Answers to 5 Common AT&T Retirement Questions

September 21st, 2017 | 3 min. read

We’ve worked with AT&T employees since our founding, and over that time we’ve helped answer a lot of questions regarding AT&T retirement benefits. As with any employer’s benefits, there are a lot of moving parts. And, each employee’s situation is different. So, when planning for something as important as retirement, questions are inevitable.

We’ve worked with AT&T employees since our founding, and over that time we’ve helped answer a lot of questions regarding AT&T retirement benefits. As with any employer’s benefits, there are a lot of moving parts. And, each employee’s situation is different. So, when planning for something as important as retirement, questions are inevitable.

Ideally, you should get a financial plan that takes into consideration your specific needs and lays out steps to reach your specific goals.

Nonetheless, there are some topics people frequently ask about. Here are answers to 5 common AT&T retirement questions.

1. What age am I eligible to retire from AT&T? What is the modified rule of 75?

Okay, this is technically two questions. But they are related, so we’ll answer them together.

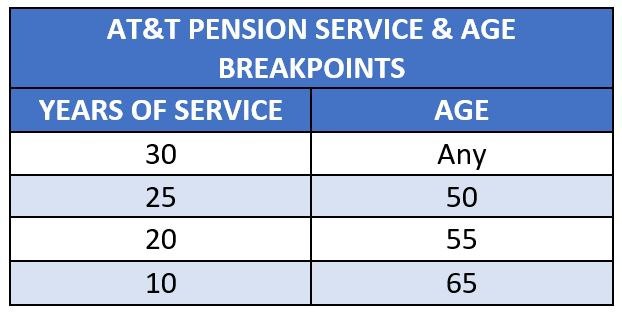

You are eligible for a vested pension benefit after five years of service, but your benefit will be negatively affected if you do not reach the age AND service breakpoints for your employment position, as shown in the chart below. This is commonly known as the modified rule of 75 since the combinations add up to 75 in most cases. However, you must meet BOTH minimum requirements.

It’s important to point out that not every combination of 75 points applies. For example, if you have 24 years of service and are age 51. Although the combination adds up to 75 (24+51=75), you do not qualify because you fail to meet both minimum requirements at each breakpoint.

Additionally, you may receive a reduced pension benefit if you take your benefit prior to age 55, even if your combination meets the 75-point rule. If you’re a union employee with 30 or more years of service, however, the pre-55 reduction does not apply. For AT&T management employees who meet the 75-point rule but don’t have 30 years of service, their pension benefit will be reduced if taken before age 55.

If you do not meet the 75-point rule yet are pension eligible (5 years of service), you will receive your earned AT&T pension at age 65. Taking it prior to age 65 will result in a significant reduction.

2. What are pros and cons of a lump-sum pension payout?

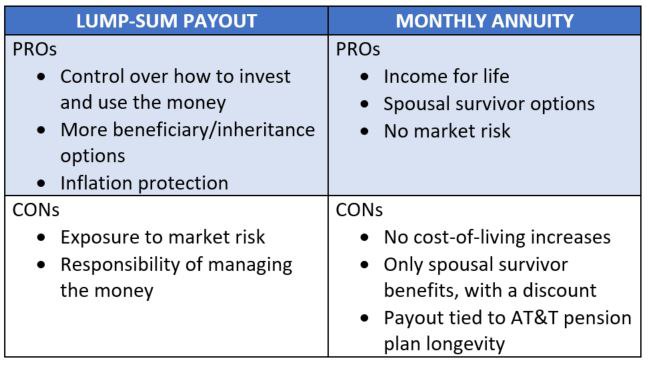

Employees can elect to receive a monthly payout like a traditional pension. Or, they can convert all (both union and management) or a portion (management only) of their pension into a one-time lump-sum benefit. The payout can be rolled over into an IRA controlled entirely by you. Whether a lump-sum or traditional monthly payout is best for you depends on your entire financial situation, including your 401(k), Social Security, real estate, etc.

There are general pros and cons for both:

3. How do rates affect my AT&T pension payout?

AT&T uses what is known as the Composite Corporate Bond Rate to calculate pension payouts (until 2012, the company used the GATT rate). Even small changes in the rate will impact the size of your lump-sum pension. Generally, when rates are lowered, lump-sum payouts are increased, and vice versa.

Therefore, rate changes may affect your decision whether to retire early or continue working, as well as to take an annuity or a lump-sum payout at retirement. (Learn more by watching our video on AT&T Corporate Rate Changes.)

4. How should I invest in my AT&T 401(k) plan?

While managers and non-managers have different 401(k) investment options, there are choices in each program that can help your money grow, and at a level of risk you are comfortable with. Younger employees generally should have more money allocated to stocks for their high return potential. Over time, you should gradually reduce risk and move more of your accumulated savings to lower-risk investments such as bonds.

How much you allocate your contributions among investments and when you start to transition is a matter of your personal situation. Working closely with an experienced adviser can help you choose the funds most appropriate for you and your specific financial goals.

5. How much AT&T stock should I buy?

While it can be rewarding to own a piece of a respected company like AT&T, it may be risky from a retirement planning perspective. If you buy too much AT&T stock, you may find most of your financial life – your current income and retirement income from your AT&T pension and AT&T 401(k) plan – is dependent on the performance of one company.

From an investment perspective, a single stock (in this case AT&T stock) is often riskier and more volatile than a mutual fund or the broader stock market. Your 401(k) should be properly diversified, with contributions spread across different investments. Investment diversification can reduce your risk, provide steadier returns and increase your opportunities for earnings.

Are you an AT&T employee or retiree with a question you didn’t find answered here? You may find it in the go-to guide on AT&T retirement topics: The AT&T Employee’s Guide to Retirement. (Just click the link below.) Or, get personal expert help by requesting to speak with one of our financial advisers by phone (800-345-4783) or contacting us online.

ADVANCE CAPITAL MANAGEMENT IS A REGISTERED INVESTMENT ADVISER. INFORMATION PRESENTED IS FOR EDUCATIONAL PURPOSES ONLY AND DOES NOT INTEND TO MAKE AN OFFER OR SOLICITATION FOR THE SALE OR PURCHASE OF ANY SPECIFIC SECURITIES, INVESTMENTS, OR INVESTMENT STRATEGIES. INVESTMENTS INVOLVE RISK AND UNLESS OTHERWISE STATED, ARE NOT GUARANTEED. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER AND/OR TAX PROFESSIONAL BEFORE IMPLEMENTING ANY STRATEGY DISCUSSED HEREIN.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.