Coping with the Financial Tasks of Losing a Loved One

June 30th, 2021 | 3 min. read

Losing a loved one is a difficult experience in many ways. It hurts emotionally, it hurts physically and, unfortunately, it often hurts financially.

Close to 70% of widows and around 50% of widowers reported experiencing significant financial troubles after losing their spouse, according to a survey by New York Life Insurance. Surviving spouses have to adjust to living on a reduced income and cutting discretionary expenses.

In some families, only one spouse is in charge of all finances. If he or she passes away, the survivor may struggle learning how to manage the family’s money for the first time.

When managing the deceased’s estate and all the financial obligations that come with it. While finances may seem trivial during times like these, it is an important matter that should be addressed as soon as possible to better protect the deceased’s assets and, potentially, yours.

The alarming figures above may not sound surprising when you consider that there can be more than 100 tasks involved in managing the affairs of a lost loved one.

To help you along when you are ready, here are the most important financial steps to take when losing a loved one.

Where to start

One thing that makes the process easier is to start with gathering all the personal and financial documents that you can find. This helps you to quickly and accurately manage the estate, as well as start planning your own finances going forward.

Here are some of the most important documents:

- Certified copies of the death certificate

- Will/trust

- Birth certificate

- Social Security cards

- Marriage license

- Insurance policies (life, health, accident, property, auto)

- Bank statements and listing of accounts

- Credit card statements and physical cards

- Investment and other financial account statements

- Auto titles

- Mortgages and property deeds

- Income tax returns

- Other assets (business interests, etc.)

Next, you will likely want to start working with an attorney. This is especially important if your loved one did not have a will or trust. An attorney will then help you through the probate process. Also, the attorney should be able to help determine if all or any debts will be covered by the deceased’s estate and what the liability for any remaining debts may be.

You will want to compile any bills (including medical, funeral, mortgage, etc.) and make arrangements to pay them accordingly. Share those that will be paid through the estate with the attorney or executor so that they can be paid on time.

Update all necessary information

After losing a loved one, it becomes your responsibility to notify and update any of the deceased’s employers, financial organizations and government administrations.

If you haven’t done so already, contact his or her employer and inquire about any benefits, such as a pension, 401(k), life insurance, stock options and owed money from accrued sick and/or vacation days. If health insurance was provided, ask about arrangements to continue coverage for any dependents.

You will have to notify all insurance providers of the passing. Especially, if the deceased had a life insurance policy. It can take a while for companies to disperse funds, so start the process as soon as you can. Further, contact the various financial institutions (banks, brokerages, credit card companies, etc.) where he or she had an account.

Update information on all mortgages, property deeds and auto titles. You can change the title of your vehicles through your state’s Department of Motor Vehicles. Also, cancelling the driver’s license with the DMV will remove your spouse’s name from their records and help prevent identity theft.

You may have to also contact the Social Security Administration to stop payments and ask about the eligibility of the surviving spouse or dependents for spousal or survivor benefits.

Lastly, update your own will, insurance policies, retirement accounts and all other assets on which the deceased was listed as a beneficiary.

Get help and start planning

Some of these tasks are challenging in themselves much less when on your own. A financial adviser can help carry the load. He or she can help you compile many of the needed financial documents mentioned above. Most importantly, an adviser will help distribute assets from the deceased’s investment accounts to the appropriate beneficiaries. That way your loved one’s wishes are fulfilled.

If you are to receive some or all of these assets, an adviser will help you make any changes to your own financial plan and investments so that you can appropriately put it toward your financial goals.

Further, you may want to consider plans for your own estate with the guidance of a financial professional. After going through the process of managing your loved one’s estate, you now know the difficulties involved. You can take the necessary measures to ensure an efficient process for your family when you pass away.

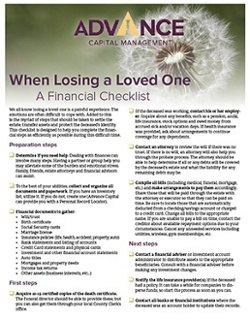

We know this is a lot to keep in mind. And it’s not easy when dealing with so soon after the loss of a loved one. Having helped many people in these situations, we’ve learned that it’s best to take it step by step. So, we’ve created an easy-to-follow checklist of all financial tasks to address when losing a loved one – and we hope it can help you too: When Losing a Loved One - A Financial Checklist

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.