The Ultimate AT&T Retirement Glossary

May 22nd, 2019 | 7 min. read

Planning for retirement doesn’t come naturally. It is very much an educational process. So, how can AT&T employees get a head start on learning what it takes to retire from AT&T? We’ve created this A-to-Z glossary to share with you the most important pieces of information that have helped our clients retire from AT&T.

A: Annuity pension

Upon retirement, AT&T employees can elect to receive a monthly annuity pension payout. There are pros and cons. For example, with an annuity, you receive a regular paycheck for life, and you don’t have to worry about the market impacting your money. On the downside, there is no cost-of-living adjustment and the annuity is tied to the pension plan’s longevity.

B: Beneficiaries

Each AT&T benefit you have earned and accumulated — pension, life insurance and 401(k) account — can be passed on to a beneficiary in the event of your death. Often, people name one or more individuals early in their careers and neglect to ever think about it again. But to ensure that your family is taken care of and that your assets are distributed according to your wishes, you must keep your designated beneficiaries accurate and up to date.

C: Composite Corporate Bond Rate

AT&T uses what is known as the Composite Corporate Bond Rate to calculate pension payouts. Even small changes in this rate will impact the size of your lump-sum pension. Generally, when rates fall, lump-sum payouts increase, and vice versa. The annual rate change is typically announced in November or December, so be sure to contact Advance Capital around that time to determine how the rate change affects you.

D: Diversification

The AT&T 401(k) plan has a variety of investment options to choose from. While participants should base their investment decisions on their personal needs, we recommend that everyone diversify their 401(k) accounts. A well-diversified portfolio holds several different investments with prices that move independently of each other. For example, stocks and bonds. Diversification can reduce risk, provide steadier returns and increase your opportunities for earnings.

How much you allocate your contributions among investments is a matter of your personal situation. Working closely with an experienced adviser can help you choose the funds most appropriate for your specific financial goals.

E: Eligibility

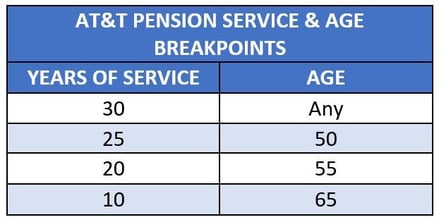

You’re eligible for a vested pension benefit after five years of service, but your benefit will be negatively affected if you do not reach certain age and service breakpoints for your employment position. Additionally, you may receive a reduced pension benefit if you take your benefit prior to age 55 – unless you are a union employee with 30 or more years of service.

F: Financial adviser

Most AT&T employees we partner with tell us that they wish they would have started planning earlier. Remember, it’s never too early to start thinking about retirement. With so many variables surrounding retirement and your personal circumstances, making the right financial decisions can be overwhelming. A financial adviser can help you create a financial plan and build an investment portfolio centered around your specific financial goals.

G: Guaranteed income

One of the primary pillars of retirement is your guaranteed income sources. For AT&T employees, those are generally your pension (see below) and Social Security. The earliest age you can claim Social Security is 62, but a permanent reduction is applied for each month you receive benefits before full retirement age (65 or 66). Conversely, your benefit increases each month up to 8% per year for every year after your full retirement age, until age 70. The goal should be to maximize all income sources together, so the right age to claim depends on your personal situation.

H: Habits

Most wealthy individuals can attribute their financial success to a set of simple habits. Here are some habits that can help AT&T employees achieve a comfortable retirement: follow a budget, live below your means, save 12-15% of your income (at least enough to earn the full AT&T employer match) and keep your job skills current.

I: Insurance

As an AT&T employee, you may be eligible for certain types of insurance coverage that extends into retirement. Employees who satisfy the modified rule of 75 may be eligible for retiree health insurance and life insurance benefits. Plans available to you will depend on your service date, retirement date, Medicare eligibility and/or other factors.

J: Joint life annuity and survivor benefits

The AT&T pension offers survivor benefits. If an employee passes away before retiring, a spouse automatically receives 50% of the monthly annuity or can choose the lump-sum equivalent. This option is only available to spouses. There are multiple survivor options to choose from for the monthly pension, but all are only available for a qualified spouse. Management employees also have the choice to take a partial lump-sum pension with a residual monthly pension.

K: 401(k)

While you’re working, AT&T allows you to save a portion of each paycheck into your 401(k) account, where it has the ability to grow tax-deferred for future use. The ability to retire comfortably and on your own schedule depends a great deal on the health of your 401(k). Some basic rules for managing your AT&T 401(k): (1) start saving as soon as you can, (2) save as much as you can up until the day you retire, (3) choose an appropriate asset allocation and (4) avoid taking out any early withdrawals or loans.

L: Lump-sum pension

Upon retirement, AT&T employees can also elect to receive their pension as a one-time lump-sum benefit, which can be subsequently rolled over into an Individual Retirement Account (IRA) and then controlled by the retiree. Like the monthly annuity, there are pros and cons. For example, one advantage is having full control over your benefit to use however you want. A disadvantage is that when invested, your benefit is exposed to market risk.

M: Modified rule of 75

AT&T relies on the “modified rule of 75” to determine an employee’s retirement eligibility, pension and retiree medical benefits. You must reach the age AND service breakpoints for your employment position, as shown in the chart below. This is commonly known as the modified rule of 75 since the combinations add up to 75 in most cases. However, you must meet BOTH minimum requirements.

N: Netbenefits.com

Fidelity administers the AT&T pension and 401(k). On their site www.netbenefits.com, employees can get pension estimates, 401(k) balances, beneficiary information and more.

O: Offers

Unfortunately, when you leave AT&T may not be your decision alone. Instead, you may receive a severance, SIPP, surplus payment or other buyout offer. Unless you can retire comfortably, your primary concern is likely how you’re going to make it through until finding another job. In the meantime, sign up for unemployment, consider your payout options, avoid any major financial commitments and don’t touch your retirement accounts, unless absolutely necessary.

P: Pension

AT&T offers a defined-benefit pension plan to eligible employees. This enables you at retirement to receive a monthly annuity pension, lump-sum pension, or a combination of the two depending upon your classification (management or union). The right choice for you depends on your personal circumstances. Since your pension will be one of your major sources of income in retirement, it is a decision you want to consider carefully.

There are three factors that help determine the size of your pension benefit: years of service, pension band (for union employees only) and income level. The higher each of these factors, the greater your pension benefit.

Q: Questions

Retirement planning isn’t all about money. It’s also about answering questions about how you want to spend your time. Here are some questions we like to ask to help people think about how best to fill their abundant time in retirement:

- What, if any, passions or hobbies have you always wanted to pursue?

- Have you considered launching a new business or new career?

- What physical activities do you participate in?

- Will you live near friends and family?

- Do you currently or want to volunteer?

- How often do you plan to travel, if at all?

R: Rollover IRA

A 401(k) rollover is the transfer of funds from your 401(k) account to an IRA. There are many reasons why you may want to roll over your savings to an IRA, including greater investment choices, the convenience of having all your assets in one place, withdrawal flexibility, more withholding options and professional management by an adviser of your choosing. To conduct a rollover, work with a financial adviser to ensure that it’s done properly and to avoid a possible taxable event.

S: Stock

A common mistake we see when helping AT&T employees manage their finances is an excessive amount of retirement savings invested in AT&T stock. While it can be rewarding to own a piece of a respected company like AT&T, it may be risky from a retirement planning perspective. You don’t want your entire financial life – your current income and retirement income – to depend on the performance of one company.

T: Time horizon

Your time horizon is essentially when you need the funds to achieve your financial goals. In this case, it is your retirement date. It plays an important role in determining how much you need to save, how you should invest your savings and how many years of service you should give.

U: Unexpected expenses

A crucial step of the retirement planning process is to build a sizeable emergency fund, which is an account with cash set aside specifically for those unexpected expenses life throws your way. According to Money Magazine, “78% of Americans will have a major negative financial event in any given 10-year period.” A good rule of thumb is to save a minimum amount equal to one month of expenses, but most people will need to save enough for 3-6 months or more.

V: Vested

You become vested in the AT&T pension plan when you have five years of service (bargained; 3 years for management) or turn 65 years of age while employed with the company, whichever is later. With a vested pension, you can either defer it until age 65 or take it prior to age 65 – but at a substantial discount. Most employees should defer their pension to receive the greater payout. However, this may not be true in all cases.

W: Withdrawals

Upon leaving AT&T, it is common to rollover your 401(k) to an IRA. But you may leave some or all of your savings in your account. If you retire from AT&T in the year in which you turn age 55 or older, you have full flexibility regarding withdrawals from your 401(k), meaning no early withdrawal penalties.

For non-managers, the most common withdrawal is to take a Partial Distribution. Four times per year you can contact the administrator and request a withdrawal from your account. Managers may elect scheduled monthly withdrawals and/or up to eight Partial Distributions. The election of monthly withdrawals counts as one of your eight Partial Distributions.

X: Exit strategy

(Yes, we’re kind of cheating here.) Perhaps nothing can give you more confidence in the future than an exit strategy, or detailed retirement plan. It will show you how to use your financial resources collectively to live a comfortable retirement. A written retirement plan has been shown to help people save more and better manage their retirement expenses, including health care.

Y: Your goals

While most of us likely share some common financial goals – retirement, owning a home, send the kids to college, etc. – the goals that make a real difference in our lives are personal. They are the ones that allow us to lead the kind of life we want. Therefore, your financial decisions should be made with your goals in mind only.

Z: Zero in

Retirement isn’t earned in a day. It takes time and discipline. Stay zeroed in on the things that will help you get there. Keep saving. Live below your means. Let your investments grow. Stick with your plan.

You can learn more AT&T’s benefits by downloading our “go-to guide” on AT&T retirement topics: The AT&T Employee’s Guide to Retirement. (CLICK THE BUTTON BELOW.) This interactive guide is designed to help AT&T employees make more informed retirement planning decisions.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.