Should You Accept an AT&T SIPP Offer?

June 16th, 2020 | 3 min. read

For many AT&T employees, the opportunity to retire comes earlier than planned. To restructure its workforce, AT&T will at times present retirement-eligible employees with a Supplemental Income Protection Plan (SIPP) offer. This provides a financial incentive to voluntarily leave the company, should you accept it. Typically, you only have a short window of time, around 7-14 days, to decide.

It is not a simple decision, as you must take into consideration factors beyond just the offer’s details. These questions will help you determine whether you should accept an AT&T SIPP offer.

1. Are you in position to retire from AT&T?

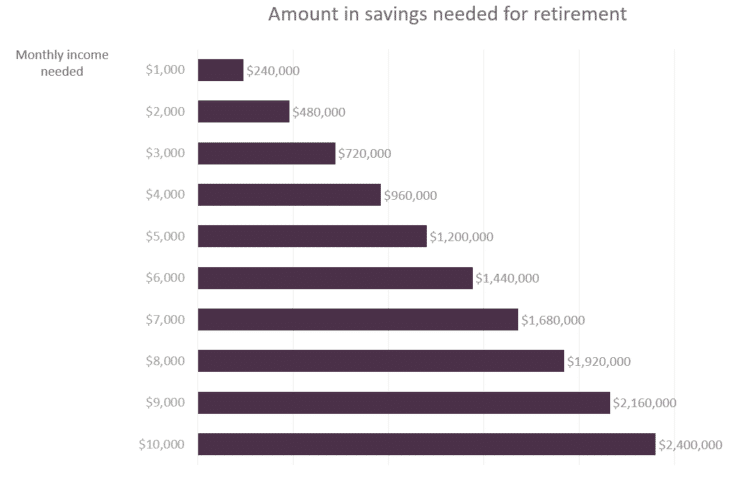

Your readiness to retire depends on if your retirement assets (pension, 401(k), Social Security, etc.) are enough to meet your retirement expenses and goals. Generally, enough assets to replace 70-80% of your pre-retirement income will allow you to maintain the same standard of living you enjoy today. We, however, typically recommend replacing 100% of your pre-retirement income. Although some of your living costs will fall in retirement (gas, shopping, etc.), others will rise (health care).

For an accurate picture of your retirement readiness, we suggest working with a financial adviser to create a financial plan – a comprehensive picture of your current finances, your financial goals and any recommended strategies to achieve those goals. As a company that has served AT&T employees for 30+ years, we can create a complimentary AT&T financial plan for you within 1 day.

2. Which AT&T SIPP payout is best for you?

If retirement is a realistic option for you, the next step is to figure out which AT&T SIPP payout is compatible with your financial plan. AT&T SIPPs come with three different payout options. Let’s look at each one and their potential benefits.

100% lump sum

As a form of income, you will owe taxes on any money you receive through a SIPP. So, with the lump sum, the primary consideration is how the taxes on this substantial sum of money impact your finances. With a large sum of money, you can build an emergency fund, pay down debt or put it toward a large purchase, such as a home down payment or new car.

50% lump sum, with the remainder paid out at $600 per month

This is a more tax-friendly option since the lump sum amount is lower. Although a smaller amount, the lump-sum portion is still useful for the financial goals mentioned above.

This option makes sense for anyone who retires early, under the age of 59 ½. The monthly $600 payment can supplement other sources of retirement income, such as 401(k)/IRA withdrawals, your pension, Social Security (which you cannot claim until age 62), etc.

12 monthly installments

Like the option above, this is more tax-friendly than a full lump-sum payout and a better option for those under age 59 ½. Its greatest benefit is that it allows you to delay tapping into your other retirement income sources while giving your retirement accounts additional time to grow.

3. Should you take a lump-sum or monthly AT&T pension payout?

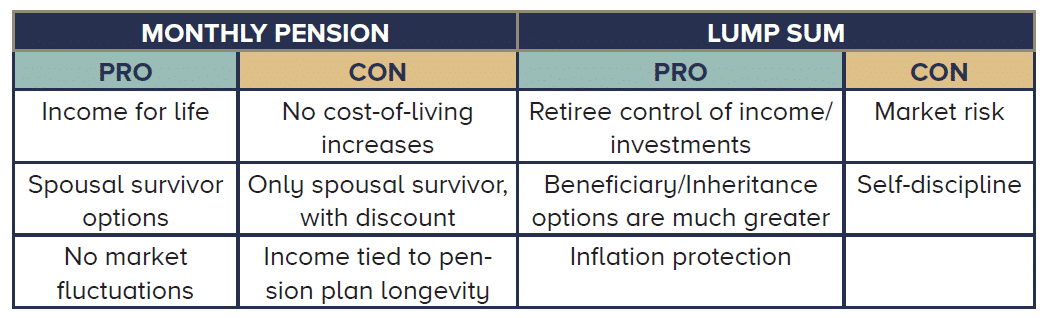

The AT&T pension plan also lets you choose between different payout options. With a lump-sum payout, you get all or a portion (only available to managers) of your pension once you retire. You may then roll over your lump sum into an IRA and invest it however you want. A monthly annuity gives you a consistent monthly paycheck for the rest of your life.

There are pros and cons to each payout option. For example, you have greater flexibility with a lump-sum payout, both in how you use it and how you can pass it on, but that freedom comes with market risk. Meanwhile, the monthly pension provides income for life, but without a cost-of-living increase, so your buying power will decline over time. Deciding which option is most appropriate for you depends on your specific needs and other retirement income sources.

4. What should you do with your AT&T 401(k)?

Upon leaving AT&T, you may leave some or all your savings in your AT&T 401(k) account. But it is common to rollover your 401(k) to an IRA. A 401(k) rollover can provide many advantages, including greater investment choices, greater withdrawal flexibility, more withholding options, and professional management by a financial adviser. When done properly, no taxes apply to the rollover.

Again, AT&T SIPP offers give you only a brief amount of time to make a decision. Considering all the different parts involved in making the right choice, we encourage you to speak with an AT&T experienced financial adviser to leave no doubt as to what works best for you.

You can learn more about navigating various AT&T retirement decisions by downloading our free ebook: The AT&T Employee’s Guide to Retirement.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.