Q3 2022 Market Update: Fighting Inflation

October 13th, 2022 | 3 min. read

Advance Capital Management’s president and chief investment officer, Christopher Kostiz, provides his key economic and market insights from the most recent quarter.

With the depths of the pandemic and COVID lockdowns behind us, the consequences continue to reverberate through the economy and capital markets. The infusion of trillions of dollars into the economy by the federal government and Federal Reserve over the past few years to help employees and businesses weather the economic effects of the pandemic has led to unprecedented inflation permeating every aspect of our lives. The price for food, rent, gas and other everyday purchases has increased by double digits, with uncertainty when it might subside.

To combat inflation, the Federal Reserve is aggressively increasing short-term interest rates and has started to reduce their bloated balance sheet. In this environment, the capital markets have remained extremely volatile. Both stocks and bonds have posted negative returns while the economy is showing signs of slowing down. Although unnerving, there are hopeful signs that inflation has peaked and its impact on the economy will begin to subside. Still, it remains unclear whether the Federal Reserve’s fight to halt inflation will eventually tip the economy into a recession.

Housing market weakens as labor market remains strong

Today, amidst higher inflation, some economic trends are concerning while others appear promising and could provide a ballast going forward. On the negative side, the housing market has weakened considerably. Existing and new home sales are down significantly this year, as home buyers face higher prices and a surge in mortgage rates. Consequently, builder confidence has fallen to an eight-year low. The manufacturing sector has also slowed from its torrid pace of last year.

Consumer demand for goods has declined as prices jumped double digits and consumers shifted spending to more services-related items. With heightened uncertainty, it’s not surprising that the consumer sentiment index has dropped to the lowest level in about 12 years and the Small Business Optimism index has fallen to a 10-year low.

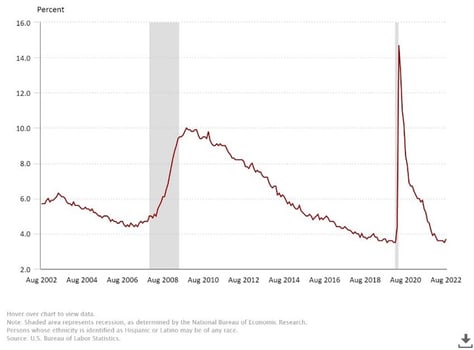

Still, the positives include a robust jobs market, solid consumer spending and rising incomes. The unemployment rate has fallen to pre-pandemic lows of 3.7 percent, with more than 12 million jobs unfilled as businesses struggle to attract and retain workers.

Unemployment rate, seasonally adjusted

Further, wages are rising at their fastest pace in decades, which bodes well for the economy since consumer spending makes up about 70 percent of economic growth.

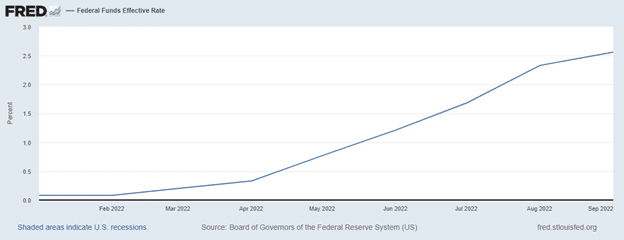

Fed raises rates to fight inflation

Over the past few months, the Federal Reserve has reiterated its commitment to get inflation under control by raising short-term interest rates and reducing its balance sheet by selling Treasury and mortgage-backed bonds. The Fed has already hiked rates 2.25 percent since January, with additional hikes expected by year’s end. These efforts have led to higher market-based interest rates, reduced consumer and business demand, and softened economic growth. The delicate balancing act by the Fed is to ensure growth doesn’t suffer too much as it aggressively tackles inflation.

Both stocks and bonds fall again

Heightened uncertainty and stubbornly high inflation led to further volatility in the capital markets during the quarter. Investors tried to discern the messaging from the Federal Reserve alongside the mixed bag of economic data. For the quarter, the S&P 500 Index returned -4.89 percent, while small- and mid-cap stocks produced -5.21 and -2.48, respectively. The bond market continued to get hit by higher inflation and correspondingly higher market-based interest rates. For the quarter, the Aggregate Bond Index fell -4.75 percent, bringing its year-to-date return to -14.61 percent. This marks the worst return for bonds in decades. International markets didn’t fare much better, with the MSCI All World Index falling -6.07 percent for the quarter.

Our market outlook

Looking ahead, the Federal Reserve’s determination to bring down inflation will continue to negatively impact economic growth, employment and asset prices over the next few quarters. However, record low unemployment along with modest consumer spending should help offset the negative trends of a slowdown in housing and manufacturing. It appears that both the capital markets and the economy will remain volatile until inflation turns lower and the Fed stops raising interest rates. This process will take time.

We expect continued volatility in stocks and bonds as these scenarios play out. We have already made material changes in client accounts this year in response to inflated valuations and rising inflation. We will continue to analyze the influx of data and make additional strategic moves in client accounts to capture opportunities or reduce risk where necessary.

As always, investing in capital markets comes with some risk and uncertainty. We thank you for your continued support of our investment process as we work hard to deliver positive risk adjusted portfolio returns to our clients. Should you have any questions, please do not hesitate to reach out to your financial adviser.

Christopher Kostiz is President and Chief Investment Officer of Advance Capital Management. As CIO, he directs the strategy and structure of the discretionary model portfolios and leads the investment committee.

Christopher Kostiz is President and Chief Investment Officer of Advance Capital Management. As CIO, he directs the strategy and structure of the discretionary model portfolios and leads the investment committee.

Christopher Kostiz, President & CIO

Chris is the President and Chief Investment Officer (CIO) of Advance Capital Management. As CIO, he directs the strategy and structure of the discretionary model portfolios and leads the investment committee.