Importance of Bonds in Your Portfolio

August 17th, 2022 | 4 min. read

-1.jpeg)

Bonds are kind of the “rocket science” of the investment world. They can be relatively complex, coming in the form of different maturities, coupons, yields, qualities and durations from a variety of issuers. Again, rocket science.

The main thing for most investors to understand is that bonds generally provide diversification in their portfolios. They are meant to hold up your portfolio when stocks decline.

Except, through the first six months of 2022 both stocks and bonds have suffered double-digit negative returns. On top of that, interest rates are rising, which is often bad for bonds. Basically, when rates rise, bond prices fall.

This has led some investors to wonder: What’s the point of investing in bonds?

Despite a shaky performance this year, bonds have historically shown their importance in a long-term investor’s portfolio. So, it's worth reviewing the important role bonds can play in your portfolio, whether you’re just starting to invest or are already in retirement.

Portfolio diversification

Bonds are generally more conservative and often behave independently from stocks. They typically counter the greater volatility of the stock market. During times of stock market turbulence, it’s common for bonds to increase in value, which helps to even out the bumps as you work toward your financial goals.

Bonds, therefore, serve as a valuable portfolio diversifier. They help lower overall risk in your portfolio without dramatically sacrificing returns.

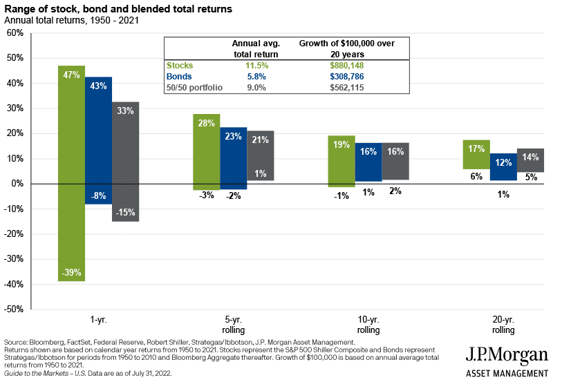

Consider the performance of a 50/50 stock/bond portfolio over the past 70 years, according to J.P. Morgan’s Guide to the Markets. You can see a lower difference between the highs and lows of a 50/50 portfolio versus an all-stock or all-bond portfolio. Yet, a 50/50 portfolio would have produced an annualized return that’s just 2.5% less than the annualized return of a stock portfolio (9% versus 11.5%).

With a balanced portfolio you can benefit from periods of growth while being resilient during those inevitable stock market downturns. This increases the chances you stick with your investment plan and actually realize those benefits.

In that sense, bonds can provide not only financial stability but mental stability, too. Because switching investment plans from fears driven by short-term market performance can prove costly.

Income

Another reason many investors own bonds is income.

Bonds regularly pay you income in the form of interest. When you invest in a bond fund, interest is paid monthly. While this interest is not guaranteed like income from a certificate of deposit (CD), bond funds generally pay a reliable amount. This is because the individual bonds inside a fund each pay a fixed amount of interest based on the obligation of that particular bond.

While the value of the bond fund may fluctuate and even decrease, interest is always positive – it’s never lost or taken away from you. Historically, bonds as an asset class have outperformed cash and CDs, albeit with a little higher risk.

This character of bonds is very important to investors who rely on their portfolios for income, mainly retirees. Whether you take regular withdrawal amounts or withdraw only direct payments from the interest, bond funds can help turn your portfolio into a source of income. While the values of stocks and bonds fluctuate, an income-oriented portfolio with a reasonable withdrawal rate can ride out the ups and downs because of consistent interest provided by bond funds.

The impact of interest rate changes on bonds

We know what you’re thinking: but what good is it to own bonds while rates rise and prices fall?

Keep in mind, a change in interest rates doesn’t affect individual bonds held to maturity because you get back the full price you paid for it.

Most individual investors, however, invest in bond funds. These funds can hold dozens, hundreds or even thousands of individual bonds. The fund managers regularly add (buy) and remove (sell) individual bonds from the fund. So, every day, the value of the bond fund can fluctuate, and most of that is driven by the movement of interest rates.

Generally, bond values and rates are inversely related. When interest rates fall, bond values increase, and vice versa. For example, if you own a bond that pays 5% interest per year and rates fall to 4%, your bond is more valuable and easier to sell in the market as it has a higher payout. Conversely, if you have that same 5% bond and other bonds now pay 6%, you’ll have a more difficult time selling it and will have to sell at a discount to do so. This is why investors worry over the ramifications of the Fed increasing rates.

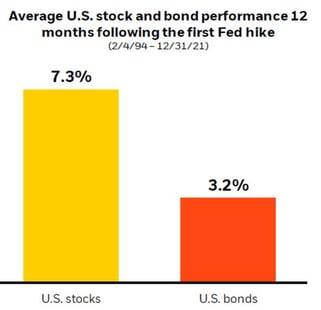

However, markets historically have gone up, even during periods of rising interest rates. During previous rounds of rate hikes dating back to 1994, the average U.S. stock and bond performance over the 12 months following the first Fed hike has been positive at 7.3% and 3.2%, respectively.

Source: BlackRock

What you can do

If you need income, you probably still need bonds. And, if you want a broadly diversified portfolio, you’ll definitely need bonds.

The best way to navigate fluctuating markets is to plan for them before they arrive. If you hold bond funds in your portfolio, your financial adviser has likely already made adjustments in regards to Federal Reserve policy and market changes.

Still, it’s always smart to periodically review your overall asset allocation – how much you have in cash, bonds, stocks and other investments – to make sure your portfolio is properly diversified.

Just remember that bonds are not risk free. While they can offer some protection during recessions and market downturns, they can also decline. But that doesn’t mean abandoning your portfolio and going to cash, which can hurt you even more than a market downturn. Instead, make adjustments, if needed, to keep your portfolio aligned with your investment objectives, time horizon and attitudes toward risk.

Finally, the most important thing you can do is remember the purpose of bonds in your portfolio. If they still fit your investment strategy, then there is no need to avoid them, no matter what the Federal Reserve does.

If you're worried about the market, learn why sticking with a diversified investment strategy over the long term is often the best approach. Download our free guide on "How to Survive a Market Downturn."

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.