Tips for Successfully Combining Finances with a Spouse

July 13th, 2017 | 3 min. read

Batman and Robin. Bill and Melinda Gates. Milk and cookies. These are examples of two great individual entities that together make a far greater whole. The same can be said of your financial well-being after combining finances with your spouse.

Batman and Robin. Bill and Melinda Gates. Milk and cookies. These are examples of two great individual entities that together make a far greater whole. The same can be said of your financial well-being after combining finances with your spouse.

However, sharing money is often a challenge for married couples. Spouses may fear being judged for their spending habits and/or losing their financial freedom.

But, couples who work well together financially are better able to accomplish their most important financial goals. They avoid unnecessary expenses, debt and, most importantly, stress, which can strain a marriage. Consider that money is the leading cause of stress in a relationship, according to a survey of people in relationships or partnerships by SunTrust Bank.

Here are tips for combining finances after marriage. You can reach the financial goals – house, travel, etc. – you established as a couple without sacrificing each other’s personal financial freedom.

Talk about money

While talking about money seems like an obvious step, too many couples don’t make it a priority or purposely avoid it. A frank discussion about household finances helps both spouses get on the same page.

Each partner should reveal their financial attributes, from credit score to financial assets. You should discuss each other’s financial values (saving, education, travel) and fears (job loss, unexpected expenses, never retiring). Also, establish short-term and long-term financial goals, so you can start planning.

Create a budget

A “budget” is the most effective way to keep track of your money and save for your goals. It helps couples avoid the turmoil that arises when one or both spouses are in the dark about where their money is going. Most importantly, a budget will help you establish a spending limit and determine what expenses each spouse can sacrifice for your financial goals. Watch our video on budgeting to help create a budget that’s right for you.

Establish a joint bank account

A joint bank account is a must for almost all couples. After marriage, you and your spouse are likely to have expenses that should be paid from a joint account, such as a mortgage payment, insurance, child care, utilities, etc.

There is no right or wrong answer on how to share responsibilities to contribute to the joint account. You can determine what works best for you and your spouse. It may make sense for each spouse to still maintain a separate account for personal spending – and for special gifts for each other.

Build an emergency fund

Consider that 47% of Americans don’t have enough money saved to cover a $400 emergency expense. And, over the course of a long marriage, you’ll likely encounter your share of unexpected expenses. Therefore, building an emergency fund should be one of your first financial goals after marriage.

An emergency fund is an account where cash is set aside for unpredictable financial needs, such as the loss of a job, a health problem or major home repairs. The fund provides greater financial security by acting as a safety net of cash to cover emergency expenses so you don’t have to use valuable assets or take on high-interest debt. A good rule of thumb is to save 3-6 months’ worth of expenses.

Combine insurance coverage

Once you get married and potentially start a family, you have a greater responsibility to keep yourself and your assets safe. Therefore, there are certain types of insurance you should have. Of course, insurance isn’t cheap.

One way to make sure you have the right amount of coverage at a reasonable price is to bundle insurance. Most companies offer discounts if you buy auto and home insurance together. Then, every six months to one year, you should review your insurance policies to make sure you’re getting the best rate and have the right amount of coverage.

You may also want to compare health insurance costs to see if it makes more financial sense for both of you to be on a single employer’s insurance.

Buy life insurance policies

Until death do us part. While it’s not something either of you want to think about, it’s important to make sure each spouse will be protected in the event one passes away.

Employer’s commonly offer a life insurance benefit. Your company may pay one year’s salary to a beneficiary of your choice to help offset lost wages and income. Your primary life insurance, however, shouldn’t come through your employer; if you lose your job, then you lose your coverage. Plus, as someone who is married and may have children, you likely need more coverage than your employer provides. Instead, purchase a term-life insurance policy from a separate provider.

Manage household finances together

These days, both spouses are likely involved when it comes to managing the household’s finances. Yet, one spouse may have a stronger interest in the financial chores. Although one spouse can manage the finances, it can create long-term issues. If that person passes away or there’s a divorce, the other spouse may suffer financially. He or she may not know how to manage the money or even where it’s located.

Thus, each spouse should feel obligated to participate, from creating the budget and setting up retirement savings accounts to meeting with a financial adviser and choosing an appropriate investment strategy. That way both spouses are prepared in the event something happens.

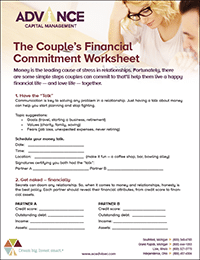

If you need more help with combining finances with your spouse, sit down with your better half and start working toward a happier financial future by filling out our Couple’s Financial Commitment Worksheet. It provides 7 actionable items that can help couples manage their money together. Click the image below to download your copy.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.