further, you may have to plan for the income-related monthly adjustment amount, or IRMAA, which is a fee you pay on top of your Medicare Part B and Part D premiums if you make a yearly income above certain annual thresholds. IRA and 401(k) distributions can add to your overall taxable income. Since Medicare premiums are based on MAGI from 2 years prior, if distributions from your accounts "bump" you up to a new income range according to Medicare, your Medicare Part B premiums will go up significantly as well.

You can and should shop around

Private insurers offering Part D, Medigap and Medicare Advantage plans can change their premiums and coverage terms. Therefore, you want to annually compare plans and shop around in an effort to get the same, or better, policy for a lower price. Unfortunately, many people don’t take advantage of the ability to change plans.

Only 13 percent of people with a Medicare Part D plan switch plans each year, according to a study by the Kaiser Family Foundation. That can be a costly mistake.

A recent study by eHealth, Inc. found that only 10% of people enrolled in Medicare prescription drug coverage were enrolled in the plan that covered their prescription drugs at the lowest possible price, and that by switching plans they could have saved an average of $541 over the course of 2017.

Remember, the annual coordinated election period is from October 15 to December 7 each year. For most, the best place to start shopping for supplemental plans is on Medicare’s own website, www.Medicare.gov. You can search for plans by using the Medicare Plan Finder.

Medicare doesn’t cover long-term care

A common misconception is that long-term care is covered by Medicare. The coverage it does offer is very limited, unlikely to meet the needs of anyone who needs long-term care.

Learn about what other ways you can pay for long-term care by downloading our white paper, Options for Funding Long-Term Care Expenses.

Choosing the right Medicare plan is not an easy decision, but it’s something you can do. The worst decision you can make is to do nothing. With the help of financial adviser, you can integrate the costs into your overall financial plan so that your other retirement needs are unaffected.