Taking Care of Your Investments While Taking Care of Aging Parents

May 17th, 2017 | 3 min. read

Taking care of aging parents doesn't mean you have to choose between their wellness and your retirement.

Taking care of aging parents doesn't mean you have to choose between their wellness and your retirement.

Often those who transition from son or daughter to caregiver will tap their retirement savings or take a break from working. Although this likely necessitates an adjustment to your retirement plan, there are ways to stay on track toward a comfortable retirement.

Determine what’s expected of you – and your finances

Before assuming a caregiving role, work with your parent(s) to find out how your help is needed. Then you can determine how it may impact your financial goals.

Will you need to provide financial support for medical costs? Will you have to start working part-time or take a break from work to care for your parent(s)? Further, will these needs change your financial plans for goals such as a child’s education or your retirement?

If you haven’t created a retirement plan or haven’t checked it in a long time, do so before you become a caregiver. You’ll find out what shape you’re in for retirement, which will help you determine if and by how much providing care for your aging parents will alter your course.

Assess your parent’s situation

Additionally, you should find out how your parents stand financially. Have an in-depth discussion about their finances. Although, most children and parents find it uncomfortable, it’s critical for your own well-being. The more you know about your parent’s finances, the better you can protect your own.

If having this discussion proves difficult, try to involve a financial adviser who can make sure everyone is adequately prepared for the years ahead. An adviser can review your parents’ finances and provide advice on what financial decisions you and your parents should make going forward.

Also, find out if your parents have taken the proper estate planning steps and have all necessary legal documents in place. This includes a will and power of attorney. Asking to be named power of attorney can be uncomfortable for some people, too. However, by taking control of your parents’ financial matters you can help make sure their bills are paid, their money is appropriately managed and their wishes are granted.

If married, divvy up responsibilities

Couples obviously have an advantage over unmarried single children. Still, they must plan appropriately. If necessary, one spouse may want to take a break from working to become the primary caregiver. Meanwhile, the other spouse, preferably the higher earner, works as much as possible to maintain a reliable household income.

Adjust your retirement plan if you stop working

If you reduce your work hours or stop working entirely, there are several ways to make up for the lost time and income. For one, you can simply plan to work longer and retire later.

Or, you can try to work even more than you did before to boost income. Consider working as a freelance consultant in your field or taking on one of the many opportunities available in the gig economy, such as driving for a ride-sharing service or renting out an empty bedroom.

Another option is to plan on spending less in retirement. You can reduce your retirement expenses, for example, by moving into a smaller home in a more tax-friendly environment. Or, scale back some of your more costly retirement goals. Stay in hostels on your overseas trip. Buy a used RV instead of a brand new one.

Getting your investments back on track

Of course, money spent on care or medical costs for an aging parent is less money saved and invested for retirement. To get back on track, you should first replenish any cash reserves you’ve depleted; especially, if you’ve touched your emergency fund, which ideally should have 3-6 months’ worth of expenses.

Once you return to work, ramp up your retirement account savings. Take advantage of catch-up contributions, which are an extra $6,000 you can save each year in an IRA, 401(k) or other employer-sponsored account once you turn age 50.

Some people may want to take on additional risk in their investment portfolios for the chance to earn a higher return and make up for any lost growth. Be aware of just how risky this strategy is. If a market correction occurs, you could end up even farther from retirement. It’s generally better to increase your savings, not your risk. Work with an adviser to determine the appropriate course of action for your portfolio.

Preparing for an aging parent

Those with aging parents should factor the unknown into their financial plans. Try to save enough not only to meet your financial goals but to exceed them. That way, you have a cushion for when something unexpected happens such as the need to care for a parent or child, disability, loss of income, etc.

If a parent passes away

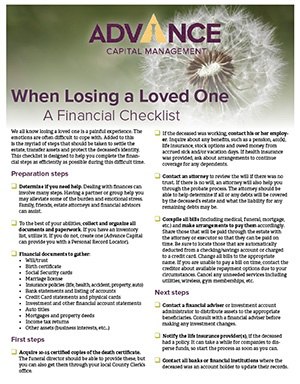

The loss of a loved one is an emotional experience. Unfortunately, it’s often more difficult when managing the deceased’s estate and all the necessary financial obligations. While finances may seem trivial during times like these, it’s an important matter that should be addressed as soon as possible to better protect the deceased’s assets and, potentially, yours.

Our financial checklist for when losing a loved one can help. Download the financial checklist below to use as a guide for many of the most important financial obligations you may face.

When Losing A Loved One - A Financial Checklist

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.