Steps to Retire on Your Own Terms

February 15th, 2018 | 5 min. read

In her book, “Top Five Regrets of the Dying,” palliative nurse Bonnie Ware writes that her patients cared more about relationships and happiness than money, fame or success. The most cited regret was: “I wish I had the courage to live a life true to myself, not the life others expected of me.” In a way, many people look at retirement as the freedom to live life more true to themselves, to break away from the demands of the workplace, to spend time how they want, to pursue their dreams. You don’t want to just retire, but rather retire on your own terms.

In her book, “Top Five Regrets of the Dying,” palliative nurse Bonnie Ware writes that her patients cared more about relationships and happiness than money, fame or success. The most cited regret was: “I wish I had the courage to live a life true to myself, not the life others expected of me.” In a way, many people look at retirement as the freedom to live life more true to themselves, to break away from the demands of the workplace, to spend time how they want, to pursue their dreams. You don’t want to just retire, but rather retire on your own terms.

Most people aim to retire after age 65, which is the time Medicare kicks in, according to a survey of around 5,100 U.S. employees by Willis Towers Watson. The second most popular retirement target age is 70 or older. This may be explained by the fact Social Security benefits can be up to 32% larger for those who delay, as well as longer life expectancy. Only 2% of those surveyed expect to retire before age 55.

There’s no right time to retire for everyone, but there is a right way to plan for it. Here’s how to position yourself to retire on your own terms.

Control your expenses

Generally, you have two options for reaching your financial goals. Either earn more money or save more money. You have less control over the amount of money you earn. After all, you can’t simply choose how much money you make. (If that was the case, this blog’s author would be doing something else, preferably on a beach.)

But, you have control over how much money you save since you have power over your expenses. Therefore, this is where you should focus when planning for retirement.

Unfortunately, most people live beyond their means. The average American household carries $137,063 in debt, according to a report by the Federal Reserve. Granted, most of that debt is in mortgages and student loans. But, the average U.S. household has $16,883 in credit card debt, as more Americans use plastic to pay for basic expenses such as food and clothing.

Debt is essentially borrowing from your future self. That’s why it is so important to live within your means. You can instead empower your future self by controlling your expenses today. Start with your discretionary expenses – shopping, dining, etc. – and eliminate or reduce as many as you can. Then move to your non-discretionary expenses – car payment, rent, etc. Can you reduce any of those? For example, can you get cheaper insurance rates? How about being smarter with your utilities?

Aim for a savings target

As fewer workers receive pensions these days, employer-sponsored retirement accounts, such as a 401(k) or 403(b), have become the primary means to reaching retirement. Getting the most out of your retirement account starts with creating a savings goal.

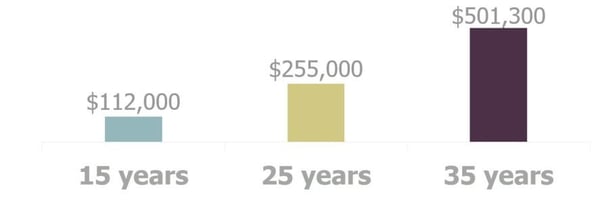

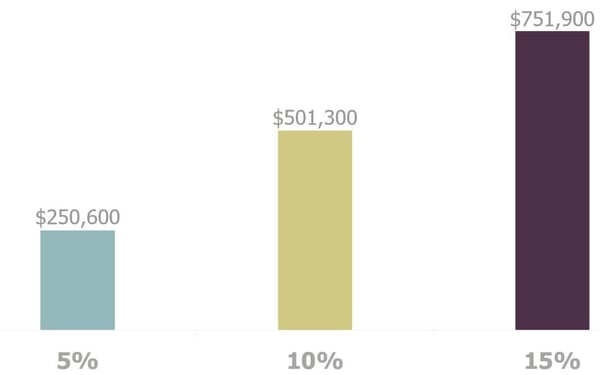

A general rule of thumb is to save 10% to 15% of your paycheck, including employer match. Of course, the ideal situation is to start as early and to save as much as possible to take advantage of compounding (the earnings earned on your earnings). This will make a huge difference over time, as shown in the graphs below.

The benefit of starting early (difference in ending balances saving 10% of $50,000 over various time periods, assuming a 5.5% annual return)

The benefit of saving more (difference in ending balances from various savings rates on a $50,000 salary over 35 years, assuming 5.5% annual return)

If you start late or fall behind, you may have to increase your contribution rate to catch up. Fortunately, at age 50, you qualify for catch-up contributions, an extra amount up to $6,000 (2018) that you’re legally allowed to contribute to your employer retirement accounts. You can also save an additional $1,000 in an IRA. The other, perhaps less palatable, options are to work longer or consider living on less in retirement.

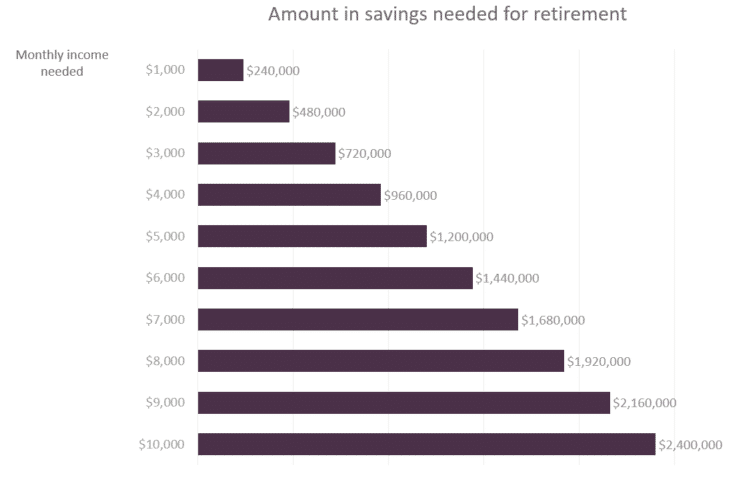

How much should you ultimately save for retirement?

That depends on each person’s individual situation. But, a common recommendation is to save enough to replace 70% to 90% of your pre-retirement income. However, it is better to aim for a replacement ratio of 100% as a way to prepare for unexpected expenses, such as high health care costs. Plus, many people want to retain the same standard of living in retirement.

You can find the monthly pre-retirement income you need to replace simply by looking at the net-pay on your paycheck.

Calculated using the “rule of 20”, which is a general rule of thumb that states you should save $20 for every $1 you expect to spend in retirement. You can reasonably live off this amount for around 25 years or more at a 4-5% withdrawal rate.

Stick with a balanced portfolio

Contributing to your retirement account is half the battle. How you invest that money also matters. Your retirement account should hold a diversified mix of stocks and bonds. The stock portion of your portfolio can help generate growth and outpace inflation; whereas, bonds in your portfolio act as ballast against market drops.

What mix is right for you depends on personal factors, such as your age, income and goals. Generally, you can start investing aggressively and then pare back risk as you near your target retirement age and/or savings goal.

Whatever your mix, stick with it. Markets are volatile in the short term, but over long periods of time they can be relatively stable and predictable. That’s why investors are better off being patient and sticking with an investment strategy as the market works itself out. Research shows investors who change course tend to underperform, which means investors who tune out the noise and stay focused have a higher chance of reaching their goals.

Keep costs low

The less you pay in investment costs, the more you keep of your portfolio’s return. That explains why an investment fund’s cost is a better indicator of its future returns than its past performance. While you can’t control where markets will go, you can control the costs you pay for the ride.

A single digit fee may not sound like much, but it can add up over time. A 1% fee on a $100,000 portfolio that earns 4% growth annually would mean paying nearly $28,000 in fees over two decades, according to an example provided by the Securities and Exchange Commission.

Combine retirement accounts

Over the course of your career, you may have retirement accounts with several employers, as well as a lump-sum pension payout. Consolidating your assets, typically into an IRA, let’s you conveniently manage it all in one place. An IRA can give you a much larger pool of investments to choose from than any employer-sponsored retirement account. So, you can manage your assets under a cohesive investment strategy that is appropriate for your specific financial needs. Further, with a wider selection of investments, you may be able to lower your fees and expenses with lower-cost investments.

Of course, moving your money doesn’t always make sense. If you have a good employer retirement plan with suitable investment choices and low fees, then you may be better off keeping it where it is. There’s always potential transaction fees and taxes to consider. Also, if you retire from your company in the year in which you turn age 55 or older, you have full flexibility regarding withdrawals from your 401(k), meaning no early withdrawal penalties. If you instead roll the money over to an IRA, then the early withdrawal penalty will apply.

Plan for Social Security

Social Security will likely be one of your primary sources of income later in life. You can receive your full benefit upon reaching your Full Retirement Age (“FRA”), which depends on your year of birth. The FRA for most people working today is age 66 or 67.

You can file for Social Security as early as age 62. However, if you take your benefit early, it is permanently reduced for each month taken before your FRA. Those who wait to file beyond their FRA until age 70, receive a delayed credit of 2/3% per month (8% per year), for a larger benefit by up to 32%.

Delaying Social Security isn’t right for everyone. Factors such as work earnings, divorce, remarriage, the death of a spouse, disability and more can greatly impact your benefit and claiming strategies. If you want to retire early, for example, you may want to consider taking it right away. But, if you want to work into your 70s or have enough assets to live off of, then it may make sense to wait for the larger benefit.

Ultimately, what works best for you depends on your personal situation. Working with an adviser, who can take a holistic view of your finances, can help you take the steps necessary to retire on your own terms and live life true to yourself.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.